HEES Shares Skyrocket Over 100% as United Rentals Confirms Acquisition Terms

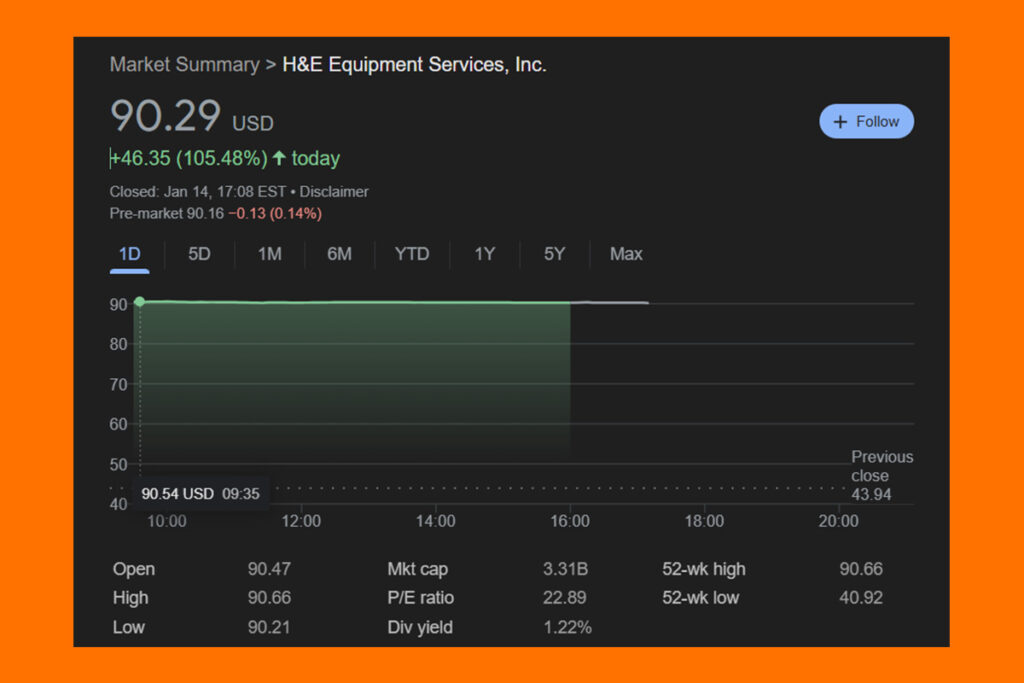

The pre-market session saw a 107% increase in shares of machinery provider H&E following the company’s agreement to allow United Rentals to acquire it for $4.8 billion, with shareholders receiving $92 in cash per share. Approximately $1.4 billion in net debt is included in this valuation. Compared to HEES’s market price the day before the purchase was announced, this acquisition value is more than 100% higher. The shares were up 106% from the previous close, closing the day at $90.28.

H&E’s Poor Q3 Results Still Weigh on Sentiment Despite Acquisition Surge

The shares of H&E Equipment Services have fluctuated by more than 5% fifteen times in the past year. However, such large-scale actions are uncommon, even for H&E Equipment Services, and suggest that the market’s opinion of the company was greatly affected by this news.

The stock fell 9.8% three months ago when the company’s poor third-quarter results were announced, which was the largest swing in the past year. Both its revenue and EPS missed Wall Street‘s projections. Furthermore, HEES noted that the growth rate of U.S. construction spending slowed in the first half of the year and is predicted to continue to do so for the rest of the year. It was a softer quarter overall.

Industry fundamentals in the third quarter continued to trail year-ago measures.

the Management

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment