Bitcoin Bull Run Stalls: Are Institutional Investors Abandoning Crypto?

A considerable decline in institutional investments in cryptocurrency markets and persistent macroeconomic uncertainty were cited by observers as reasons why Bitcoin’s recent surge beyond the crucial psychological barrier of $90,000 was short-lived. Before completing a double-top chart pattern of around $94,200 on the daily chart, which signals an impending price collapse, Bitcoin staged an almost 10% recovery to above $95,000 on March 2.

According to TradingView statistics, Bitcoin has been fighting to stay above the $90,000 threshold since plunging to about $81,400 the next day. According to Ryan Lee, principal analyst at Bitget Research, several variables, including US spot Bitcoin ETFs, are causing the Bitcoin collapse.

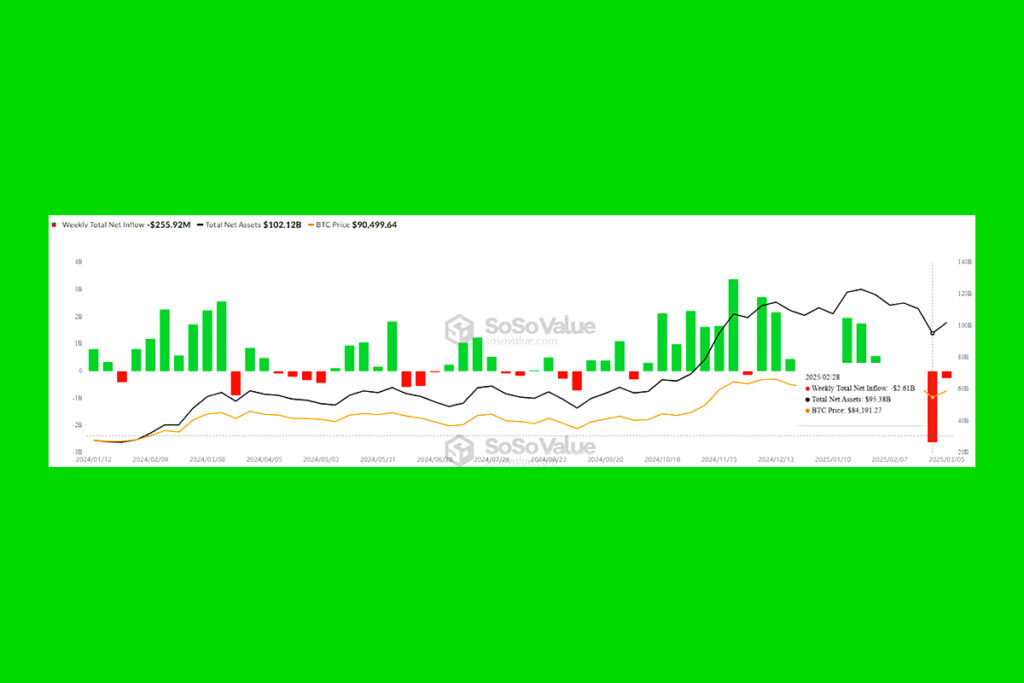

Significant outflows from spot Bitcoin ETFs have amplified selling pressure, as institutional investors pulled back, likely reacting to macroeconomic uncertainties and shifting risk sentiment.

Lee

Bitcoin ETFs Hit Hard, But Analysts Still See $180K Price Target

According to Sosovalue statistics, the US spot Bitcoin ETFs saw cumulative net outflows of nearly $2.6 billion during the final week of February, and they are currently experiencing their fourth consecutive week of net negative outflows. According to Lee, macroeconomic variables are exerting pressure on Bitcoin’s price behavior in addition to ETF inflows.

New tariff announcements from President Trump have heightened concerns about inflation and economic stability, prompting investors to favor safer assets over risk-on investments like Bitcoin.

Lee

However, with price projections ranging from $160,000 to over $180,000, analysts were upbeat about the direction of Bitcoin’s price in due course.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment