JPMorgan Chase Q4 Profit: Net Interest Income Drives The Company’s $14 Billion Fourth-Quarter Profit

As investment banking fees increased, JPMorgan Chase (JPM) released fourth-quarter profits on Wednesday that exceeded analysts’ projections. With $42.77 billion in sales, the largest bank in the world by market value posted a $14 billion profit. According to Visible Alpha’s poll, analysts anticipated $11.92 billion and $41.49 billion, respectively. The net interest income exceeded the average expectation of $22.93 billion, coming in at $23.35 billion.

Jamie Dimon Warns of Inflation and Geopolitical Risks Despite Strong Economic Outlook

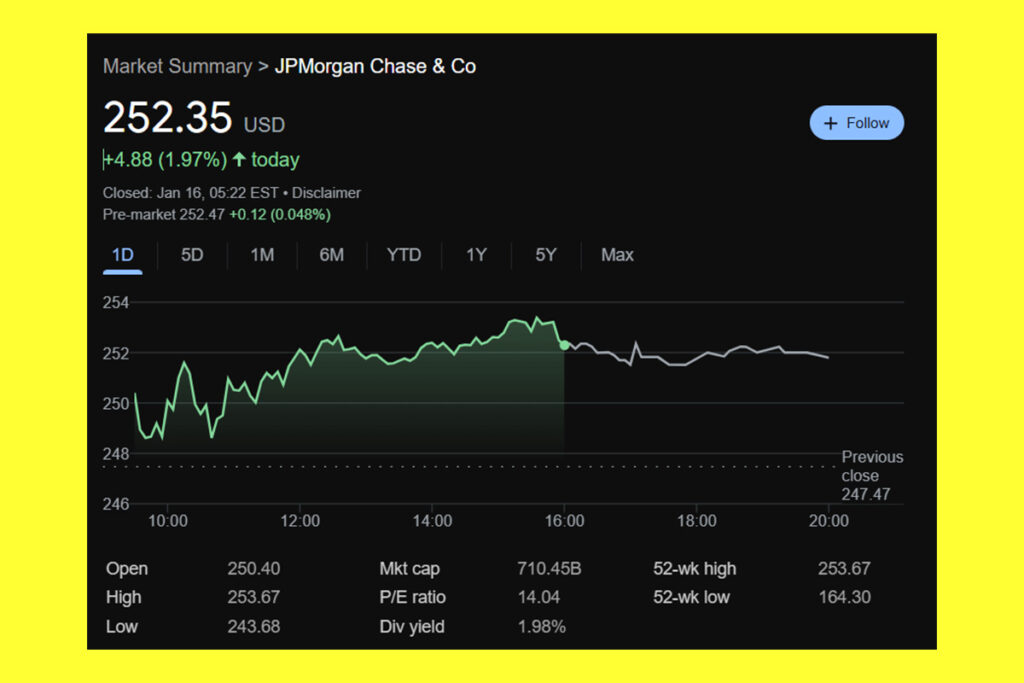

The company’s investment banking revenue increased 46% from the same period the previous year, and JPMorgan‘s fees for all of its products increased 49%, which led to better-than-expected earnings. Following the report, JPMorgan shares increased by roughly 1.5% to $251.09 during intraday trade on Wednesday. In the last year, they had gained about fifty percent.

The results came as the U.S. economy has been resilient, noting unemployment remains relatively low, and consumer spending stayed healthy, including during the holiday season. Businesses are more optimistic about the economy, and they are encouraged by expectations for a more pro-growth agenda and improved collaboration between government and business.

JPMorgan CEO Jamie Dimon

Nonetheless, Dimon stated that he continues to perceive two major threats to the economy, adding that future and continuing expenditure needs would probably be inflationary, which means that inflation might continue for a while. Furthermore, according to him, after World War II, geopolitical conditions have never been more complex or perilous.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment