Bitcoin and Crypto Market- Bitcoin Dips Below $100K, Triggering $1B in Liquidations

Bitcoin and Crypto Market– The cryptocurrency market experienced a sharp decline in the past 24 hours, with over $1 billion in liquidations as traders were caught off guard by the sudden shift in market sentiment. This liquidation follows a strong bullish rally that had dominated the market over the past 30 days, leaving many unprepared for the abrupt downturn.

Market Liquidity and Price Drops

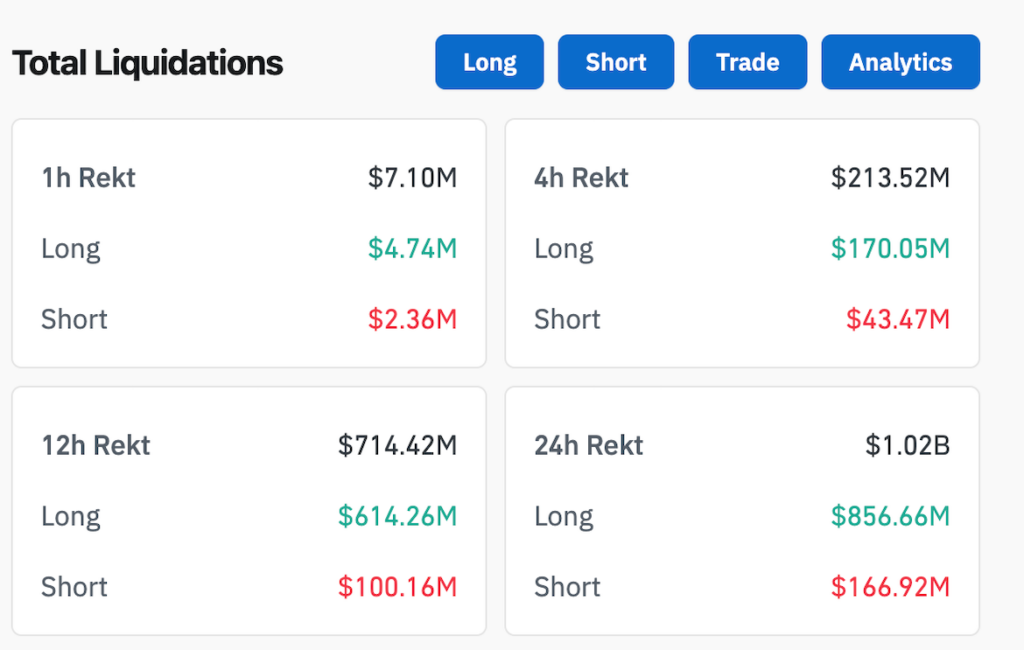

According to data from CoinGlass, on December 19, around $1.02 billion was liquidated within just 24 hours. The majority of these liquidations, approximately $856.7 million, were long positions. During the same period, Bitcoin (BTC) saw a 3.36% drop, falling below the crucial $100,000 level, which is often seen as a psychological price point for traders.

At the time of publication, Bitcoin was trading at $97,350, continuing its decline from earlier in the month. On December 5, Bitcoin dropped suddenly by 5.47%, dipping below $93,000 and causing $300 million worth of long positions to be liquidated. In a more dramatic move on December 10, the crypto market experienced a significant drawdown, wiping out over $1.7 billion in leveraged positions within a 24-hour span.

Analysts Suggest Short-Term Setback, Long-Term Optimism

Despite the recent volatility, some analysts believe that this market downturn may only be temporary. Pav Hundal, lead analyst at Swyftx, suggested that the market had been overly optimistic over the past month, leading to an underestimation of potential risks. Hundal explained, We’ve had such a bullish narrative over the last month that the market was completely unprepared for bad news. Now we’re seeing indiscriminate selling.

Hundal described the situation as “short-term angst” and emphasized that this is not the beginning of a larger downturn. He remained hopeful that a “Santa rally,” a traditional end-of-year market surge, could still be in play.

Market Behavior: Typical Bull Run Volatility

Crypto analysts like Caleb Franzen view the current volatility as typical behavior during a bull run. Franzen pointed out that during the previous bull cycle, Bitcoin saw nine pullbacks over 16 months, all of which were followed by higher highs. In a December 19 post on X (formerly Twitter), he encouraged traders to “buckle up, buttercup,” highlighting that such price fluctuations are common in volatile markets.

Jamie Coutts, Chief Crypto Analyst at Real Vision, also echoed these sentiments, suggesting that there may be a buying opportunity in the near future. He indicated that, despite the current pullbacks, the longer-term outlook remains positive, and this dip could be seen as a chance to enter the market.

The Impact of Trump’s Upcoming Inauguration

Another factor that analysts are watching closely is the potential impact of Donald Trump’s upcoming inauguration as the 47th President of the United States on January 20, 2025. Hundal believes that the crypto market is likely to price in expectations related to Trump’s administration, particularly regarding his stance on cryptocurrency and the potential creation of a U.S. Bitcoin strategic reserve.

According to Hundal, One side of the market is going to be on the wrong side of that bet, so I’d expect to see some volatility when the new administration comes in and the direction becomes a little clearer. Market participants are closely following any developments related to Trump’s plans for cryptocurrency regulation, which could significantly impact the broader market sentiment.

Volatility to Continue Amidst Uncertainty

As the crypto market continues to fluctuate, it is clear that volatility will remain a dominant theme in the coming months. Despite the recent liquidations, analysts maintain a cautious optimism, predicting that the market could rebound as it has done in previous cycles. With growing interest in crypto from both retail and institutional investors, the future of the market remains uncertain, but the potential for further growth is still very much alive.

The latest market downturn may be unsettling for some traders, but many believe that it represents a temporary correction rather than the start of a more extended bear market. As always, investors are advised to remain vigilant, watch for signs of recovery, and stay updated on macroeconomic and political developments that may affect market conditions.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Leave a comment