Global Finance Faces Liquidity Squeeze: Will XRP Adoption Become the Solution?

Financial markets’ tightening liquidity has raised interest in XRP, which analysts believe could be the solution to this problem. Some analysts predict that XRP’s price may increase as it becomes more widely used for cross-border transactions and settlements.

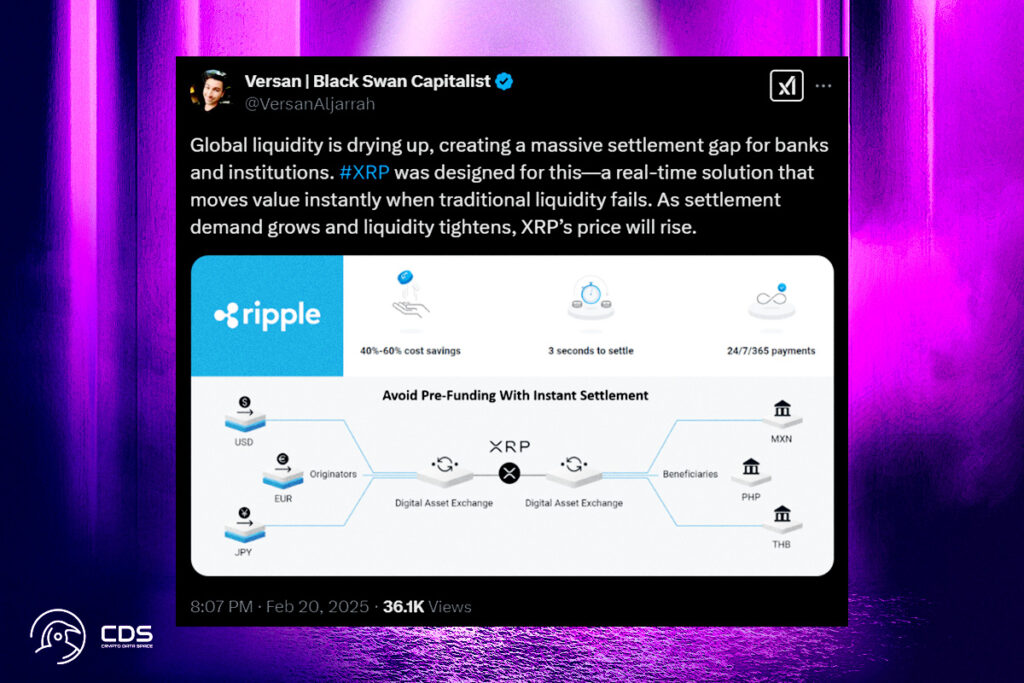

Black Swan Capitalist’s founder, Versan Aljarrah, recently voiced worries regarding a widening settlement gap that is impacting banks and other financial institutions. He noted in a recent statement that traditional financial systems are finding it increasingly challenging to handle transactions effectively due to global liquidity restrictions. He contends that XRP might offer a solution because of its real-time settlement capabilities.

XRP Adoption Surging? Analysts Say It Could Replace Traditional Liquidity Sources!

XRP is made to enable quick and affordable transactions, especially when it comes to cross-border payments. Financial institutions may increasingly look to XRP as a substitute as conventional liquidity sources become less available, according to Aljarrah. He thinks that if more institutions incorporate the asset into their payment systems, demand may directly affect the token’s price and drive it upward.

Aljarrah maintained that XRP is an essential part of the global financial system and not just another cryptocurrency, which further supported his position. Other supporters, including financial advisor Linda Jones, who likened owning XRP to purchasing early Berkshire Hathaway stock, share his viewpoint.

Could XRP Become the Next Bitcoin? Supply Shock Theory Sparks Debate!

The long-term worth of the token is still up for debate, with some analysts making bold forecasts. Chad Steingraber, one such individual, has predicted that the asset might hit $20,000 per token, pointing to institutional demand as a major motivator. One possible possibility, according to Steingraber, is that leading financial institutions start using XRP as a reserve asset. He thinks that by keeping sizable XRP reserves, institutional liquidity providers might raise demand.

He also suggests that a rapid spike in bank purchases of XRP can cause a supply shock, bringing the total amount of XRP available to the public to levels similar to the 21 million token cap on Bitcoin. In this case, the token’s price can reach previously unheard-of heights because of its restricted supply and strong institutional demand.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment