Bitcoin ETFs Cross $100 Billion: What This Means for BTC Investors

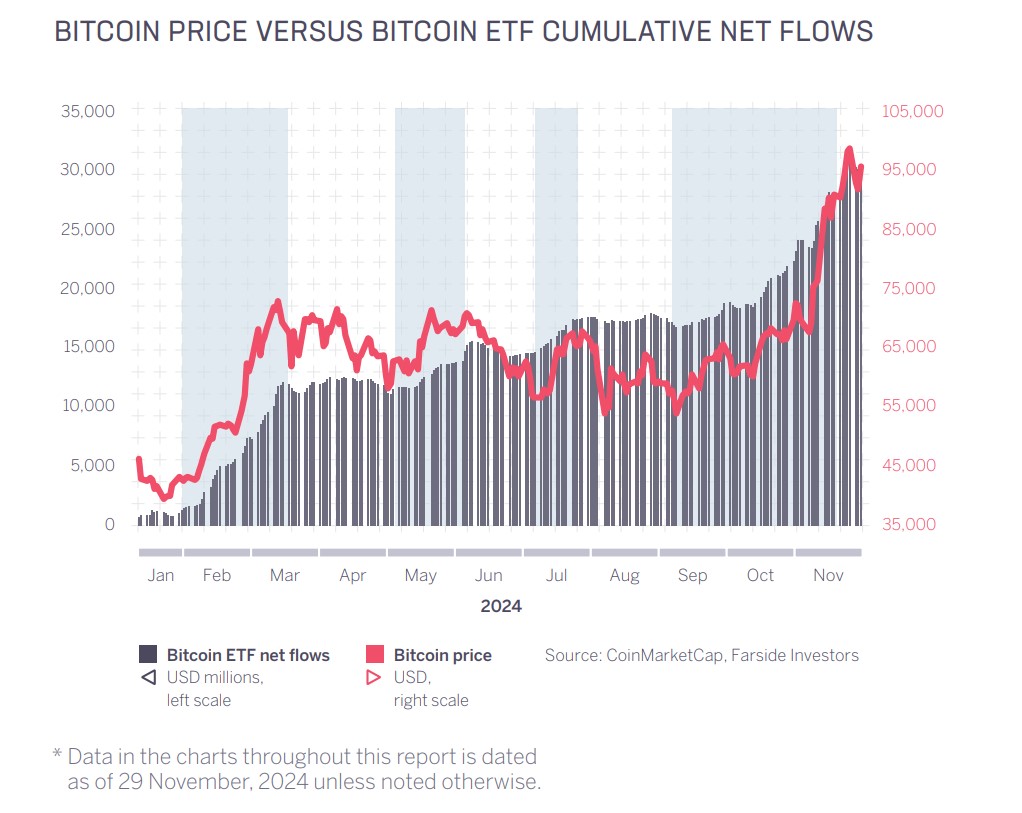

Bitcoin ETF – Bitcoin (BTC) could experience significant demand shocks in 2025, potentially causing its price to skyrocket, according to a report from Sygnum Bank, a leading crypto asset manager. Institutional inflows are already creating a “multiplier effect” on BTC’s spot price, with each $1 billion in net inflows into Bitcoin spot ETFs leading to a 3-6% price increase. Sygnum’s Crypto Market Outlook 2025 report predicts this trend will intensify as major institutional investors—including sovereign wealth funds, endowments, and pension funds—expand their Bitcoin holdings.

Accelerating Institutional Adoption in 2025

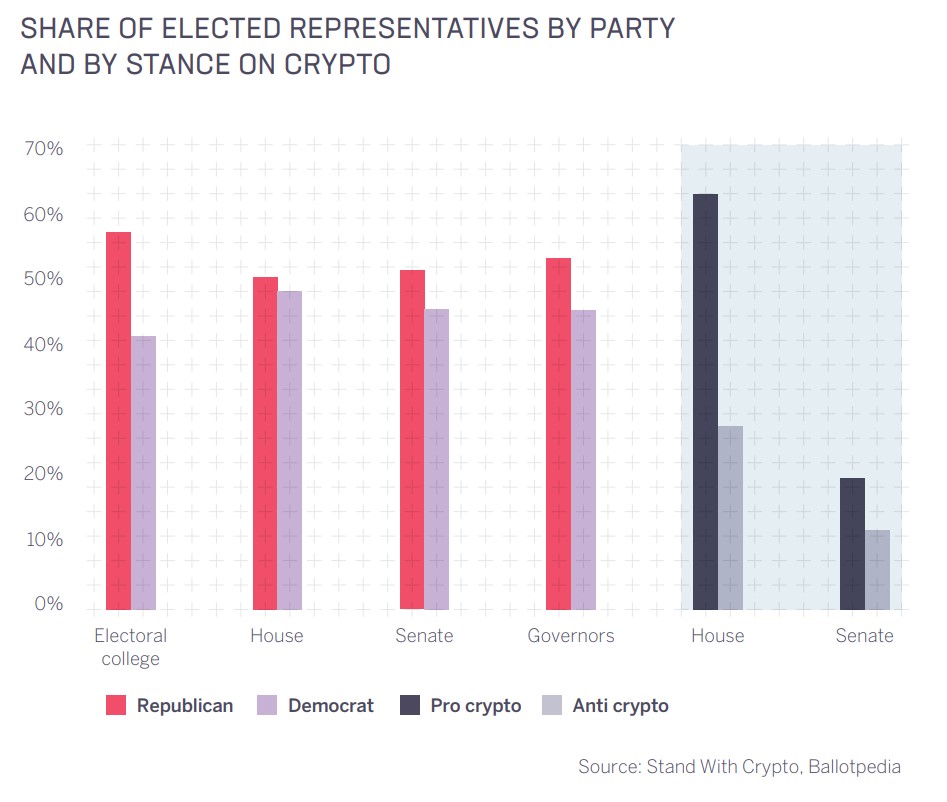

With improving US regulatory clarity and the possibility of Bitcoin being recognized as a central bank reserve asset, Sygnum expects 2025 to be a pivotal year for institutional crypto participation. Martin Burgherr, Sygnum’s Chief Clients Officer, stated, “Even modest allocations from institutional investors can significantly impact the crypto ecosystem.”

This acceleration is expected to contribute to Bitcoin’s dominance in the market, with institutional investors playing a crucial role in its price movement and market dynamics.

Altcoin Market Faces Uncertainty

While Bitcoin is poised for continued growth, the outlook for altcoins remains uncertain. Sygnum suggests that alternative cryptocurrencies will only see significant growth if US lawmakers pass favorable laws for crypto adoption. Tailored regulations are seen as essential for fostering a healthy altcoin market, allowing projects to pass value to token holders without burdensome compliance requirements.

Bitcoin ETFs Driving Demand

In a sign of growing institutional interest, US Bitcoin ETFs broke the $100 billion mark in net assets for the first time on November 21, 2024. This surge in interest is largely attributed to the launch of spot Bitcoin ETFs in January, providing easier access for new investors to purchase Bitcoin.

Conclusion: Bitcoin’s Strong Market Position

While regulatory challenges remain, Bitcoin’s strong growth drivers, including institutional interest and its superior ETF product, position it for continued dominance in the coming years. The explosive growth of Bitcoin ETFs, coupled with the potential for large-scale institutional involvement, suggests Bitcoin could experience a paradigm shift in 2025.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Leave a comment