Bitcoin and Ether- US and Europe Lead the Way in Bitcoin and Ether Adoption

Bitcoin and Ether– In 2024, global cryptocurrency adoption reached new heights as Bitcoin broke price records and governments began incorporating digital assets into their financial systems. From Bitcoin’s strategic reserve talks in the U.S. to Europe’s groundbreaking regulatory framework, 2024 set the stage for mainstream crypto integration. Here are some of the most significant events driving crypto adoption across the world.

United States Eyes Strategic Bitcoin Reserve

In a major move for Bitcoin adoption, the United States government has considered adopting Bitcoin as a savings technology under the incoming administration of President-elect Donald Trump. The proposed Bitcoin Act, spearheaded by Wyoming Senator Cynthia Lummis, seeks to establish a U.S. Bitcoin reserve. The idea has gained bipartisan support, with notable backing from both Republicans and Democrats, including Representative Ro Khanna.

As the proposal gains momentum, some experts, such as Adam Back, co-founder of Blockstream, believe that Bitcoin could exceed the $1 million mark per coin if the Bitcoin Act is passed. Additionally, several U.S. states, including Texas and Pennsylvania, have introduced similar proposals, signaling growing interest in Bitcoin as a reserve asset.

Europe’s MiCA Framework Sets a Global Standard

The European Union’s introduction of the Markets in Crypto-Assets Regulation (MiCA) has been a landmark achievement for cryptocurrency regulation. MiCA provides clear guidelines for the issuance, reserve management, and redemption of stablecoins, with the aim of boosting market stability and consumer protection. The regulatory framework is expected to serve as a “global benchmark” for other regions looking to create similar standards, making cross-border crypto transactions easier and safer.

MiCA’s comprehensive approach has already encouraged major financial institutions, such as Societe Generale, to expand their crypto offerings. As Binance’s spokesperson noted, MiCA will foster innovation by providing legal certainty, which is crucial for the broader adoption of cryptocurrencies across Europe and beyond.

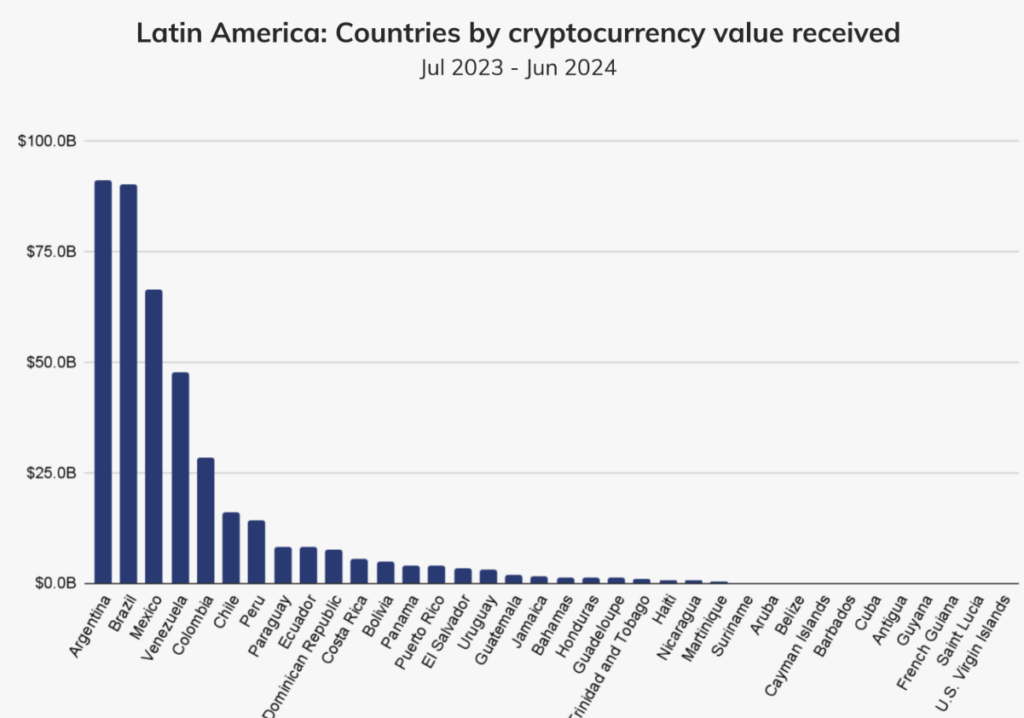

Bitcoin Adoption in Latin America Grows Stronger

Latin America continues to lead the way in Bitcoin adoption. El Salvador, which became the first country to adopt Bitcoin as legal tender in 2021, celebrated the third anniversary of its historic decision in 2024. The country made over $31 million in profits from its Bitcoin holdings. Additionally, El Salvador signed a mutual agreement with Argentina to strengthen both countries’ digital asset industries.

El Salvador’s growing influence in the region has spurred other Latin American countries, such as Brazil, Mexico, and Venezuela, to adopt more crypto-friendly policies. Brazil, for instance, received over $90.3 billion in cryptocurrency transactions in 2024 alone, according to a report by Chainalysis. This expanding Bitcoin adoption in Latin America could inspire further countries in the region to embrace cryptocurrencies, providing a strong foundation for the global crypto market.

Bhutan and Brazil Lead in Government Bitcoin Holdings

Apart from Latin America, other countries are also embracing Bitcoin. Bhutan’s government, for example, has been mining and holding Bitcoin for over five years. As of December 2024, Bhutan’s government-owned wallet contained over $1.1 billion worth of BTC. This significant adoption by national governments indicates the increasing institutional recognition of Bitcoin as a store of value.

In Brazil, the crypto market has exploded, with the country seeing more than $90 billion in cryptocurrency transactions in 2024. Brazil’s growing crypto adoption complements its economic ambitions and reflects a global trend of increasing cryptocurrency utilization.

US Bitcoin ETFs and Institutional Involvement Soar

The rise of Bitcoin ETFs (Exchange-Traded Funds) in the U.S. has also played a significant role in Bitcoin’s mainstream acceptance. By 2024, institutional ownership in U.S. Bitcoin ETFs surpassed 27%. Major financial institutions, such as BlackRock and Fidelity, have been key players in expanding the availability of Bitcoin ETFs, providing investors with easier access to Bitcoin exposure through traditional investment channels.

The success of these Bitcoin ETFs is seen as a significant indicator of growing institutional involvement in the crypto space. As crypto markets mature, analysts expect to see continued institutional interest in Bitcoin in 2025, particularly as more clearinghouses for Bitcoin ETF trading become available.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Leave a comment