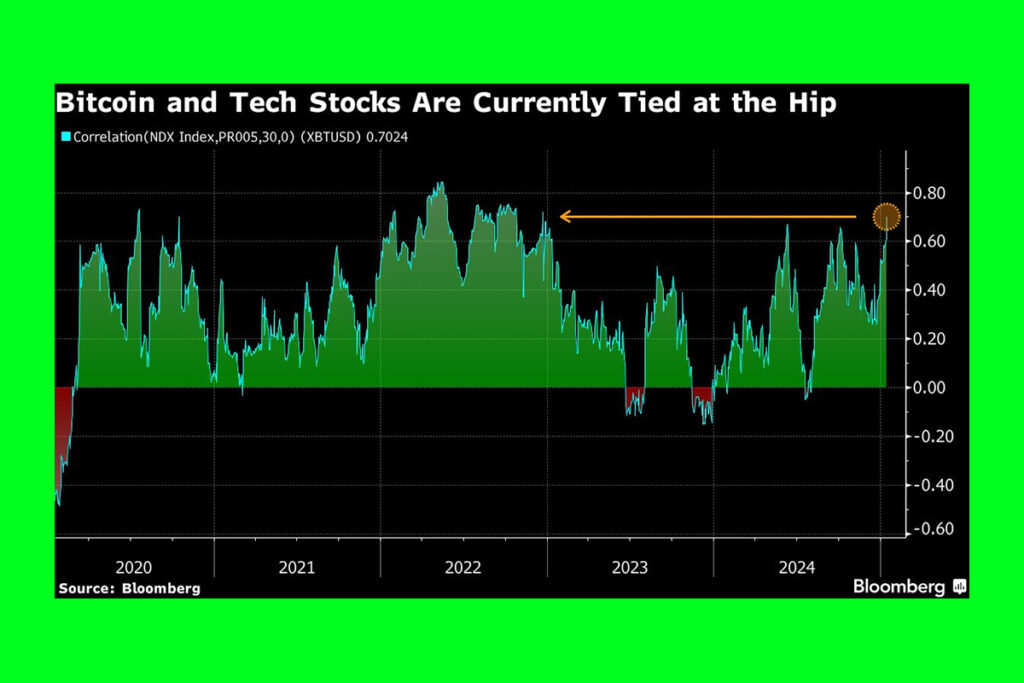

Bitcoin and Nasdaq 100 Display Unprecedented Correlation Amid Soft US Inflation Data

As the equity market’s response to US inflation data on Wednesday contributed to a greater sentiment for digital tokens, the correlation between Bitcoin and a measure of US technology stocks has reached a two-year high. According to data gathered by Bloomberg, the 30-day correlation coefficient between the largest cryptocurrency and the Nasdaq 100 Index is approximately 0.70. Assets moving in lockstep are indicated by a reading of 1, and an inverse tie is indicated by a reading of minus 1.

Price growth was 2.9% year over year, which was in line with predictions, while core inflation was 0.2% month over month, which was less than analysts had predicted. With the US economy doing well and the impact of Donald Trump’s plan undetermined, markets have been worrying about the Federal Reserve’s potential for additional interest rate reduction. Crypto and stocks rose as a result of the softer core price index. Following the inflation news, Bitcoin increased by more than 2.6%, while S&P 500 and Nasdaq futures increased by more than 1%.

Trump’s Inauguration Sparks Speculation on US Cryptocurrency Policies and Economic Impact

On January 20, President-elect Donald Trump will take office and might launch a flurry of new policies. Speculators are balancing his promise to establish the US as the worldwide hub for cryptocurrency with the potential of inflationary tariffs and immigration policies.

The overall sensitivity to interest rates over the past month suggests increased importance of Wednesday’s CPI print. Additionally, notable Trump momentum may still form in the days leading into the inauguration.

K33 Research analysts Vetle Lunde and David Zimmerman

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment