Falling Binance Bitcoin Reserves Signal Bullish Market Momentum

Two months before the 90% price spike in March, Bitcoin reserves on Binance, the biggest cryptocurrency exchange globally by trade volume, have fallen to levels not seen since January 2024. According to a Dec. 25 research note by Darkfost, a contributor to CryptoQuant, Binance’s Bitcoin reserves recently fell below 570,000 BTC, the lowest level since January. When exchange reserves fall, it usually means that investors are putting Bitcoin in cold storage and are optimistic about the cryptocurrency’s future price.

When periods of withdrawals occur, it is often a sign of positive momentum building in the market,

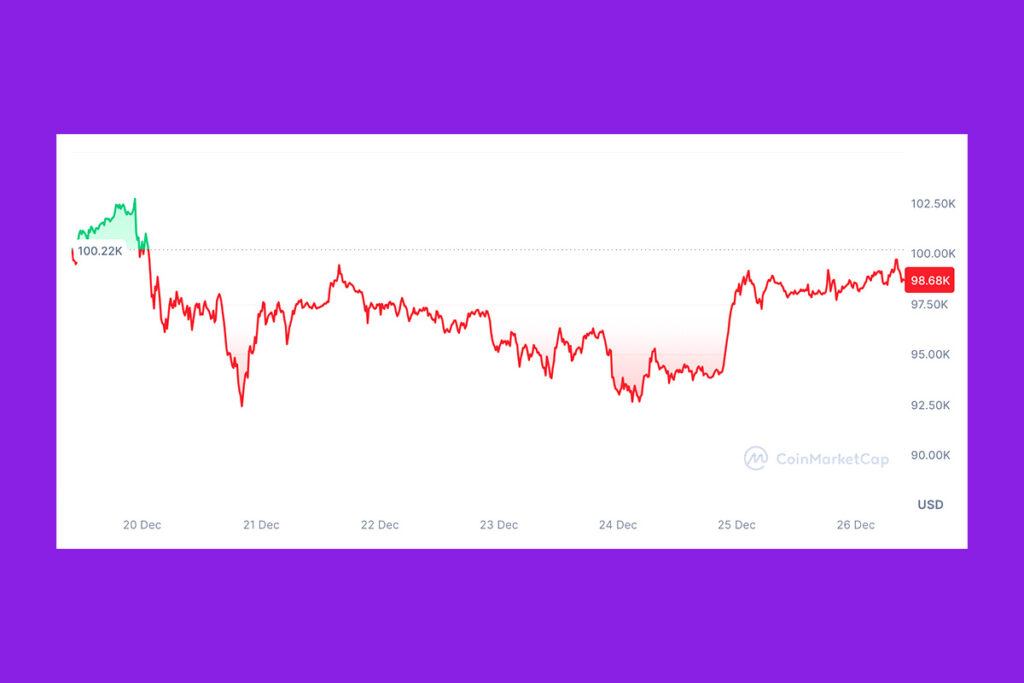

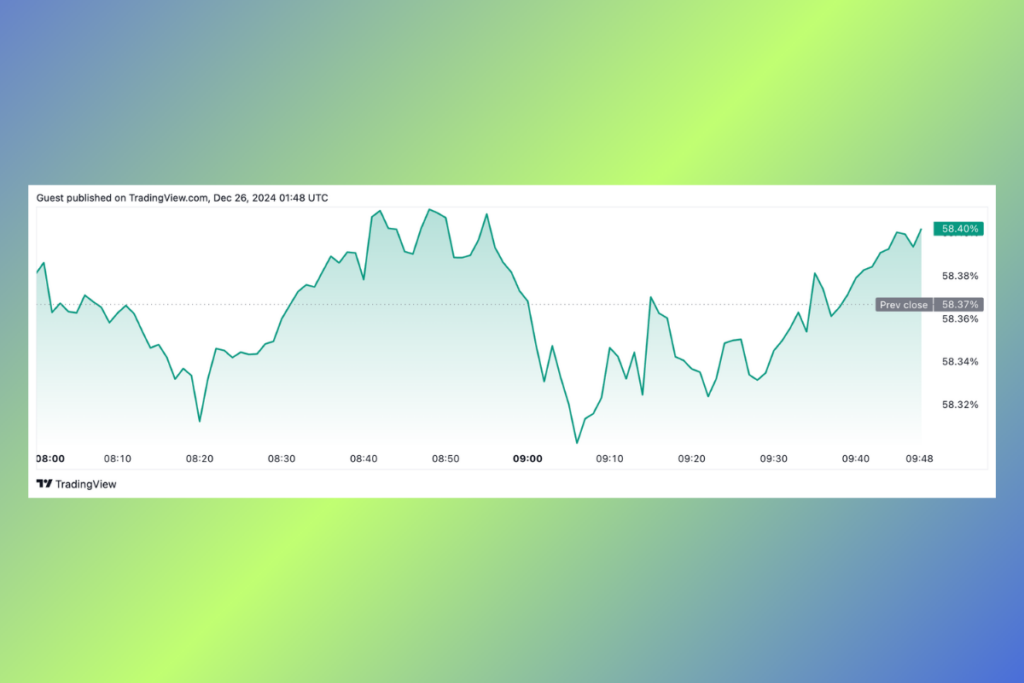

Bitcoin Struggles to Hold Above $100K Amid Market Dominance at 58.4%

According to TradingView, the dominance of Bitcoin is currently at 58.4%, barely below the crucial 60% barrier. The 60% threshold, according to some analysts, would indicate a more extensive shift toward other cryptocurrency assets. Benjamin Cowen, the founder of Into The Cryptoverse, stated on August 18 that he thought Bitcoin would reach its last push toward 60% by December at the latest. Two months later, on October 30, it did so.

Since initially breaking the psychological $100,000 mark on December 5, Bitcoin has had difficulty maintaining its position above it. After hitting a fresh high of $108,300 on December 17, the price of Bitcoin has been trading below $100,000 since December 19. The main analyst at Bitget Research, Ryan Lee, believes that if liquidity returns following the Christmas holidays, the price of Bitcoin might surpass $105,000.

Post-Christmas, market activity typically picks up again, with funds expected to actively position for sectors that might benefit from Trump’s upcoming inauguration… The expected trading range for BTC this week is $94,000 – $105,000.

Lee

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment