Understanding ETF Fund Flows: What They Are and Why They Matter

What Is an ETF?

An exchange-traded fund (ETF) is an investment vehicle designed to track a specific asset class or index. ETFs simplify investing by offering curated bundles of assets managed by professionals. While you don’t directly own the underlying assets in an ETF, you benefit from its price movements as it mirrors the performance of the assets it represents.

For instance, an ETF tracking the S&P 500 reflects its overall performance, allowing you to gain exposure to all the companies within the index without investing in each one individually. ETF shares trade on stock exchanges like regular stocks, making them highly accessible to investors.

However, ETFs come with management fees. These fees compensate the fund managers responsible for maintaining the portfolio, ensuring it remains aligned with its objectives, such as tracking a particular index or sector.

What Are ETF Fund Flows?

ETF fund flows measure the movement of money into and out of ETF shares over time. They provide insights into investor sentiment rather than directly reflecting an ETF’s performance. Essentially, these flows act as a barometer of confidence or doubt among investors.

Types of ETF Flows

- Inflows: When investors purchase ETF shares, it results in inflows, often signaling bullish sentiment toward the ETF.

- Outflows: When investors sell their ETF shares, it creates outflows, suggesting bearish sentiment or reduced confidence.

For example, if Bitcoin is underperforming, Bitcoin-focused ETFs like the VanEck Bitcoin Trust may experience significant outflows, reflecting bearish market sentiment.

Why Do ETF Fund Flows Matter?

ETF flows are crucial for understanding public sentiment, market trends, and investor behavior. While flows don’t track an ETF’s price, they reveal patterns in buying and selling activity that can inform investment decisions.

Key Insights from ETF Flows:

- Investor Sentiment: Large inflows often indicate growing confidence in an ETF, while substantial outflows suggest the opposite.

- Market Trends: Comparing flows across sectors can highlight emerging or declining industries.

- Historical Context: Analyzing past flow patterns during specific economic conditions, like recessions, can provide valuable insights.

How Are ETF Flows Used?

Fund managers and investors leverage ETF flows to gauge investor interest and adapt strategies accordingly.

- For Fund Managers: Significant inflows may prompt managers to create additional shares to meet demand, while outflows might require reducing supply to balance the market.

- For Market Analysis: Investors can analyze flows to understand broader market sentiment. For instance, if S&P 500 ETFs see outflows while crypto ETFs experience inflows, it could signal shifting investor trust from traditional markets to cryptocurrencies.

How to Analyze ETF Flows

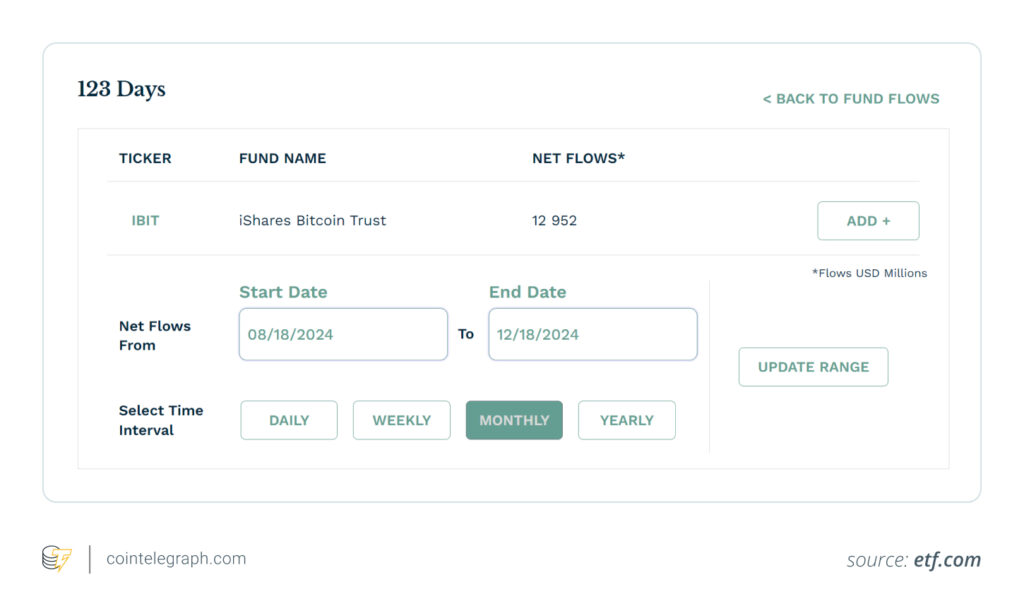

Analyzing ETF flows can be done through tools like ETF fund flow calculators, which track inflows and outflows over specific timeframes. When interpreting these metrics, consider the following:

- Volatility: Flows naturally fluctuate, and short-term changes may not indicate long-term trends.

