Altcoin Season- The Impact of Rising Interest Rates on BTC and Altcoins

Altcoin Season– As the global financial environment continues to grapple with high interest rates, the possibility of liquidity flowing into altcoins within the crypto market has been significantly reduced. The so-called “altcoin season” that crypto enthusiasts often look forward to is increasingly likely to be driven by contracts rather than spot markets. This shift in market dynamics is a crucial consideration for investors, particularly those in the crypto space.

The Economic Cycle and Its Influence on Investment Behavior

Both traditional markets and crypto markets adhere to similar economic cycles, driven by liquidity expansion and contraction. Before crypto assets became a mainstream part of investment portfolios, investors already had a well-established system built around economic cycles.

Typically, economic recovery begins with assets closely tied to the macroeconomy. As interest rates fall, the yields on government bonds decrease. Institutional investors and central banks often move their capital away from the money market and into safer, low-volatility assets like gold and index ETFs. These assets offer a better potential return than government bonds, albeit with relatively low risk and volatility.

Once liquidity flows sufficiently into “value storage assets,” the marginal returns on these assets start to decline. This encourages investors to seek higher-risk, higher-reward opportunities, such as copper, crude oil, and individual stocks. At the end of an interest rate cut cycle, when interest rates begin to rise, investors typically sell high-volatility assets, reduce their exposure, and move their liquidity back into the money market. This cycle demonstrates the fundamental principle: assets with lower volatility are viewed as “value storage assets,” while those with higher volatility are seen as “value expansion assets.”

BTC as a “Value Storage Asset” in the Crypto Market

When considering the dynamics of the crypto market, Bitcoin (BTC) occupies a unique position. Despite its volatility, which is far higher than traditional assets like gold or stock indices, BTC’s price fluctuations are less extreme compared to other crypto assets. This characteristic, combined with its integration into the global financial system, has led to Bitcoin being regarded as a “value storage asset” within the crypto ecosystem.

On the other hand, altcoins, with their more pronounced volatility, are categorized as “value expansion assets.” These assets present the potential for greater returns, but they come with significantly higher risks, making them appealing during times of liquidity influx when investors are seeking to expand value.

The Current Market Cycle: High Interest Rates and Cautious Investor Behavior

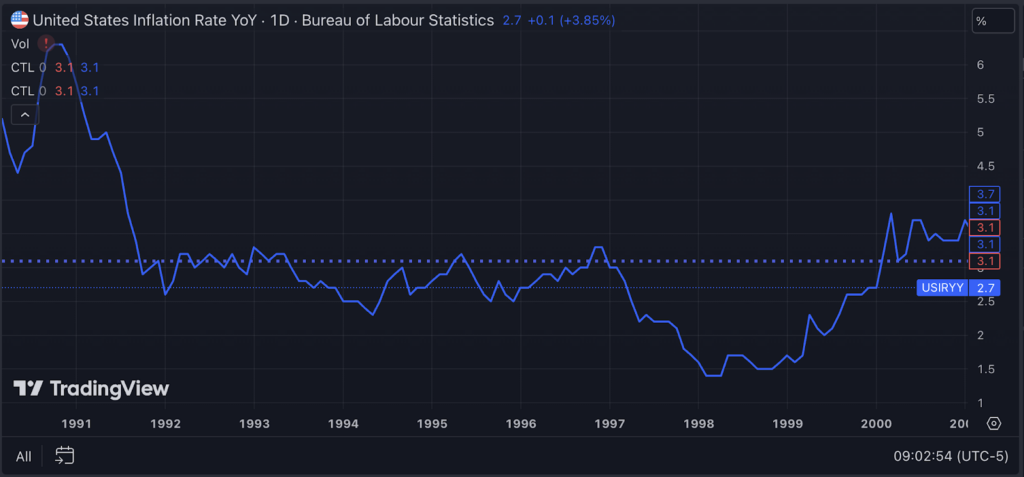

As of the latest Federal Reserve decisions, we are currently in the middle of an interest rate cut cycle, with one or possibly two more cuts expected in the near future. Despite the ongoing rate cuts, rising terminal rates are a significant concern for many investors. Government bonds, which remain attractive at interest rates above 4%, continue to appeal to risk-averse investors. This has created a scenario where risky assets, including altcoins, face downward pressure on their risk premiums.

The crypto market is showing signs of this shift. After the December 20th FOMC meeting, BTC and ETH saw a noticeable drop in their far-month futures premiums, with BTC’s risk premium being less volatile compared to ETH. This suggests that, even within the ongoing bull market, investors are becoming more cautious, and are increasingly preferring to hold “value storage assets” like BTC and stablecoins, rather than venturing into the more speculative altcoin markets.

In parallel, the traditional equity markets are exhibiting similar trends. Since December, small-cap stocks, represented by the IWM ETF, have experienced a decline, while the broader market, represented by the SPY ETF, has shown resilience. The SPY ETF rebounded to near its previous highs within days of the FOMC’s impact, while the IWM has struggled to regain momentum, highlighting investors’ preference for lower-volatility assets in the current high-rate environment.

Investors’ Cautious Outlook on Altcoins

The implied probability distributions in the options market further reveal this cautious sentiment. Compared to assets like SPY and BTC, the left-skewed implied probability for small-cap stocks (IWM) and altcoins like ETH is significantly more pronounced. This suggests that investors are betting on a higher probability of underperformance for these more volatile assets in the medium and long term.

When investors lack confidence in the performance of high-quality “value expansion assets,” the outlook for secondary assets, such as altcoins, becomes even more uncertain.

Will There Be a Bull Market Without an Altcoin Season?

Given the current market conditions, we may be entering a “bull market without an altcoin season.” However, this scenario does not mean altcoins are off the table entirely. Instead, it reflects a shift in investor behavior, where liquidity continues to flow into BTC and stablecoins, while altcoins take a backseat due to their heightened volatility.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Leave a comment