Tesla Shares Decline: Can AI and Robots Save the Stocks?

As Tesla (TSLA) expands into robots and artificial intelligence, Morgan Stanley analyst Adam Jonas predicted on Monday that the company’s stock would rise to $430. As EV sales fell in February, the company’s shares fell nearly 28%, leaving investors to question whether CEO Elon Musk’s political participation was deterring purchasers.

Tesla’s Shift to AI and Robotics Could Boost Stock to $430, Says Morgan Stanley

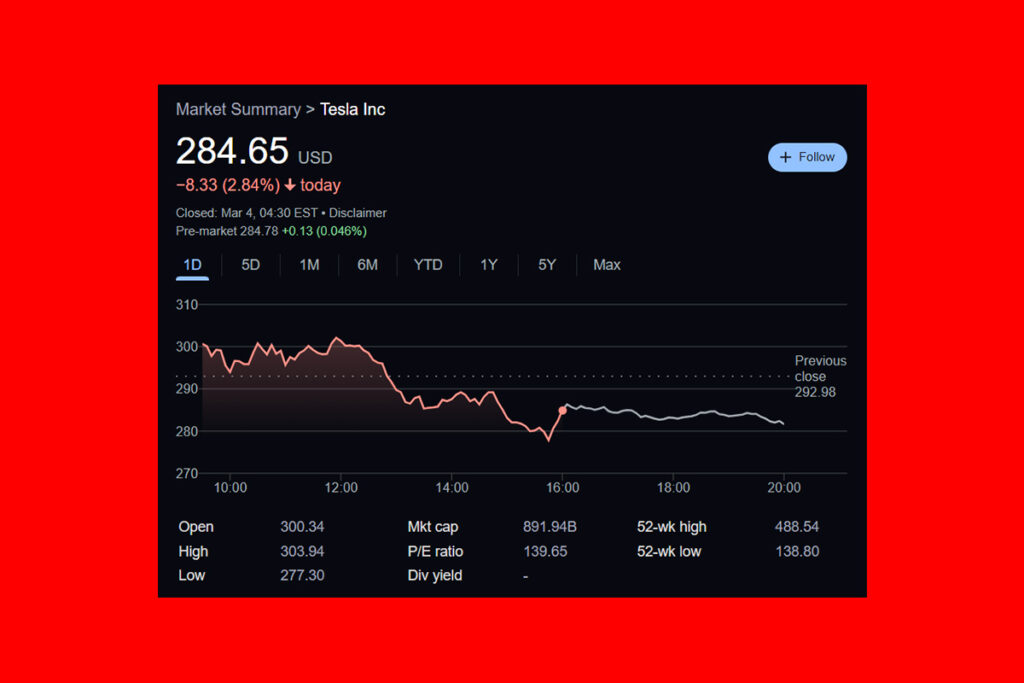

Amidst a wider tech sell-off on Monday, Tesla’s stock dropped more than 2.8%. As word of Jonas’s memo spread around Wall Street, shares first increased by 2%. According to Jonas, Tesla’s full-year 2025 deliveries may decrease annually, making it a desirable time for investors to invest. With a price target of $430, over 50% higher than Friday’s finish of $292.98, and a bull case of $800, the analyst reinstated Tesla as a top selection for the auto industry.

Tesla’s softer auto deliveries are emblematic of a company in the transition from an automotive ‘pure play’ to a highly diversified play on AI and robotics. As we continue our analysis of the overlap of AI and robotics, it is increasingly clear to us that the commercial opportunity of non-auto expressions of embodied AI is likely far larger and faster-adopting than that of autonomous cars,

Jonas

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment