$500M Liquidated: Bulls Struggle Amid Trump Inauguration Day BTC Volatility

As US President Donald Trump’s inauguration came to an end on January 21, Bitcoin tested support at $100,000. Since Trump made no mention of Bitcoin, cryptocurrency, or a US strategic reserve including them, Bitcoin bulls were ultimately disappointed by the volatile Inauguration Day.

Longs had a poor day as a result. At the time of writing, 24-hour crypto-long liquidations totaled more than $500 million, according to data from the tracking platform CoinGlass. The potential for another liquidity sweep in the mid-to-high $ 90,000 range was then taken into consideration by traders.

I’d take a long from 99.5K~ if offered. I think gray box needs to hold for local bullishness and sweeping all the Trump leadup / news PA makes sense. I’d also accept a sweep of the 97K low, but that’s farthest it should go. Any good amount of time spent past 96-97K and my plan / read is likely off. Inval low 90’s, aiming for new ATH’s.

trader Crypto Chase

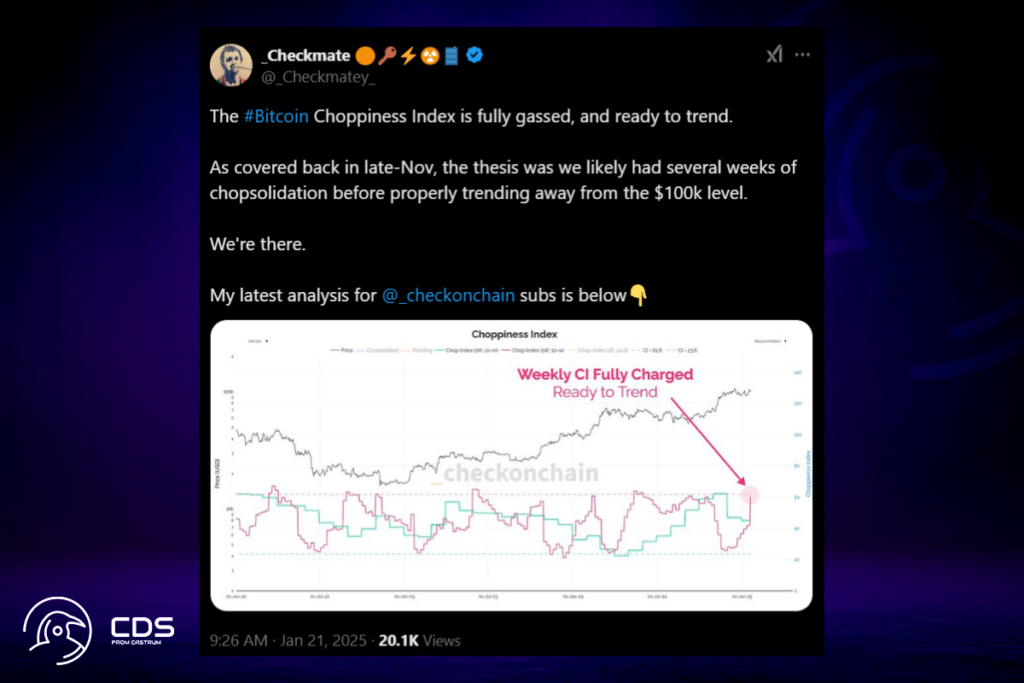

Bitcoin Price Prediction: Market Poised for Trend Shift, Says Checkonchain Developer

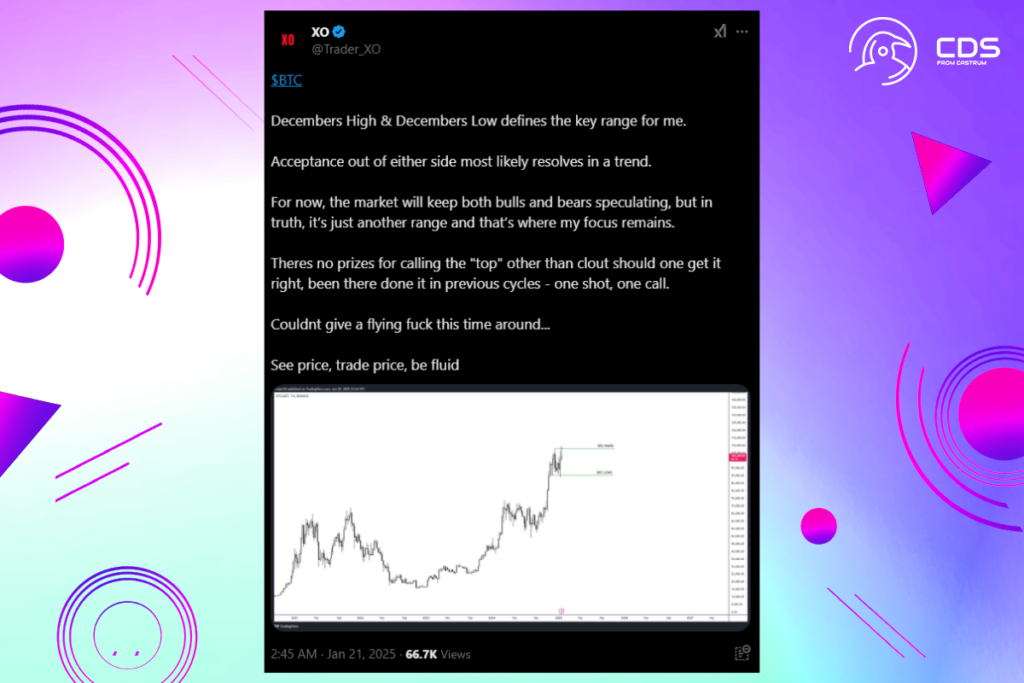

The December Bitcoin price range, which included lows of about $90,000 and highs of $108,000, was still in control, according to fellow trader XO.

Decembers High & Decembers Low defines the key range for me. Acceptance out of either side most likely resolves in a trend. For now, the market will keep both bulls and bears speculating, but in truth, it’s just another range and that’s where my focus remains.

However, in a recent update, James Check, the developer of the on-chain data resource Checkonchain, forecasted that a new trend in the price of Bitcoin will emerge sooner rather than later. The Choppiness Index, a volatility indicator that now marks the conclusion of a phase of sideways movement, was responsible for this.

The Bitcoin Choppiness Index is fully gassed, and ready to trend. As covered back in late-Nov, the thesis was we likely had several weeks of chopsolidation before properly trending away from the $100k level. We’re there.

Check

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment