Kraken Resumes Crypto Staking in the US After SEC Settlement

For consumers in the US, Kraken has brought back cryptocurrency staking services. This is over two years after the program was put on hold because of a Securities and Exchange Commission (SEC) settlement. Kraken had agreed to end its staking-as-a-service operation in February 2023 following a $30 million settlement with the SEC.

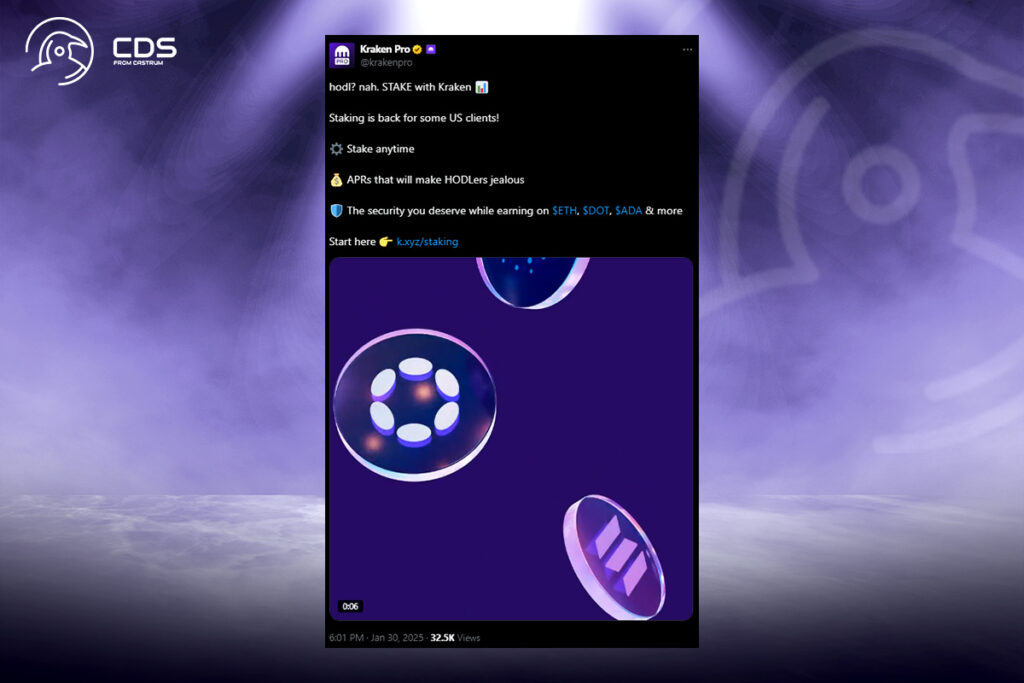

According to the regulatory action, securities laws were broken by the company’s prior staking service. Kraken has now modified its strategy to allow US customers to stake digital assets in accordance with legal requirements. In this regard, eligible users can stake supported tokens using Kraken Pro with the new offering, which is accessible in 37 states and two territories. As regulations allow, the exchange intends to open up access to additional states.

Kraken Introduces Bonded Staking for US Users—Here’s How It Works

Mark Greenberg, Global Head of Consumer at Kraken, called the relaunch a significant victory for both the company and the larger U.S. cryptocurrency market. 17 digital assets, such as Ethereum (ETH), Solana (SOL), Polkadot (DOT), and Cardano (ADA), are supported by Kraken’s staking services. Additionally, re-staking will be available to U.S. clients, also enabling them to stake ETH for use in EigenLayer projects that profit from Ethereum’s security.

Bonded staking, which necessitates holding assets for a predetermined amount of time, is available to qualified users. The validators in charge of block production and transaction validation are entrusted with these staked assets by the exchange. Staking rewards are returned by validators to Kraken, which disburses them to customers after subtracting any relevant costs.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment