Tax Alert: Turkish Revenue Administration Addresses Rental Income Debate

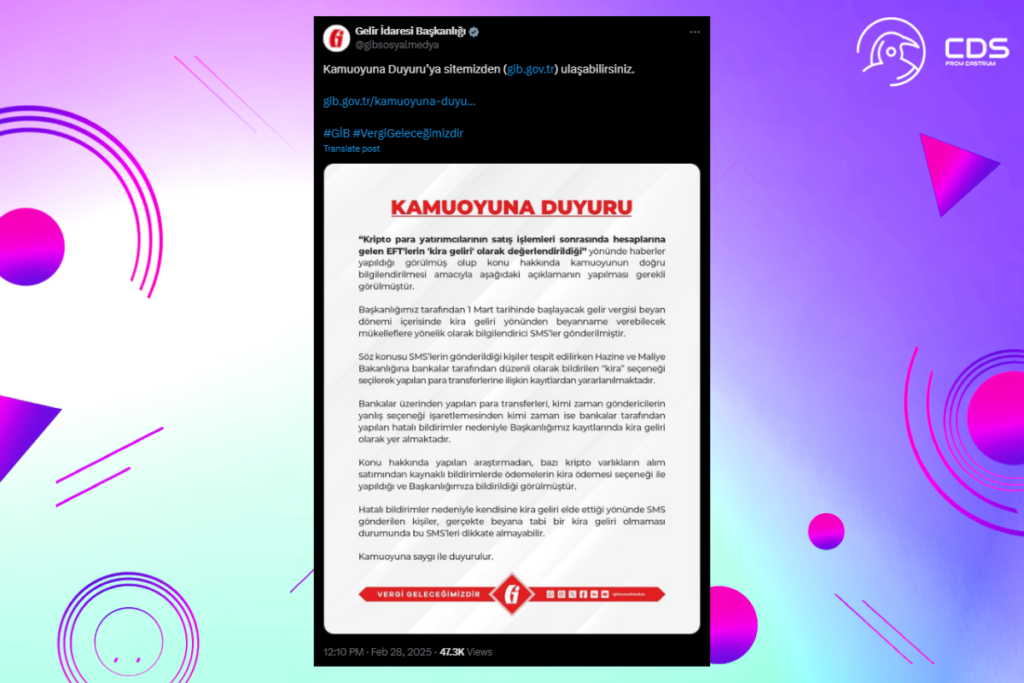

In response to worries about cryptocurrency-related activities, the Turkish Revenue Administration (GİB) recently released a statement addressing rental income restrictions. This clarification follows increasing debates over tax laws and whether or not some financial transactions qualify as rental income.

Crypto Profits as Rental Income? Turkey’s Tax Debate Heats Up

The declaration comes after a recent discussion about whether or not profits from cryptocurrency transactions could be categorized as rental income. According to earlier reports, people who use their personal bank accounts to facilitate cryptocurrency transactions run the possibility of having their profits classified as rental income. Those who trade cryptocurrencies may be subject to additional tax requirements as a result of this classification.

Concerns have arisen as Turkish tax authorities have sent notices to crypto-related traders questioning whether their use of bank accounts constitutes a form of virtual leasing. The possibility that these transactions could be taxed under rental income laws has caused great uncertainty among investors and traders.

Crypto Taxes in Turkey: Who Needs to Worry About Rental Income Rules?

Standard cryptocurrency transactions do not automatically fall under rental income taxation, as GİB emphasized in its most recent announcement. However, the government underlined that real estate and other comparable tangible assets are expressly subject to rental income taxation. Other tax requirements may apply if an individual is shown to be regularly providing financial services or using their accounts in a way that resembles a company.

This explanation distinguishes typical cryptocurrency transactions from those that might be categorized as organized commercial operations. Even though individual cryptocurrency dealers are not directly impacted, those who facilitate large-scale financial transactions through their bank accounts may still need to examine their tax obligations carefully.

Conclusion

The recent statement from the Turkish Revenue Administration clarifies the taxation of transactions involving cryptocurrencies. The declaration reassures investors while upholding regulatory oversight by reiterating the separation between rental revenue and financial activity. It is crucial for cryptocurrency traders to be aware of and adhere to changing legislation as Turkey continues to improve its approach to taxing digital assets.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment