Generative AI Rivalry Intensifies, Dragging Adobe Shares Plunge

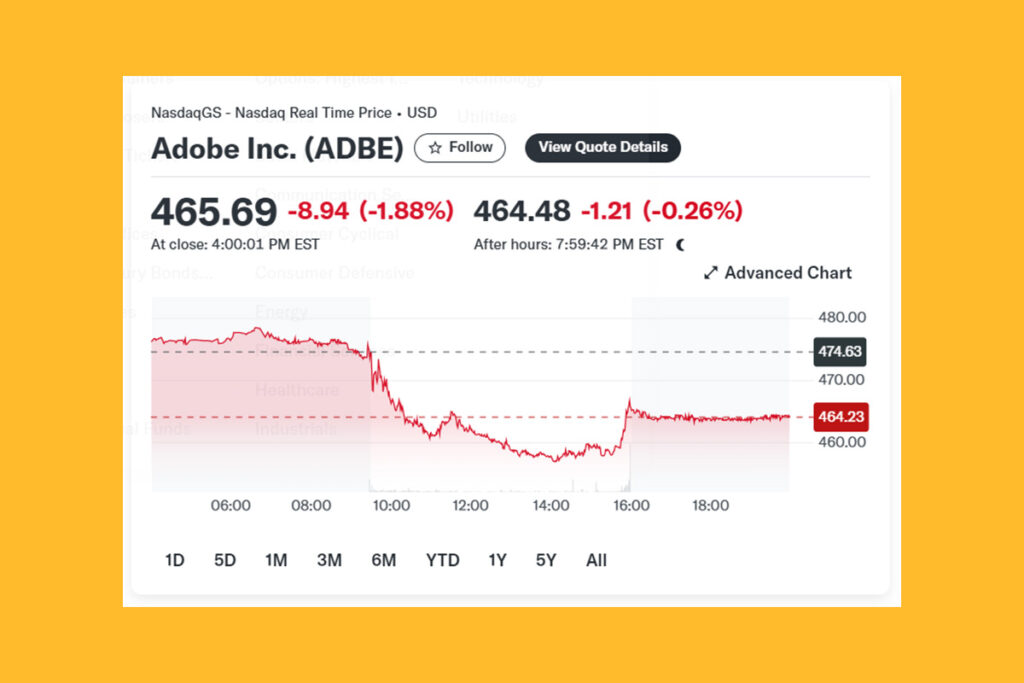

The shares of Adobe fell by almost 14%. Investor concerns that the company’s AI tools aren’t yielding results fast enough to fend off growing competition from other generative AI software makers were heightened Thursday after its poor outlook. Adobe stated in its results report on Wednesday that it anticipates fiscal year 2025 revenue between $23.3 billion and $23.6 billion, as well as adjusted earnings per share between $20.20 and $20.50. According to Bloomberg data, Wall Street analysts predicted that the company would generate $23.8 billion in revenue and an adjusted EPS of $20.52 a year.

Adobe Faces AI Monetization Challenges Amid Rising Competition

Adobe debuted its Firefly generative AI models, which produce text effects and visuals, in March 2023. In October, months after Google’s launch of a comparable approach, the creative software behemoth introduced its Firefly video-generation model. Also, the technology from Adobe was released much later than others from firms like Runway, Midjourney, and Stability AI. And with OpenAI, the company behind ChatGPT, releasing its text-to-video generation bot Sora just last week, the battle is getting fiercer.

Concerns over the company’s AI products being monetized and pressure from competitors have caused Adobe‘s stock to drop about 20% this year. The management of Adobe has not made clear how it plans to monetize the tools, according to Wall Street analysts.

Investors are finding it hard to reconcile the company’s bullish AI commentary with soft results and growth guidance,

wrote Bernstein analyst Mark Moerdler

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment