SEC Grants Initial Approval for Bitwise Bitcoin-Ethereum ETF

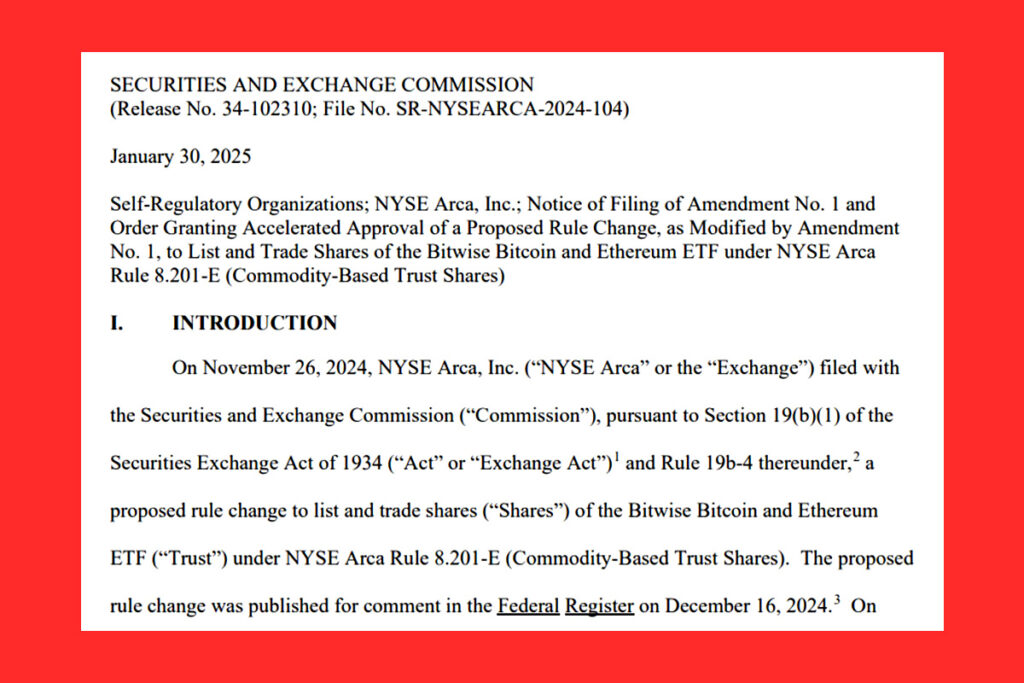

Bitwise Asset Management‘s exchange-traded fund that tracks the price of Ethereum and Bitcoin has received preliminary approval from the US Securities and Exchange Commission. Form 19b-4, the first stage in the procedure that would enable ETFs to begin trading, was approved by the regulator on January 30. For the fund to become live, Bitwise still requires the SEC to approve a Form S-1, a pending registration application.

Weighted based on the relative market capitalizations of each asset, the Bitwise Bitcoin and Ethereum ETF would provide exposure to the spot prices of Bitcoin and Ether in a single fund. This was 17% ETH and 83% BTC as of the filing date. By multiplying pricing benchmarks by the current circulating supply and filing states of two crypto assets, the ETF will determine their market capitalization.

Bitwise Pushes Ahead with ETFs as SEC Opens Door to Crypto Products

Less than two weeks after the SEC’s new, crypto-friendly acting chair was appointed, the approval was granted. In November, after Donald Trump won the election, Bitwise filed documentation for the joint ETF with authorities. Bitwise Investment Advisers will oversee the fund, Coinbase will provide custody, and Bank of New York Mellon will act as the administrator, transfer agent, and cash custodian.

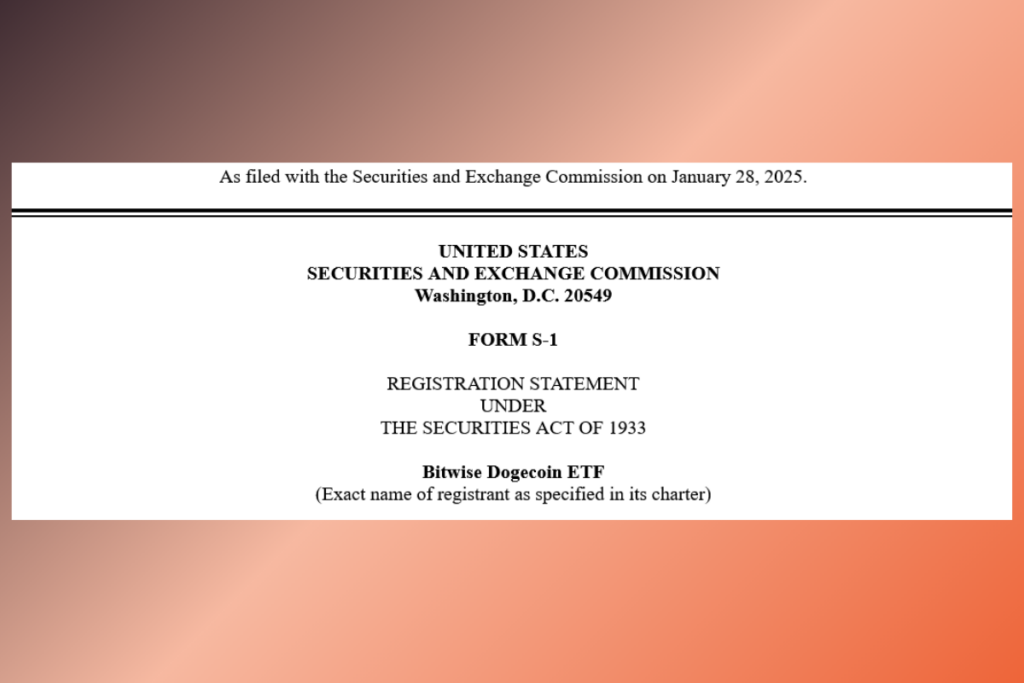

After approving comparable ETFs from Hashdex and Franklin Templeton on December 19, it is the third combined Bitcoin and Ethereum spot ETF to be approved by the SEC. Following a filing for a spot Dogecoin product on January 28, Bitwise also intends to introduce ETFs for meme coins.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment