Understanding Cryptocurrency Taxation Across the Globe

Cryptocurrencies are increasingly woven into the fabric of modern financial systems. Like any other asset class, digital currencies are subject to taxation in many parts of the world. As a burgeoning and rapidly evolving market, cryptocurrencies are drawing significant attention from both investors and governments. This article explores how cryptocurrency tax policies differ worldwide and the underlying reasons behind these variations.

How Cryptocurrency Taxes Work in Different Countries

Countries Requiring Cryptocurrency Taxes

In countries like the United States, paying taxes on cryptocurrency is non-negotiable. Authorities enforce strict regulations, taxing almost all forms of income, including digital assets.

Cryptocurrencies in the U.S. are classified as property rather than currency. Consequently, selling digital assets triggers capital gains taxes. Depending on how long the cryptocurrency was held before selling, these profits are subject to short-term or long-term capital gains tax rates.

The United Kingdom follows a similar framework, treating cryptocurrencies as taxable assets. Capital Gains Tax (CGT) applies to profits exceeding the tax-free allowance. Investors earning above this threshold must report their earnings and pay the applicable taxes.

In Australia, cryptocurrencies are likewise classified as assets. Investors must pay capital gains tax on profits from selling tokens. However, an important exception exists: transactions involving cryptocurrency for goods or services may be tax-exempt if the value does not exceed AUD 10,000.

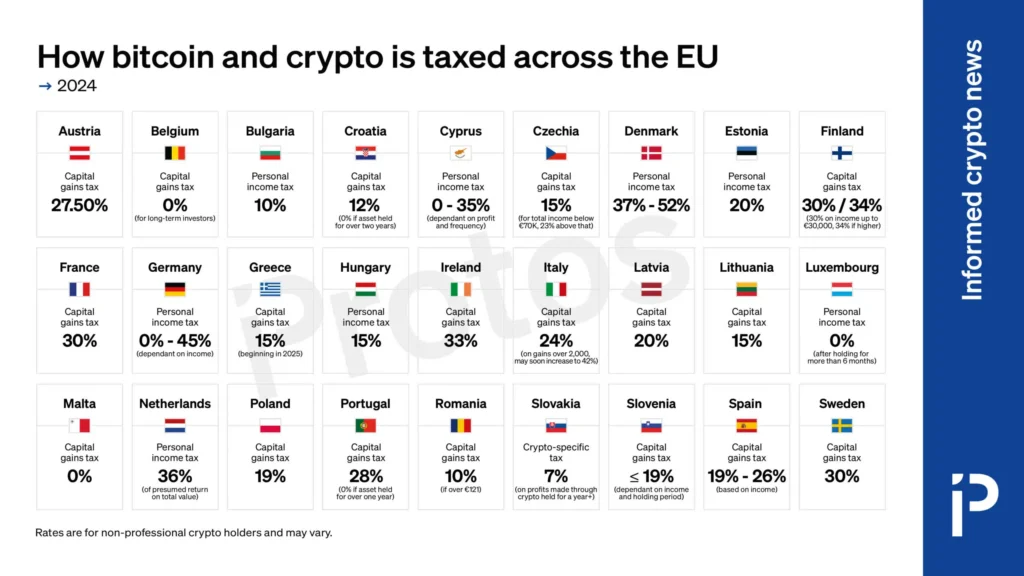

Progressive Approaches in Europe

In Europe, Switzerland stands out for its progressive stance. Residents can not only use cryptocurrencies to make purchases but also to pay taxes. The Swiss Federal Tax Administration (FTA) specifies that payments made in tokens, such as salaries, are taxable as employment income and must be reported on official salary certificates.

Why Are Some Countries Tax-Free for Cryptocurrencies?

Certain countries foster cryptocurrency adoption by forgoing mandatory taxation. These policies aim to attract investment and spur the growth of blockchain startups.

Portugal, for example, exempts individuals from paying taxes on profits from cryptocurrency trading, except when used in business or professional activities. Similarly, Germany incentivizes long-term crypto investment by waiving taxes on cryptocurrencies held for over a year. However, selling assets before this period incurs capital gains taxes.

Malta has established itself as a crypto-friendly jurisdiction. Cryptocurrencies are taxed only when exchanged for fiat currency, leaving most other transactions tax-free.

Where Cryptocurrencies Are Banned

Some countries impose outright bans on cryptocurrency activities instead of taxing them.

China banned all cryptocurrency transactions in 2021, including trading and mining, causing significant challenges for investors and businesses operating in the crypto space. Similarly, Algeria prohibits the use, trading, and mining of cryptocurrencies, effectively eliminating crypto-related activities.

Other nations, including Morocco, Pakistan, and Indonesia, enforce similar bans, largely concentrated in the MENA and Asia regions.

Why Some Countries Lack Cryptocurrency Taxation

Beyond outright bans or investment incentives, some nations lack cryptocurrency taxation simply because they haven’t established regulatory frameworks.

For instance, Japan recognizes Bitcoin and other cryptocurrencies as legal forms of payment. However, the regulatory landscape surrounding their taxation remains incomplete, with gaps in how specific transactions are handled.

In Nepal, cryptocurrencies exist in a legal gray area. Despite their de facto ban, the absence of comprehensive regulations leaves digital assets without clear tax obligations.

The Future of Cryptocurrency Taxation

The global approach to cryptocurrency taxation is far from uniform. While some countries actively develop regulatory frameworks and tax policies, others remain in limbo or outright reject the use of cryptocurrencies.

As cryptocurrency adoption continues to rise worldwide, tax regulations are expected to evolve to provide greater clarity and stability. These changes, however, may roll out unevenly depending on regional political and economic dynamics.

In the years ahead, a more standardized global approach could emerge, offering a balanced environment for both investors and regulators. For now, understanding the diverse landscape of cryptocurrency taxation is essential for navigating this transformative asset class.

Leave a comment