Crypto News– In September, many investors expressed their dissatisfaction with the lackluster performance of Bitcoin (BTC). Some had even chosen to exit the market ahead of the summer break, adhering to the age-old adage: ‘Sell in May and go away.‘ Nevertheless, it appears that now is an opportune moment to redirect our focus towards the broader crypto and BTC market.

CryptoBirb: Bitcoin’s Best Buying Window Opens as September Concludes

Renowned cryptocurrency market analyst, CryptoBirb, recently shared a brief analysis of the historical returns generated by BTC in the subsequent months of the year. According to their findings, September, typically considered the weakest month historically, paradoxically presents the best prospects for market returns. It is closely trailed by the statistically most profitable months, namely October and November. Consequently, the concluding weeks of September may offer an exceptional window for acquiring Bitcoin.

Drawing from historical data, it’s worth noting that September stands out as the only month throughout the entirety of BTC’s trading history that has consistently yielded losses on average. Thus, CryptoBirb boldly asserts:

‘The second half of September is an insanely good opportunity to buy Bitcoin.‘

It’s essential to acknowledge, however, that this thesis does not offer a definitive guarantee for the optimal ‘buy the dip’ moment within the current week. Instead, it is founded on statistical insights and does not provide insights into the future price trajectory.

Nonetheless, history often exhibits patterns, particularly in the cyclical Bitcoin market. Consequently, when examining the statistics of the consecutive months of October and November, CryptoBirb doesn’t hesitate to identify what could arguably be the prime period for initiating long positions in BTC.

The Final Quarter: Where Bitcoin Historically Delivers Its Highest Gains

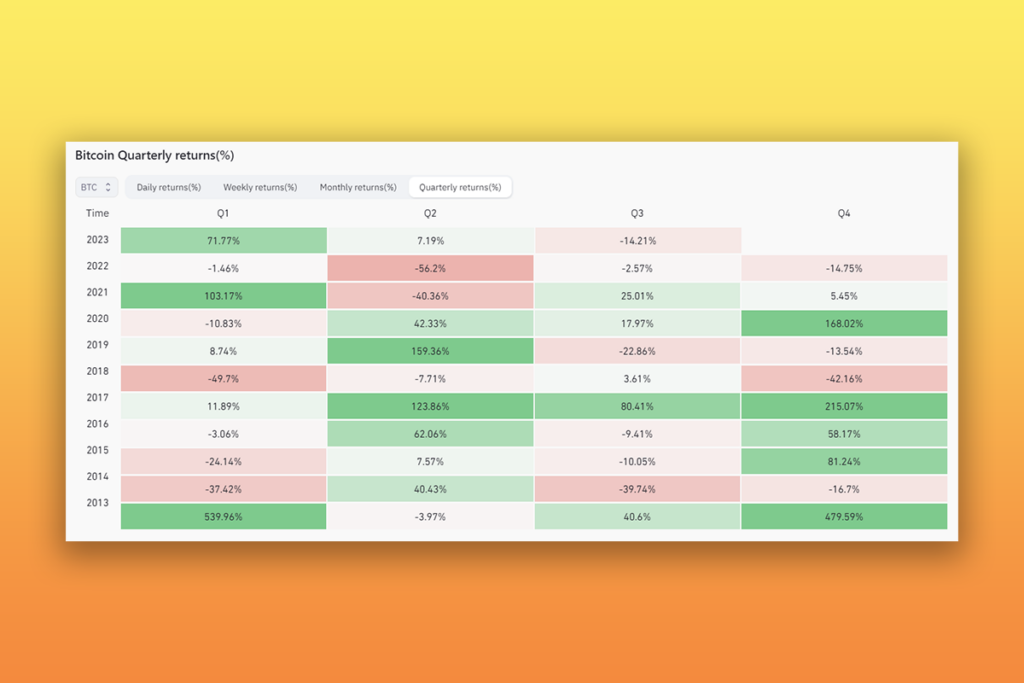

To corroborate CryptoBirb’s assertion, one can turn to the statistics provided by Coinglass, an analytics platform renowned for its comprehensive insights into profit and loss trends across various timeframes within the BTC market – spanning from daily to quarterly.

Primarily, it’s noteworthy that historically, the fourth quarter of each year (encompassing October through December) stands out as the most profitable period. In stark contrast, the third quarter (comprising July through September) consistently ranks as the least lucrative. Focusing solely on this specific timeframe, it becomes evident that the latter part of the third quarter presents an optimal window for purchasing BTC. This aligns precisely with the current ongoing weeks of September.

1 Comment