Bitcoin Drops Below $80,000: What’s Behind the Crypto Market Crash?

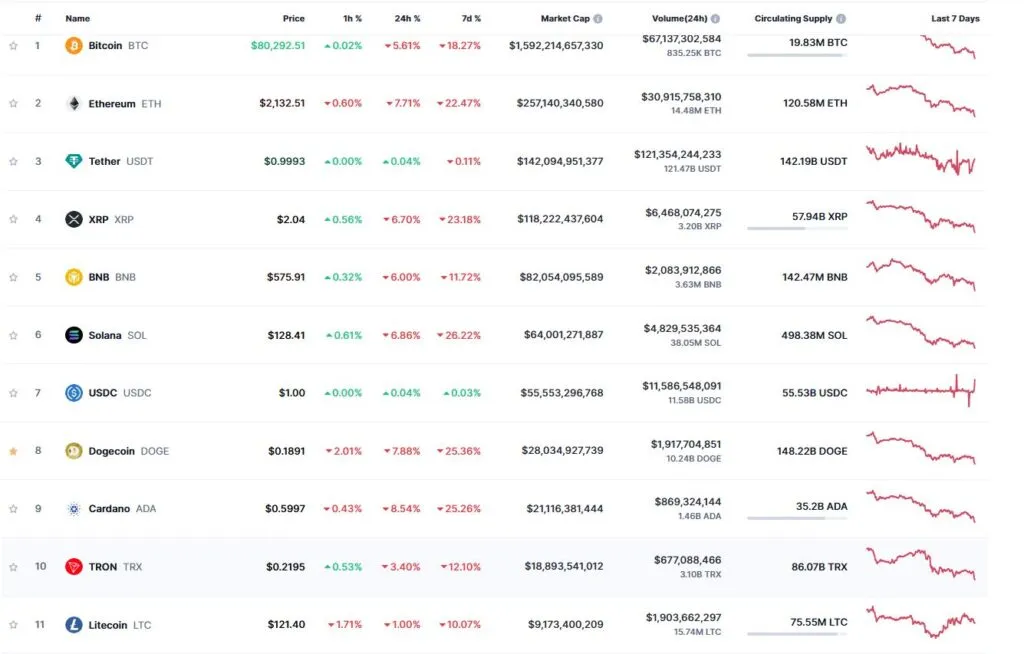

Bitcoin Drops Below $80,000 – On February 28, the cryptocurrency market saw a major downturn. Bitcoin (BTC) briefly dropped to $79,000, sending shockwaves through the market and sparking panic among investors. Ethereum (ETH) also saw a significant decline, falling below $2,200. Major altcoins, including XRP and Solana (SOL), lost up to 8% of their value, deepening the market’s losses.

Trade War Fears and High Tariffs Shake the Crypto Market

The sudden drop in the market comes amid rising fears of a global trade war. U.S. President Donald Trump’s announcement of new tariffs on the European Union, Canada, and Mexico has created uncertainty about the future of global trade. This has led to a panic sell-off, triggering over $700 million in liquidations over the past 24 hours. As a result, the total market capitalization of cryptocurrencies has decreased by 4%, falling to $2.7 trillion.

Bitcoin’s Price Declines While Market Dominance Increases

In the last 24 hours, Bitcoin fell by more than 5%, reaching a low of $79,523 before stabilizing at $80,430. This sharp drop led to $365.91 million worth of liquidations in Bitcoin. Despite the decline, Bitcoin’s market dominance increased by 0.07%, indicating that altcoins took the brunt of the selling pressure.

Ethereum Experiences Major Drop: Sinks to $2,132

Ethereum also experienced a significant decline, losing 7% of its value and dropping to $2,132. This drop resulted in $166.28 million in Ethereum liquidations, causing additional stress among Ethereum investors and worsening the overall altcoin losses.

Altcoins Struggle: XRP and Solana Suffer Losses

XRP fell by 7%, dropping to $2.04, and experienced $17.94 million in liquidations. Solana (SOL) saw an 8% drop, falling to $128.42, making it one of the worst-performing altcoins of the day. Dogecoin (DOGE) and Shiba Inu (SHIB) also lost 8%, despite increasing whale accumulation and higher burn rates for SHIB. Raoul Pal, a prominent market expert, remains optimistic despite these drops, pointing to oversold conditions in the market.

Pepe Coin and Trump Coin Hit Hardest: Losses Reach Up to 16%

Among the hardest-hit cryptocurrencies, Pepe Coin (PEPE) and TRUMP Coin experienced the largest losses, with drops ranging between 12% and 16%. Investors are now adopting a more cautious approach, assessing the market’s volatile nature and risks.

Top Gainers Amidst the Chaos: Berachain and Litecoin Show Strength

Despite the overall market downturn, a few cryptocurrencies managed to stay in the green. Berachain (BERA) gained 4%, reaching $7.71, while Litecoin (LTC) saw a 2% increase, trading at $124.81. UNUS SED LEO (LEO) also rose by 1%, reaching $9.20.

Global Stock Markets Plunge: Asia Reacts to U.S. Tariffs

The trade concerns have not only affected the cryptocurrency market but have also negatively impacted global stock markets. In Asia, Japan’s Nikkei 225 dropped 0.9%, and the Topix fell by 0.68% in early trading. South Korea’s Kospi tumbled 1.54%, with the Kosdaq down by 1.69%. Hong Kong’s Hang Seng Index lost 1.14%, while Australia’s S&P/ASX 200 slipped by 0.86%. China’s CSI 300 remained mostly flat as investors assessed the potential impact of further U.S. trade measures.

U.S. Markets Decline: Crypto and Stocks Move in Tandem

U.S. stock markets also experienced a downturn after Trump’s tariff announcements. The S&P 500 fell by 1.59%, closing at 5,861.57. The Nasdaq Composite tumbled by 2.78%, ending the day at 18,544.42, dragged down by an 8.5% drop in Nvidia stocks. The Dow Jones Industrial Average lost 193.62 points, or 0.45%, closing at 43,239.50.

Uncertainty Continues to Plague the Crypto Market

The cryptocurrency market remains under pressure, as global trade tensions and mass liquidations contribute to a heightened level of uncertainty. With Bitcoin and Ethereum testing critical support levels, investors are staying cautious, waiting for further market signals to determine the next move. Volatility in the market continues, as traders keep a close watch on any signs of stabilization.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

1 Comment