Liquid staking has become a popular method for earning passive income from crypto assets while maintaining flexibility in a highly volatile market. However, traditional liquid staking often provides lower returns than direct staking, leaving many investors seeking better options. This has led to the rise of liquid restaking, a new DeFi innovation that combines the benefits of liquid staking with enhanced yields.

In this guide, we’ll explore the top liquid restaking protocols for 2024 and why they’re making waves in the crypto world.

What Is Liquid Restaking?

Liquid staking enables users to stake their cryptocurrency while retaining liquidity through derivative tokens, commonly known as Liquid Staking Tokens (LSTs). These LSTs can be traded, used in DeFi, or leveraged for additional staking opportunities.

The challenge with liquid staking has been the reduced returns compared to traditional staking. To address this, developers have introduced liquid restaking, allowing users to stake their LSTs for additional rewards. By doing so, investors can compound their earnings while still benefiting from the flexibility of liquid staking.

Liquid Staking vs Restaking: What’s the Difference?

- Traditional Staking: Crypto assets are locked on the blockchain to earn rewards. Funds cannot be withdrawn until the staking period ends.

- Liquid Staking: Users receive LSTs, which represent their staked assets and can be traded or used in DeFi.

- Liquid Restaking: LSTs are staked again on separate protocols to earn additional rewards, unlocking compounded returns.

How Does Liquid Restaking Work?

While the concept of liquid restaking may seem complex, many platforms simplify the process:

- Stake your crypto on a liquid staking platform to earn LSTs (e.g., stETH for Ethereum).

- Restake your LSTs on a liquid restaking platform to earn additional rewards.

- Receive a secondary token (e.g., rLSTs) that provides access to both your original stake and your restaking rewards.

This process enables users to maximize their earnings without sacrificing liquidity. However, it’s important to evaluate the risks and security of each protocol before diving in.

Top Liquid Restaking Protocols for 2024

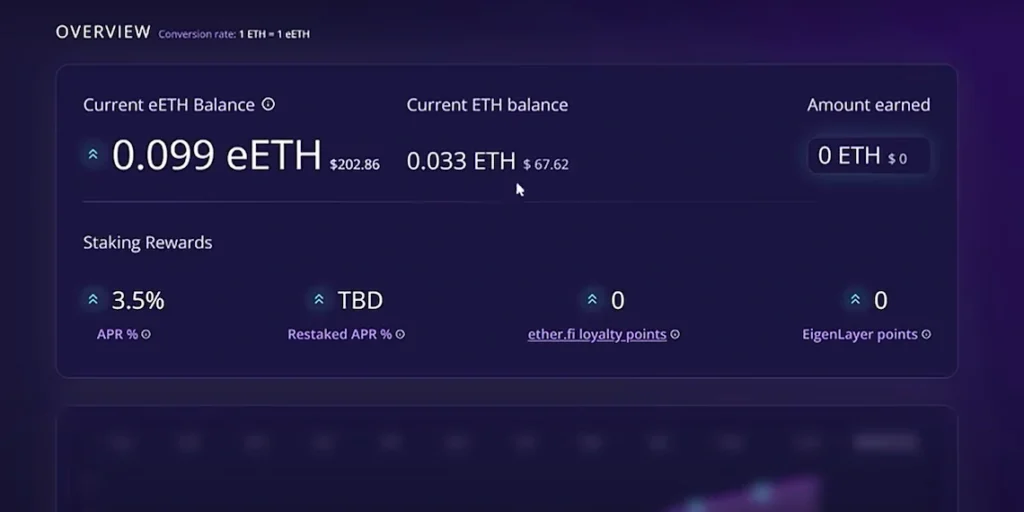

1. Ether.fi

Ether.fi bridges the gap between DeFi and everyday spending by combining ETH staking with a Visa card for spending rewards. Users can deposit ETH or stETH, stake them to earn eETH, and further optimize yields through automated vaults.

- Key Features:

- Earn and spend staking rewards with an integrated Visa card.

- Automate yield optimization with Vault features.

- Borrow against your crypto for real-world purchases.

