Bitcoin and Ether ETFs Now Approved by SEC: Market Impact Explained

Bitcoin and Ether ETF– The United States Securities and Exchange Commission (SEC) has officially approved Bitcoin and Ether index exchange-traded funds (ETFs) from asset managers Hashdex and Franklin Templeton. This move marks a significant step for the cryptocurrency market, as both firms can now launch their respective ETFs, which will be available for trading on major U.S. exchanges.

SEC Greenlights Hashdex and Franklin Templeton’s Crypto ETFs

On December 19, the SEC announced its approval of Hashdex’s Nasdaq Crypto Index US ETF and Franklin Templeton’s Crypto Index ETF. These ETFs will hold spot Bitcoin (BTC) and spot Ether (ETH) directly. Hashdex’s ETF will be traded on the Nasdaq stock market, while Franklin Templeton’s offering will be listed on the Cboe BZX Exchange.

The approval follows a series of filings and amendments, with both ETFs tracking the performance of Bitcoin and Ether through established crypto indexes. The Franklin Crypto Index ETF will follow the Institutional Digital Asset Index, which represents digital assets like Bitcoin and Ether. Meanwhile, Hashdex’s Crypto Index ETF will track the Nasdaq Crypto US Settlement Price Index, which includes both cryptocurrencies.

Why Did the SEC Approve These Crypto ETFs?

The SEC’s decision was based on the belief that these ETFs’ structures and operational terms are similar to previously approved spot Bitcoin and spot Ether exchange-traded products (ETPs). In a statement, the SEC emphasized that both firms met the criteria set out in the Exchange Act, which includes rules designed to prevent fraudulent practices, protect investors, and maintain market integrity.

The commission also highlighted that Franklin Templeton’s amended filing, submitted on December 18, was approved on an “accelerated basis.” This approval underscores the growing regulatory acceptance of crypto-related financial products, which may inspire further developments in the market.

The Impact on the Crypto Market: Increased Demand Expected

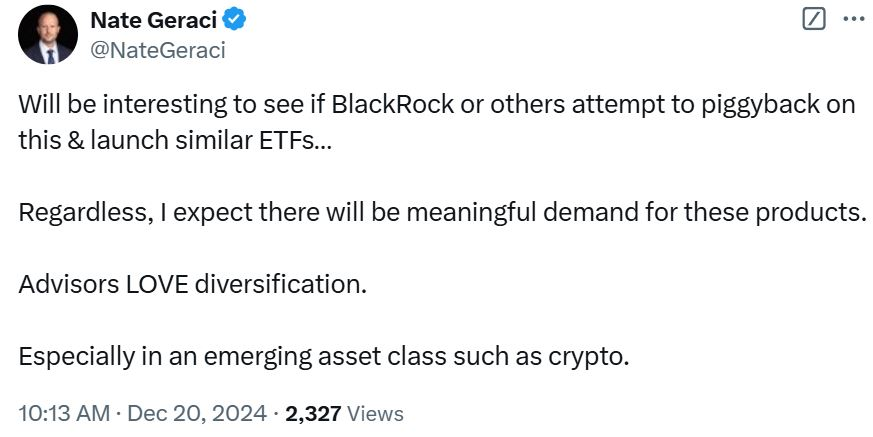

Nate Geraci, president of The ETF Store, commented on the approval in a post to X (formerly Twitter), speculating that other firms might follow suit. He noted, It will be interesting to see if BlackRock or others attempt to piggyback on this & launch similar ETFs. He added that he expects “meaningful demand” for these products, particularly from financial advisers who value diversification—especially in emerging asset classes like cryptocurrency.

Indeed, the approval could prompt a wave of interest in crypto ETFs, particularly as more traditional financial institutions look to tap into the growing crypto sector.

Background: Delays and Amendments Before SEC Approval

The road to approval for both Hashdex and Franklin Templeton was not without its hurdles. Franklin Templeton first applied for approval of its crypto index ETF in August. However, the SEC delayed its decision in November, pushing the decision timeline further into the year.

Hashdex, too, faced delays. The asset manager submitted its second amended application for the ETF on November 25. This followed a request from the SEC in October for more time to consider whether to authorize the proposal. The firm had previously filed an amended S-1 in October to provide further clarification on the product’s structure.

Other Firms Eye Crypto ETFs: Competition Rising

Hashdex and Franklin Templeton were not the only firms vying for approval to launch crypto index ETFs in the United States. On November 26, NYSE Arca, the securities exchange, requested to list a Bitwise ETF that would hold both Bitcoin and Ether.

Earlier in October, NYSE Arca expressed interest in listing a Grayscale crypto index ETF, which would hold a diverse basket of spot cryptocurrencies. In November, U.S. regulators signaled that they were considering this listing for approval, further demonstrating the increasing momentum behind crypto ETFs.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Leave a comment