- Scale: The significance of flows depends on the size of the ETF. A $10 million outflow might barely impact a multi-billion-dollar fund.

- Market Context: Pair flow data with market events or news for deeper insights.

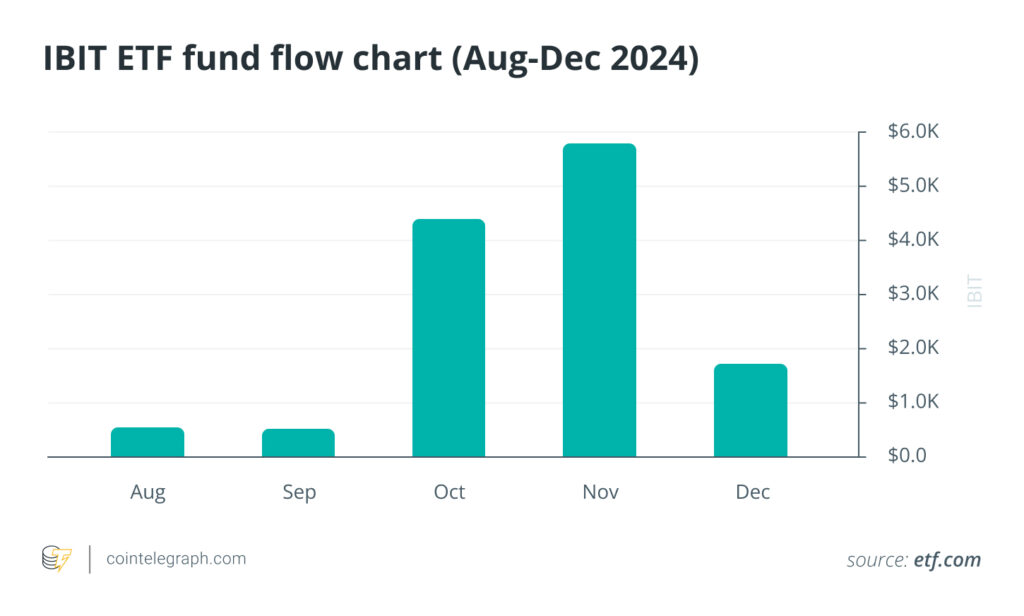

For example, in late 2024, Bitcoin-focused ETFs saw significant inflows despite Bitcoin struggling to break $100,000. This investor confidence ultimately preceded a price rebound, showcasing how inflows can sometimes act as early indicators of market recovery.

Active vs Passive ETFs: What’s the Difference?

Another consideration when evaluating ETFs is whether they are actively or passively managed.

- Active ETFs: Managed by professionals aiming to outperform the market, active ETFs involve frequent buying and selling of assets. While they offer higher potential returns, they also come with greater risks and higher fees.

- Passive ETFs: These aim to replicate the performance of a specific index. They’re less risky and more cost-effective but typically offer lower returns over time.

Your choice between active and passive ETFs should align with your risk tolerance, investment goals, and desired level of involvement.

How to Use ETF Flows in Trading

ETF flow data can be a powerful tool for making informed trading decisions when combined with other analytical methods.

Strategies for Using ETF Flows:

- Compare Flows Across Sectors: Analyzing inflows and outflows in various industries can help identify rising or declining sectors.

- Contextualize with News: Monitor ETF flows alongside current events to predict potential market movements. For example, positive developments in a sector experiencing outflows might signal a buying opportunity.

- Combine with Technical Tools: Pair ETF flow data with technical indicators like RSI or trend analysis to refine your strategy.

- Diversify Investments: Flows reveal that asset classes often rise and fall in cycles. Diversifying your portfolio ensures that gains in one area can offset losses in another.

Example: Bitcoin ETF Flows

In December 2024, the iShares Bitcoin Trust ETF saw significant inflows, with $908 million added in a single week. This was likely driven by optimism around the SEC’s progress on approving the Bitwise Bitcoin ETF. Such data highlights how flows often correlate with market news and investor expectations.

Conclusion

ETF fund flows are a valuable resource for understanding market sentiment, identifying trends, and developing trading strategies. By analyzing inflows and outflows, you can make more informed investment decisions, whether you’re a beginner or an experienced trader. Combined with other tools and a diversified approach, ETF flows can be a cornerstone of a successful investment strategy.

Leave a comment