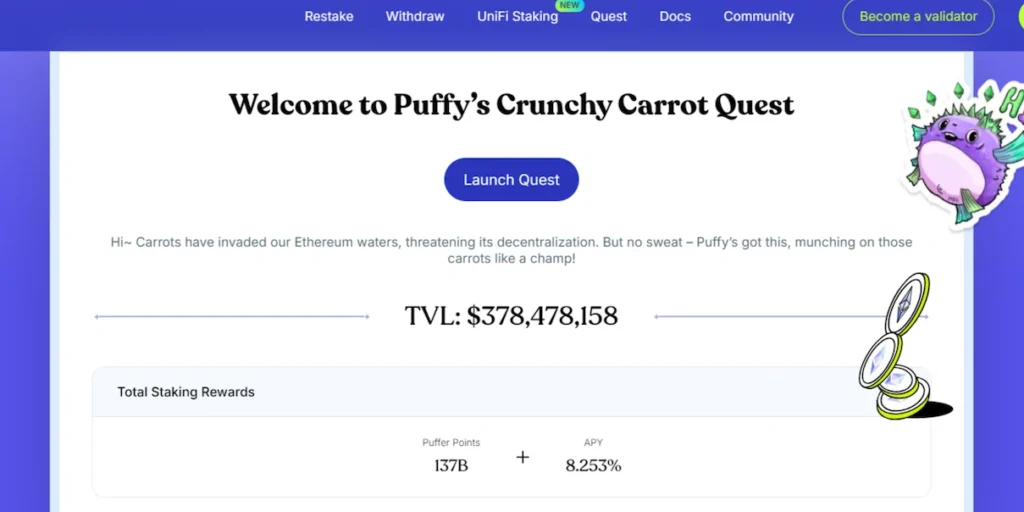

2. Puffer Finance

Built on Eigenlayer, Puffer Finance allows solo stakers to run Ethereum validators with as little as 2 ETH. Users receive PufETH tokens to restake and earn additional rewards while benefiting from anti-slashing protections.

- Key Features:

- Solo staking with reduced entry barriers.

- PufETH tokens enable restaking for increased yields.

- Backed by industry leaders like Consensys and Coinbase.

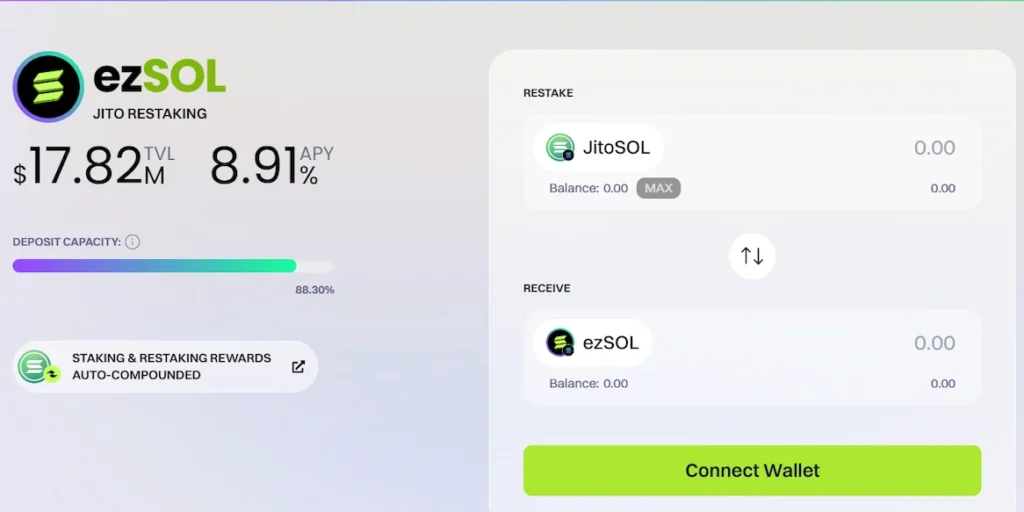

3. Renzo

Renzo integrates deeply with Eigenlayer and supports multi-chain staking for Ethereum and Solana. Users can auto-optimize their staking strategies and earn LSTs for use across various DeFi protocols.

- Key Features:

- Multi-chain staking support (ETH, stETH, jitoSOL).

- Auto-compounding rewards.

- Over $4 billion TVL in under 12 months.

