Ether ETFs: Record Outflows and Strong Inflows

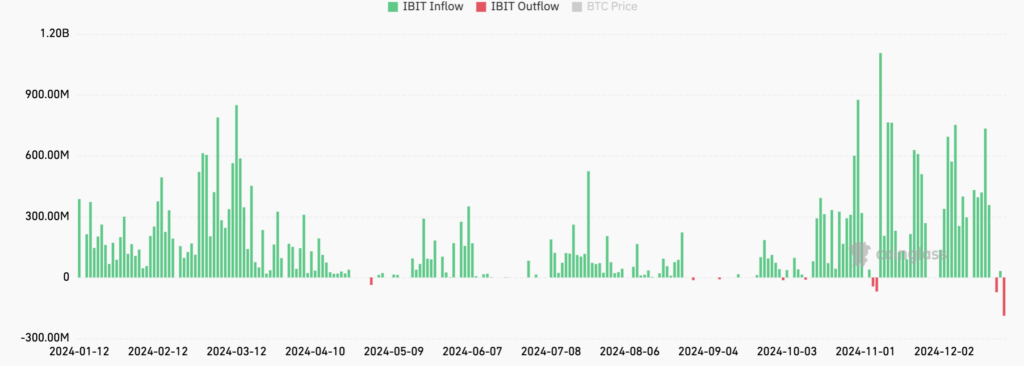

Ether ETF– BlackRock’s Bitcoin exchange-traded fund (ETF), the iShares Bitcoin Trust (IBIT), experienced its largest-ever single-day outflow on December 24. The fund saw $188.7 million in outflows, surpassing its previous record of $72.7 million set just days earlier on December 20, according to CoinGlass data. This marks a continued trend of outflows across U.S.-based Bitcoin ETFs, which have now seen over $1.5 billion in redemptions over four consecutive trading days.

Bitcoin ETFs Continue Struggling with Outflows

On Christmas Eve, all 12 U.S. spot Bitcoin ETFs combined to see $338.4 million in outflows. Since December 19, these funds have faced a cumulative net outflow of $1.52 billion. The largest individual outflows came from the Fidelity Wise Origin Bitcoin Fund, which saw $83.2 million exit, and the ARK 21Shares Bitcoin ETF, which lost $75 million.

In contrast, the Bitwise Bitcoin ETF was the only fund to report positive inflows, with $8.5 million entering the fund.

Ether ETFs Show Strong Inflows Despite Bitcoin’s Struggles

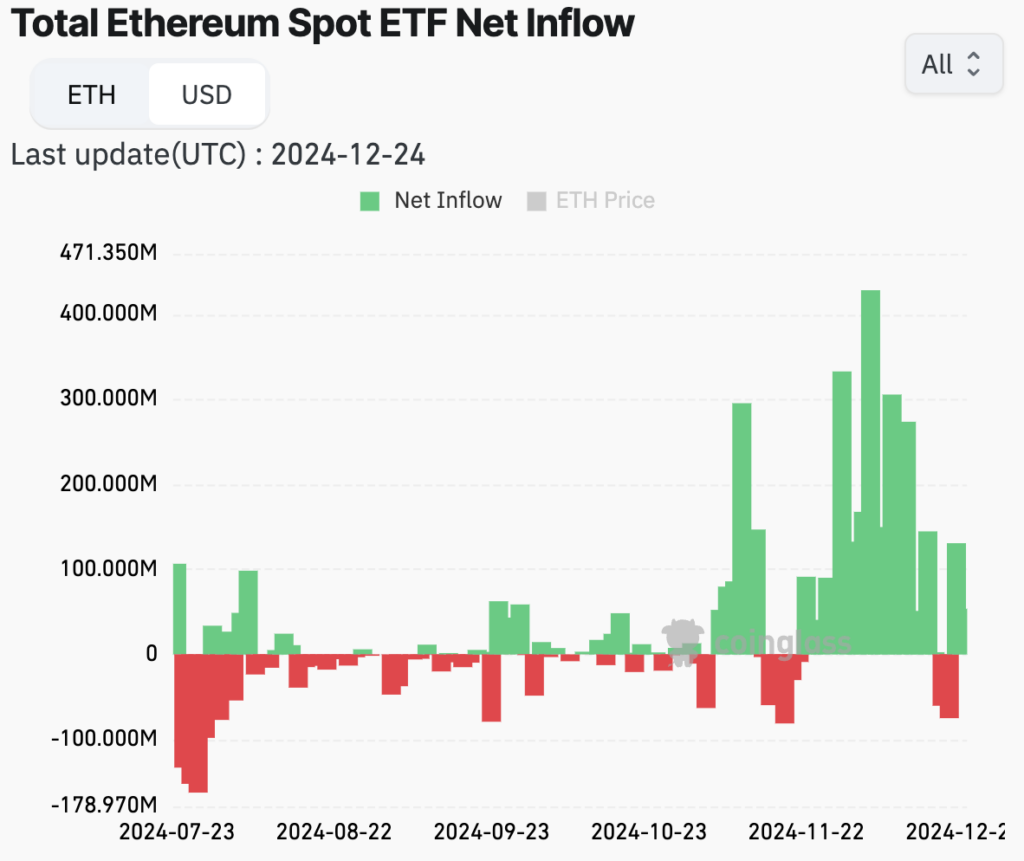

While Bitcoin-focused ETFs are facing challenges, spot Ether ETFs are continuing to show strength. On December 24, U.S. Ether ETFs saw another round of positive inflows, totaling $53.6 million, following a $130.8 million inflow the previous day on December 23. Ether ETFs have gained significant momentum since late November, following a slower start compared to Bitcoin ETFs.

Before the holiday season, Ether ETFs experienced an 18-day streak of inflows, though that was interrupted on December 18. Despite this, the overall trend remains positive as Ether continues to outperform Bitcoin in recent trading sessions.

Ether’s Relative Strength to Bitcoin: Analysts Predict Outperformance in 2025

At the time of writing, Bitcoin was trading at $98,035, up 4.59% in the last 24 hours, while Ether was priced at $3,420, showing a 3.28% gain. According to TradingView, the ETH/BTC ratio is currently at 0.035, reflecting Ether’s relative strength against Bitcoin. Some analysts believe that Ether may outperform Bitcoin in January 2025, suggesting strong potential for Ether in the near future.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Leave a comment