Crypto News – An analysis by InvestorsObserver rates Aevo as low risk.

Aevo Crypto Rises 29.82% in the Last 7 Days and Receives a Low-Risk Rating

This implies that significant changes in Aevo are accompanied by large inflows or outflows of money from the coin. It is quite improbable that the prices of low-risk cryptocurrencies will be influenced. A significant shift in a low-risk coin indicates a large inflow or outflow of funds.

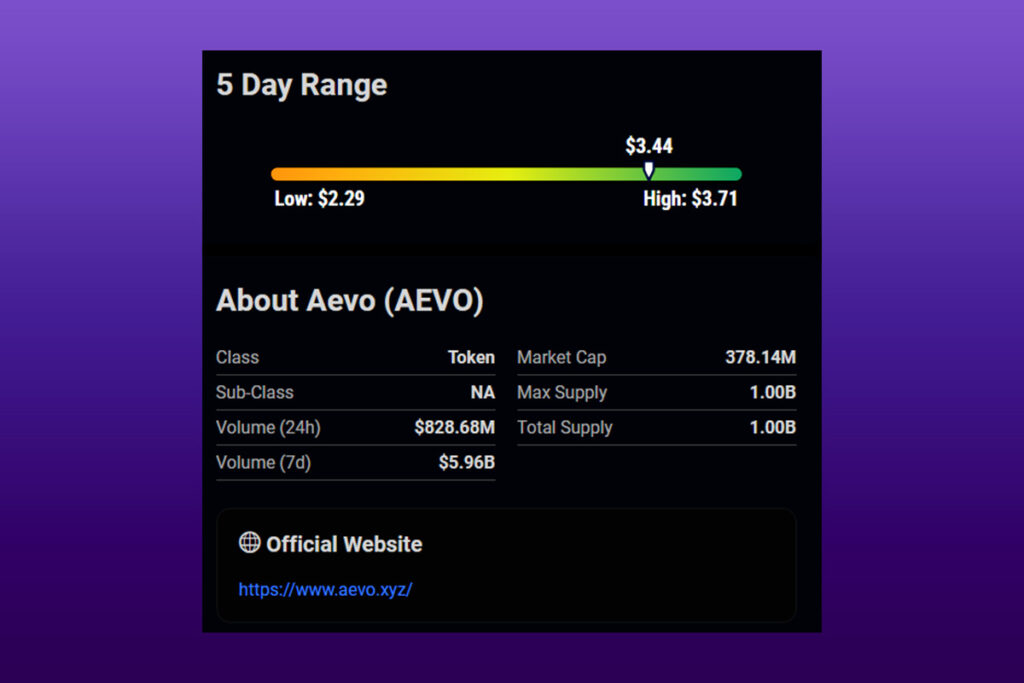

Aevo is currently trading at $3.25 after rising 7.28% over the previous 24 hours of trading. The market capitalization of the token has increased, and volume has been above average at the same time as the price change. Right now, the token’s market capitalization is $357,314,470. AEVO’s price fluctuation in relation to recent changes in market capitalization and volume indicates a low level of risk.

Leave a comment