Crypto News– In a surprising turn of events, Bitcoin, the frontrunner in the world of cryptocurrencies, has surged beyond the $28,000 mark, a level not witnessed since August 17th.

2 October Bitcoin Price Soars Beyond 28,000 Dollars, Amassing 1.17 Billion Dollars in Just a Month, Commencing the ‘Uptober’ Momentum

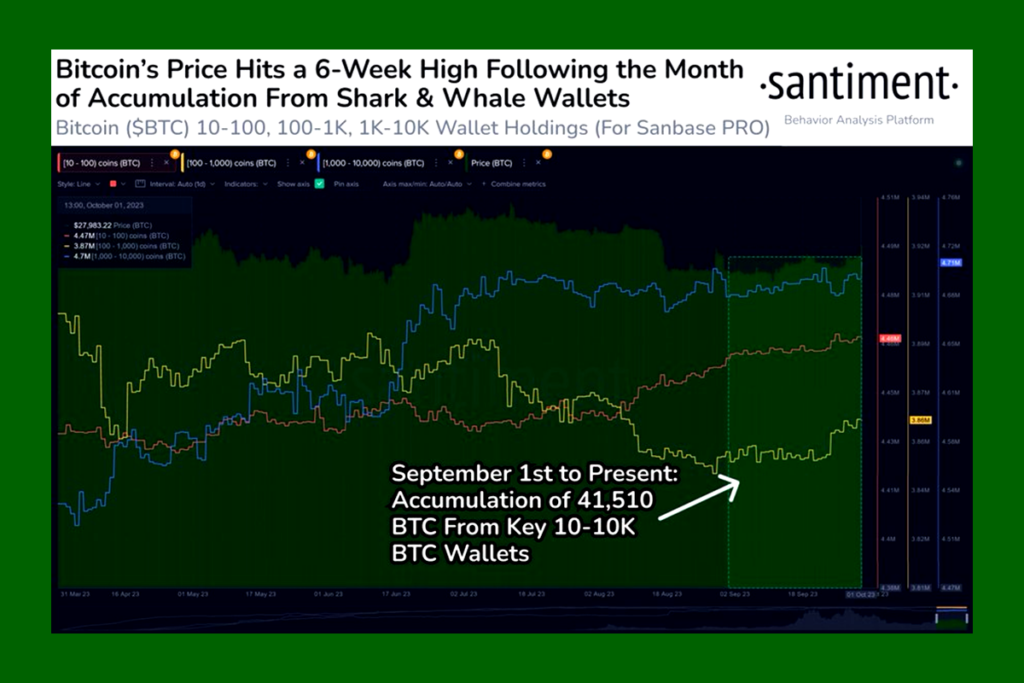

This sudden surge in demand has sparked renewed optimism among crypto enthusiasts and triggered discussions among market experts and investors alike. With Bitcoin accumulating significantly during its recent dips, on-chain analytics company Santiment foresees a potential climb to $30,000, provided that major holders resist the temptation to cash in for profits.

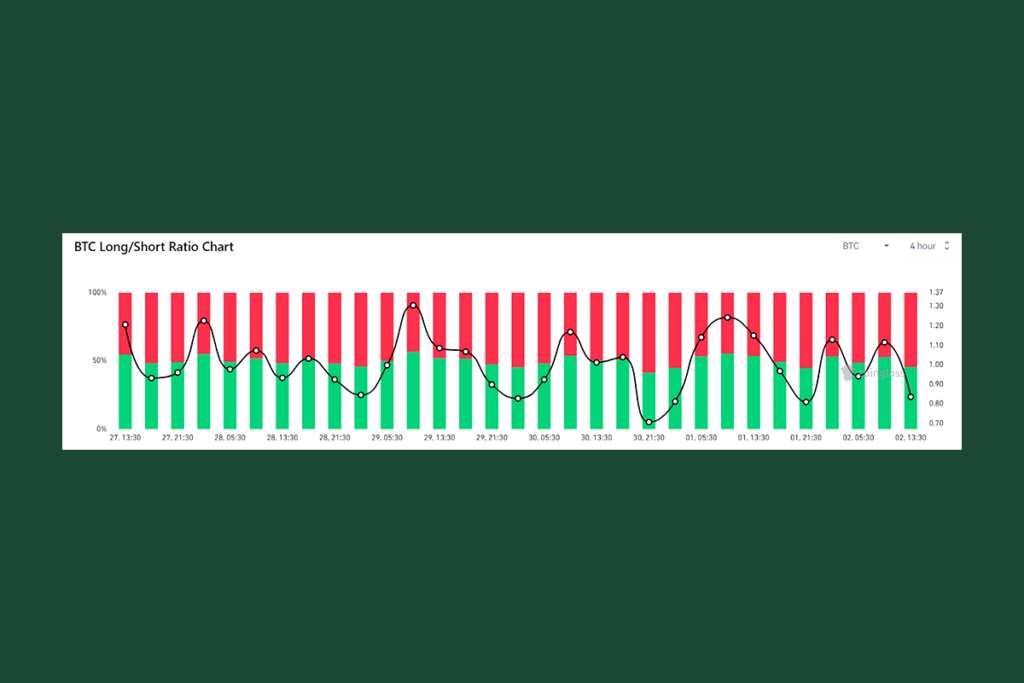

Bitcoin’s journey in “Uptober” has commenced, accompanied by the liquidation of $39 million in short positions in the crypto market. This unexpected surge in Bitcoin’s price, along with that of Ethereum (ETH) and other digital currencies on October 2, resulted in over $60 million worth of crypto shorts being swiftly liquidated.

Data from TradingView indicates that Bitcoin experienced a rapid 3% increase within a mere 15 minutes, surging from $27,100 to $28,000, where it stabilized at the time of this report.

CoinGlass data reveals that BTC prices witnessed a surge in short liquidations amounting to $39 million in just a few hours after the price showed strong buying demand near the $27,000 level.

This substantial liquidation highlights the increasing buying pressure, particularly as bearish sentiment struggled to maintain its selling momentum. For those unfamiliar with the term, short liquidation occurs when traders, expecting a price decline, are forced to exit their positions, often at a loss, due to unexpected upward movements.

The reason behind this sudden surge is seemingly straightforward, as per Santiment’s analysis. On-chain data reveals that September was one of Bitcoin’s worst months this year, leading to multiple price dips. This created an attractive opportunity for whales to accumulate Bitcoin at discounted prices. Santiment’s data shows that wallets holding between 10 to 10,000 BTC went on a shopping spree, accumulating a staggering $1.17 billion worth of Bitcoin (equivalent to 41,510 BTC) since the beginning of September. It is this aggressive accumulation pattern that has set the stage for the “Uptober” trend.

- altcoin news

- best crypto exchange

- best crypto to buy now

- Bitcoin News

- blockchain news

- crypto crash

- Crypto ETF

- crypto headlines

- crypto industry news

- crypto investment news

- crypto market news

- Crypto News

- Crypto News Today

- crypto prices

- crypto prices today

- crypto regulations

- crypto technology news

- crypto updates

- cryptocurrency events

- cryptocurrency news

- cryptocurrency trends

- decentralized finance news

- defi crypto

- digital currency news

- ethereum news

- new crypto coins

Leave a comment