CME Group Partners with CF Benchmarks to Introduce APAC-Specific Crypto Reference Rates

Crypto News – CME Group, a major player in the global derivatives market, has unveiled a new collaboration with CF Benchmarks, a crypto indexing firm, to launch two novel APAC-focused reference rates for leading cryptocurrencies like bitcoin and ether.

Scheduled to be operational on September 11, the newly introduced rates are the CME CF Bitcoin Reference Rate APAC and the CME CF Ether-Dollar Reference Rate APAC. These rates will be published once daily at 4 p.m. Hong Kong time, denominated in U.S. dollars, providing essential pricing information for the two prominent digital assets.

Giovanni Vicioso, CME’s Global Head of Cryptocurrency Products, emphasized that these innovative rates have been designed to cater to the dynamic requirements of global participants in the swiftly expanding digital asset arena. He noted that a significant portion of this year’s crypto trading volume on the CME Group platform—37%—has taken place during non-U.S. hours, with 11% stemming from the APAC region. Vicioso further highlighted the importance of aligning cryptocurrency price risk hedging more closely with portfolio timings, especially given the increasing use of Bitcoin and Ether futures products in institutional portfolios and structured offerings such as ETFs.

Presently, CME and CF Benchmarks collaborate to produce various crypto-related reference rates, including the CME CF Bitcoin Reference Rate and the CME CF Ether-Dollar Reference Rate, both published at 4 p.m. London time. Additionally, they release two other rates at 4 p.m. New York time—the CME CF Bitcoin Reference Rate New York and the CME CF Ether-Dollar Reference Rate New York.

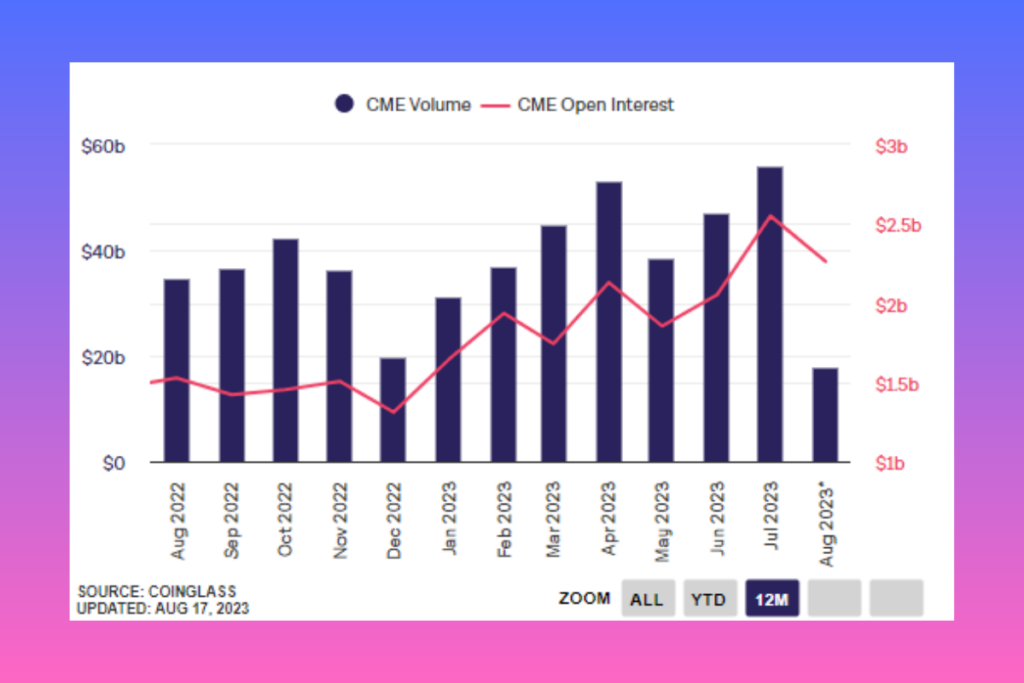

A noteworthy achievement for CME’s bitcoin futures market was the July trading volume surpassing the previous high set in April. According to Coinglass data, CME recorded $55.78 billion in bitcoin futures trading volume for July, exceeding the $53.06 billion traded in April.

Back in December, the partnership introduced DeFi reference rates and real-time indices for prominent platforms like Aave, Curve, and Synthetix.

Leave a comment