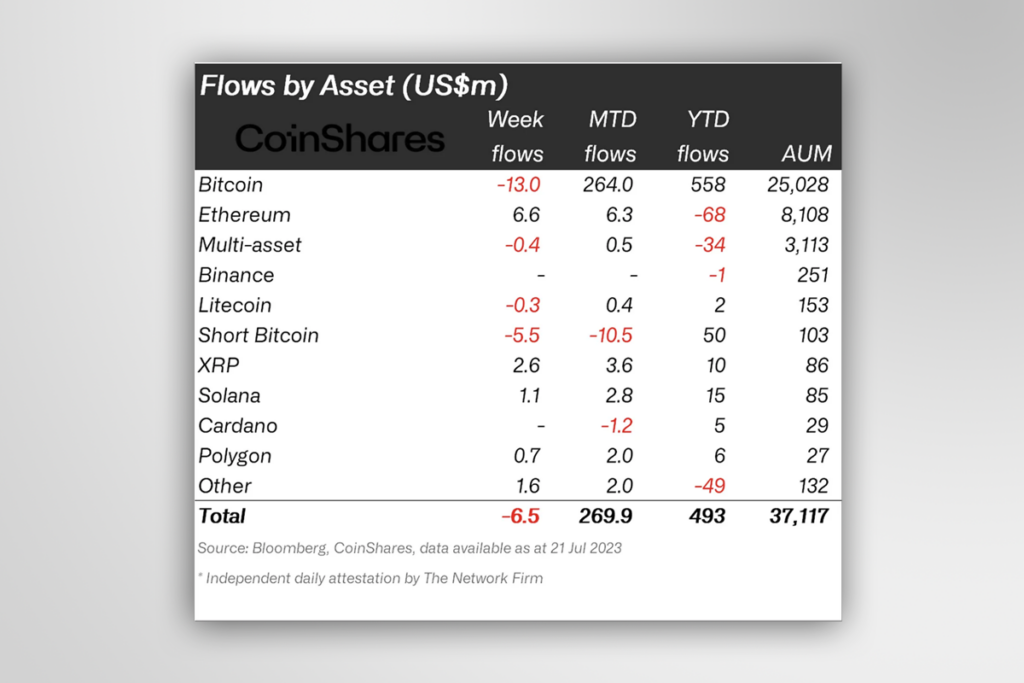

Last week marked a significant shift in the digital asset investment landscape, with investment products experiencing a net outflow of $6.5 million. This development ended a four-week streak of net inflows, indicating a potential change in investor sentiment.

Digital Asset Investment Products Witness $6.5M Net Outflow: A Shift in Crypto Investment Trends

Bitcoin, the leading cryptocurrency, saw a net outflow of $13 million in investment products. This outflow contrasts with Ethereum, which recorded $6.6 million in inflows. This divergence suggests a potential shift in investor sentiment, with Ethereum possibly gaining favor over Bitcoin.

Alternative digital assets, including Solana, Uniswap, and Polygon, also attracted inflows. These assets recorded inflows of $1.1 million, $0.7 million, and $0.7 million, respectively, signaling growing interest in these cryptocurrencies.

The total trading volume of digital asset investment products for the week was $1.2 billion, significantly lower than the weekly average for the year. The previous week had seen a trading volume of $2.4 billion.

primary impact is on the North American market

The recent outflows primarily impacted the North American market, accounting for 99% of the total outflow, amounting to $21 million. However, Switzerland and Germany bucked the trend, attracting inflows of $12 million and $1.9 million, respectively.

Despite the overall outflow, Ethereum and XRP showed encouraging signs. Ethereum led the way with $6.6 million in inflows, suggesting a potential shift in sentiment. XRP also saw renewed interest from investors, with inflows totaling $6.8 million over the last 11 weeks, representing 8% of assets under management (AuM).

In conclusion

The recent net outflow in digital asset investment products indicates a shift in crypto investment trends. While Bitcoin saw outflows, Ethereum and other alternative digital assets attracted inflows, suggesting a potential change in investor preferences.

Leave a comment