Bitcoin Volatility Crash: Could Bitcoin Be on the Verge of a Massive Surge?

With implied volatility hitting all-time lows, Bitcoin is still trading in a narrow range around $96,000. BTC/USD is still strong despite recent market events like the Bybit exchange hack and growing institutional interest. Bitcoin’s one-week realized volatility has decreased to 23.42%, a level not seen since late 2024, according to data from Glassnode. In the past, significant market changes have frequently been preceded by such compressed volatility.

Strategy’s Bitcoin Holdings Near Half a Million: Will It Buy More?

An important element influencing the current state of Bitcoin is the growing institutional participation. Previously known as MicroStrategy, Strategy now looks ready to grow its Bitcoin holdings. The company’s strong dedication to building up Bitcoin is demonstrated by the CEO, Michael Saylor, who recently provided an updated Bitcoin treasury chart.

As of right now, Strategy holds 478,740 Bitcoin, which is worth around $46 billion. To finance these purchases, the company recently finished issuing $2 billion in convertible notes. In keeping with its positive attitude toward Bitcoin, the corporation acquired almost $742 million for 7,633 BTC on February 10.

In support of the firm’s Bitcoin-heavy strategy, BlackRock has raised its investment in Strategy to 5%, adding to the institutional momentum. Furthermore, treasury funds and pension systems from twelve U.S. states are exposed to Strategy. California’s teachers’ retirement fund is the largest, investing $83 million.

Bitcoin Price Prediction: Bullish Breakout or Bearish Reversal Below $90K?

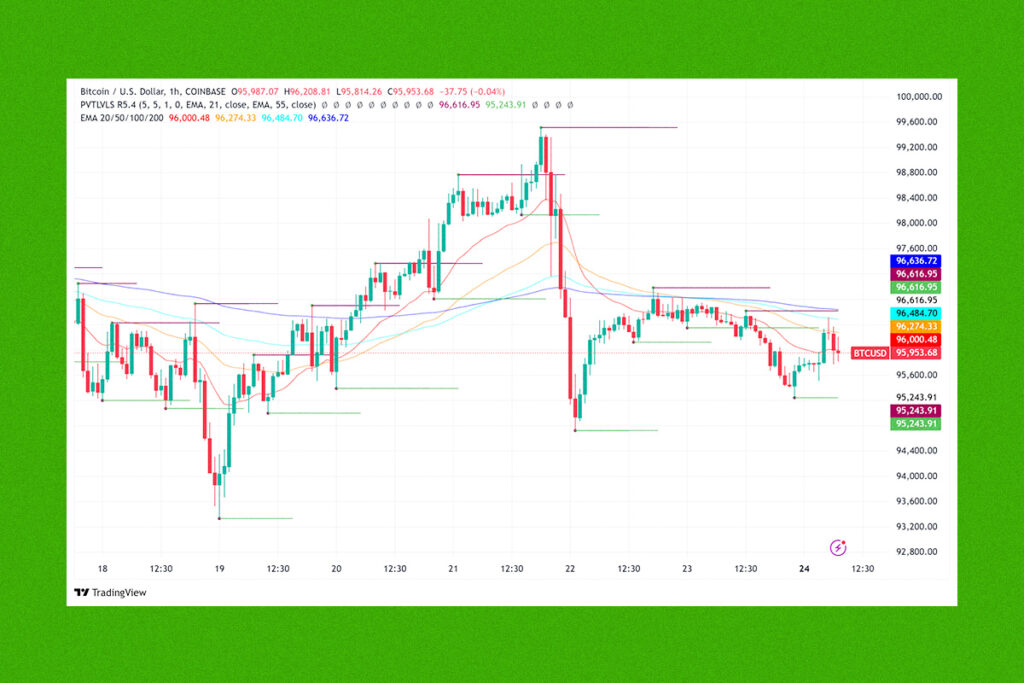

A conflict between bulls and bears is implied by the current price structure of Bitcoin. A notable resistance level is the 50-day simple moving average (SMA) around $98,933, while the $92,000–$94,000 range continues to be a solid support area. Key price levels that traders are keeping a close eye on include:

- Resistance at $106,000: A new wave of price discovery can be triggered by a breakout above this level.

- Crucial Support at $92,000-$94,000: For Bitcoin’s present price action to continue, this range must be maintained.

- Potential Downside to $85,000: Experts estimate that Bitcoin may fall to $85,000 if it loses important support.

Because of growing institutional acceptance, Bitcoin’s long-term outlook is still positive despite short-term consolidation. Future growth could be facilitated by Bitcoin’s ability to break through the psychological $100,000 barrier. Analysts predict that the next major resistance level will be $102,500. However, a more substantial reversal in the direction of $90,000 would occur if the price fell below the current support levels.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment