Bearish Sentiment Dominates: Ethereum, Solana, and Cardano Experience Sharp Losses

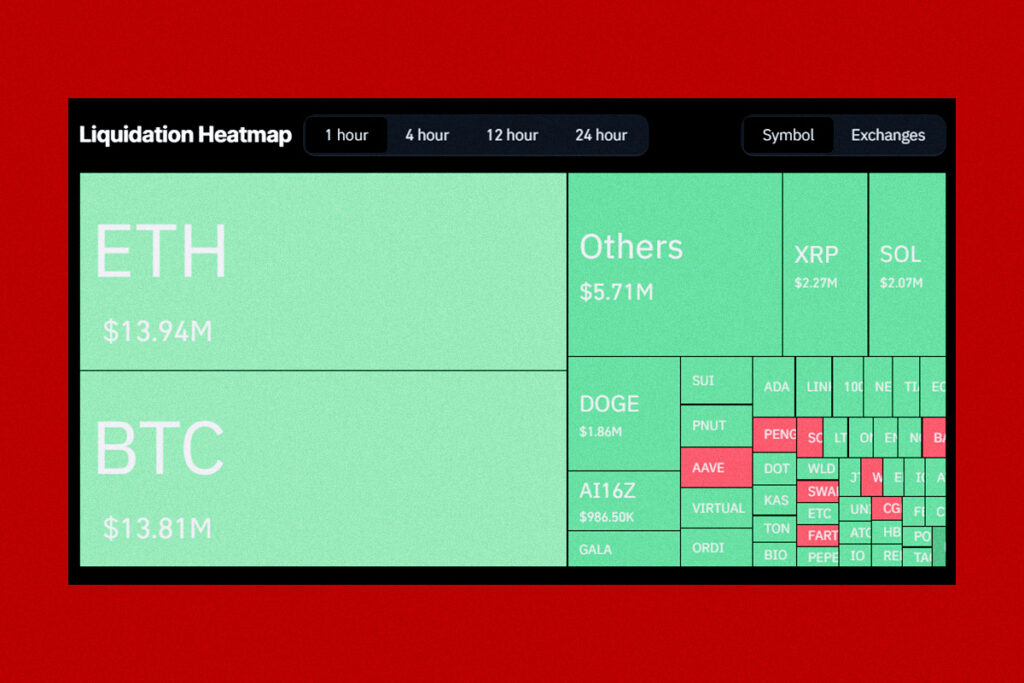

With a notable increase in lengthy liquidations and widespread drops in all of the main cryptocurrencies, the cryptocurrency market has had a tumultuous day. According to Coinglass statistics, $262.41 million long positions were erased across major centralized exchanges, bringing the total number of cryptocurrency liquidations over the preceding day to $328.45 million. In contrast, short liquidations were $66.04 million, highlighting the predominance of bearish sentiment. The current sell-off primarily affected leading altcoins.

- Over the last day, Ethereum’s value dropped by 7.53%.

- On the same day, Solana also dropped by more than 6.90%.

- On the last day, Cardano fell by over 7.81%.

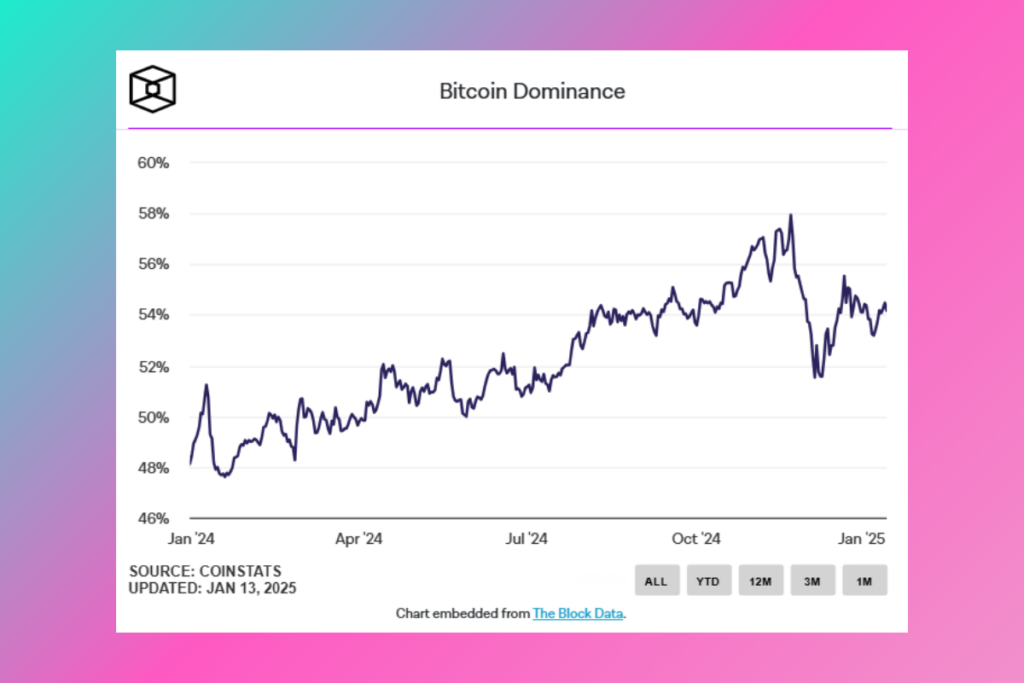

Bitcoin Leads During Market Volatility: Dominance Reaches 54.8%

With a 2.93% dip over the last day and a 9.04% drop over the week, Bitcoin has shown comparatively stronger performance. According to one analyst, this relative stability could be attributed to the fact that Bitcoin is a leading asset during uncertain market periods and that institutional interest in it has grown.

There are expectations for bitcoin ETF outflows to reverse, continued corporate purchases, and a decreasing unemployment rate, so we foresee a positive outlook for the digital asset in the coming days,

BRN analyst Valentin Fournier

Ethereum dominance, which measures the digital asset’s percentage of the total cryptocurrency market capitalization, has decreased to 11.3%, while Bitcoin dominance, which measures the asset’s share of the market, has increased to 54.8%. This suggests that bitcoin is receiving preferential treatment amidst the current market volatility.

Analysts Predict Bitcoin Recovery Amid Weak Sentiment Among Short-Term Investors

The sentiment of short-term Bitcoin investors, however, seems brittle. CryptoQuant data shows that short-term bitcoin holders are selling at a loss, as seen by their 0.987 Short-Term Spent Output Profit Ratio (SOPR), which gauges their profitability.

Analysts expect a significant upside in the current sell-off despite this weakness. Historical trends indicate that markets frequently recover when short-term investors give up, according to CryptoQuant. According to CryptoQuant experts, long-term holders, who usually see such circumstances as purchasing opportunities, might intervene to buy coins that short-term traders are selling at a discount if the price of bitcoin continues to drop.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment