Crypto News, BitGo, a Palo Alto-based crypto custody veteran, has successfully raised $100 million in a Series C funding round, pushing its valuation to an impressive $1.75 billion.

BitGo Raises 100M $ Amid Expansion Efforts

The newly-acquired capital is earmarked for strategic acquisitions and an ambitious global expansion.

This fundraising news follows BitGo’s tumultuous relationship with Galaxy, which had originally intended to acquire BitGo for $1.2 billion.

Past Hurdles and Ambitions

The deal faced turbulence, attributed to BitGo’s failure to provide audited financial records from 2021, leading Galaxy to terminate the acquisition.

BitGo responded with a lawsuit against Galaxy, claiming Galaxy intentionally violated their merger agreement. BitGo, not deterred, later hinted at an acquisition of Prime Trust, a regulated crypto custody startup from Nevada. Yet this potential acquisition too unraveled, coinciding with Prime Trust’s recent Chapter 11 bankruptcy filing.

Impressive Growth Metrics

Despite these challenges, BitGo has showcased remarkable resilience and growth. They’ve reported a 60% uptick in their clientele, a 20% surge in assets under their custody, a substantial 200% leap in fiat custody, and a notable increase in staked assets. Additionally, the firm has introduced the Go Network, an instantaneous settlement platform.

Fundraising Landscape

Back in November, rumors swirled about BitGo’s intent to fundraise at a $1.2 billion valuation, coming on the heels of a botched deal with Galaxy. Their last significant fundraising effort dates back to 2017, where they amassed $42.5 million in a Series B round. This round saw investments from influential names like former PayPal COO David Sacks and Goldman Sachs.

The Broader Crypto Venture Scenario

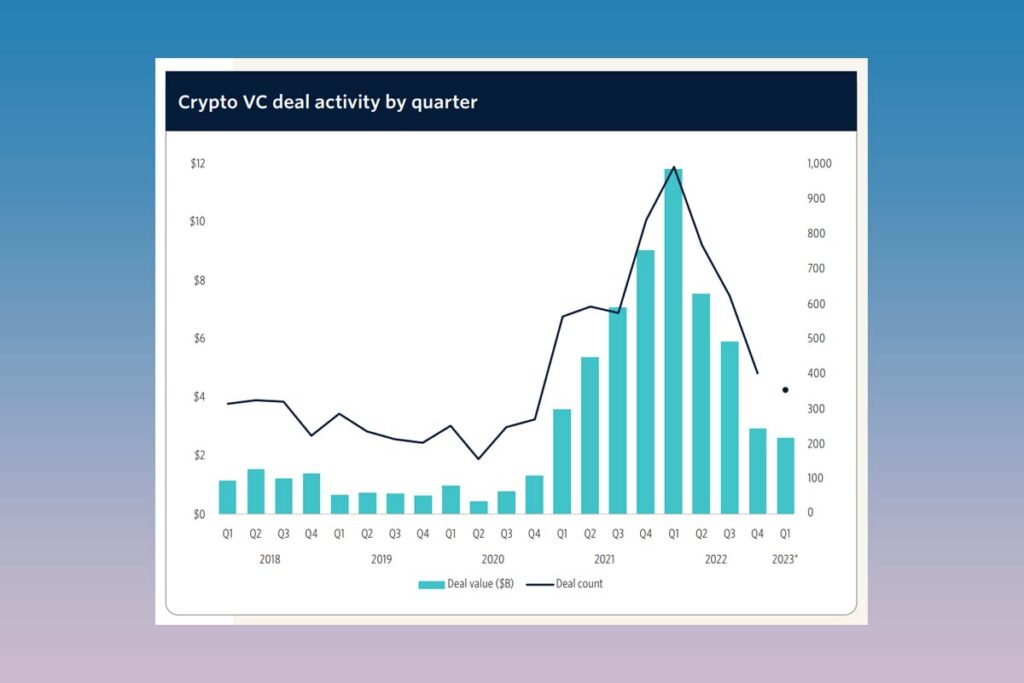

2023 paints a complex picture for crypto companies seeking venture capital, particularly for late-stage entities. High-profile ventures such as FTX, BlockFi, and Celsius Network faced setbacks, influencing the overall funding environment.

This year’s venture funding for the crypto realm is anticipated to hover around $2.5 billion in Q3, a sharp drop from the $13.5 billion achieved in Q1 2022. However, outliers exist, like Tools for Humanity and EigenLayer, who have both managed to secure substantial investments this year.

Leave a comment