Bitcoin ETFs See Strong Inflows After Christmas, Reversing Outflows

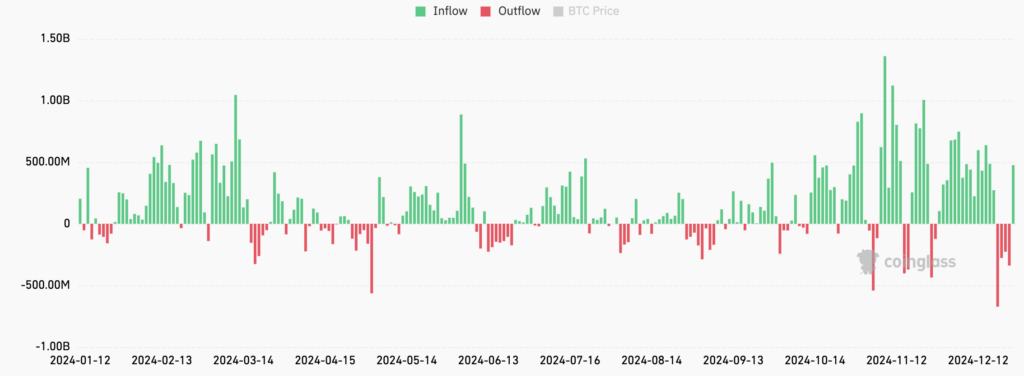

Bitcoin ETF– Bitcoin exchange-traded funds (ETFs) in the United States experienced a notable rebound on December 26, following a four-day streak of significant outflows totaling over $1.5 billion. On the day after Christmas, these ETFs recorded a collective net inflow of $475.2 million, marking a significant recovery.

Key Players Leading the Bitcoin ETF Inflows

The largest contributor to this rebound was the Fidelity Wise Origin Bitcoin Fund, which saw inflows of $254.4 million, according to CoinGlass. The ARK 21Shares Bitcoin ETF also saw substantial interest, attracting $186.9 million in net inflows. Meanwhile, BlackRock’s iShares Bitcoin Trust ETF (IBIT) recorded a more modest, but still notable, $56.5 million in inflows.

Smaller but still significant inflows were observed in Grayscale’s mini Bitcoin ETF, which saw $7.2 million, and VanEck’s Bitcoin ETF, which had inflows of $2.7 million.

Recovery After Consecutive Outflows

This surge in inflows comes after a tough week for Bitcoin ETFs, during which they saw consecutive outflows between December 19 and December 24. The total net outflows during this period amounted to $1.52 billion. One of the hardest-hit ETFs was IBIT, which experienced its largest-ever single-day outflow on December 24, losing $188.7 million. This was more than double its previous record outflow of $72.7 million, which occurred just a few days earlier on December 20.

Bitcoin Price Decline Amid ETF Inflows

Despite the positive flow of funds into Bitcoin ETFs, the price of Bitcoin itself has been under pressure. As of the latest data, Bitcoin was down 2.2% over the past 24 hours, falling from approximately $98,000 to just above $96,000. This price dip follows a general trend of market volatility in the final days of the year. However, the significant inflows into Bitcoin ETFs signal continued investor interest in the cryptocurrency, even in the face of short-term price fluctuations.

Ethereum ETFs Also Experience Strong Inflows

Ethereum ETFs have also seen positive movement, marking their third consecutive day of net inflows. On December 26, Ethereum funds collectively recorded $117.2 million in inflows. Leading the charge was Fidelity’s Ethereum ETF, which brought in $83 million in net inflows. BlackRock’s iShares Ethereum Trust ETF followed closely behind with $28.2 million, while Grayscale’s Ethereum Trust saw inflows of $6 million.

This trend in Ethereum ETFs contrasts with the performance of Ethereum itself, which was down 1.7% over the past day, dipping below the $3,400 mark. Ethereum has been underperforming relative to Bitcoin over the last couple of months, failing to reach new all-time highs, unlike Bitcoin, which has seen significant price growth.

Bitcoin and Ethereum ETFs Wrap Up the Year Strong

With only a few days left of trading for the year, Bitcoin and Ethereum ETFs are finishing their inaugural year on a strong note. So far in 2024, Bitcoin ETFs have seen total net inflows of $35.9 billion, bringing their total assets under management (AUM) to $111.9 billion. Ethereum ETFs, on the other hand, have seen $2.63 billion in net inflows, with an AUM of approximately $12 billion.

While the inflows into these ETFs are a positive sign of growing investor confidence in the cryptocurrency market, it remains to be seen how these trends will evolve in 2025. Analysts will be closely monitoring both Bitcoin and Ethereum’s price movements, as well as the overall market sentiment in the coming months.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Leave a comment