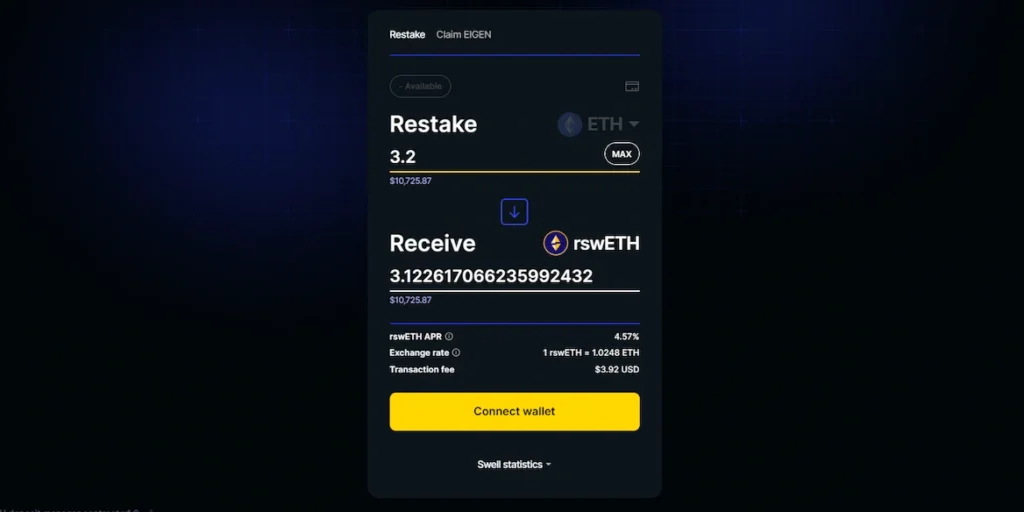

4. Swell Network

Swell Network focuses on ETH staking and restaking. Users can lock up ETH to earn swETH and then restake it for rswETH, integrating with popular DeFi platforms for maximum rewards.

- Key Features:

- Supports both staking and restaking in one platform.

- Governance via Swell DAO for protocol improvements.

- Integrations with Eigenlayer, Liquis, and more.

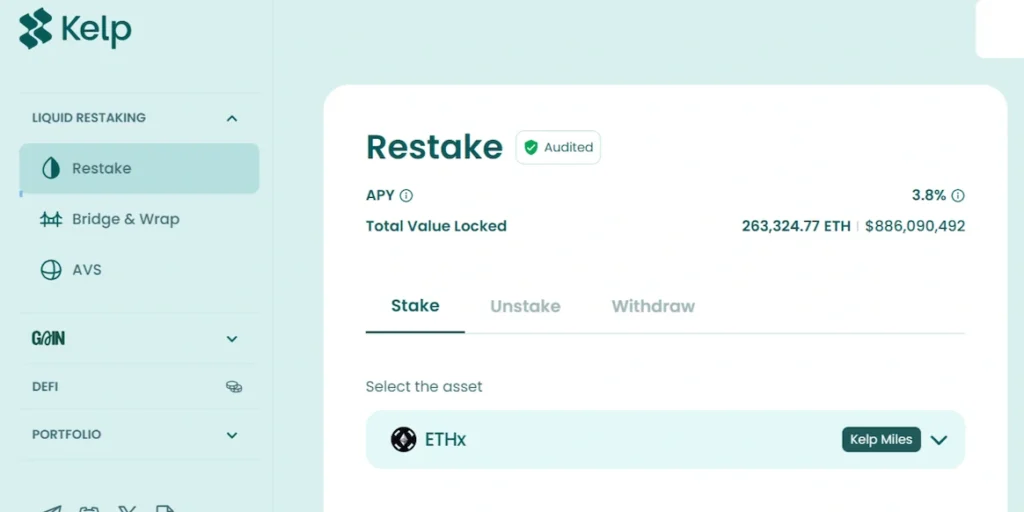

5. KelpDAO

KelpDAO combines Eigenlayer staking with yield farming. Its Gain product automatically deploys LSTs across multiple layer-2 protocols, making yield farming accessible and efficient.

- Key Features:

- Yield farming for LSTs through automated vaults.

- Fee-free airdrop points for future rewards.

- Supports ETH, stETH, ETHx, and rsETH.

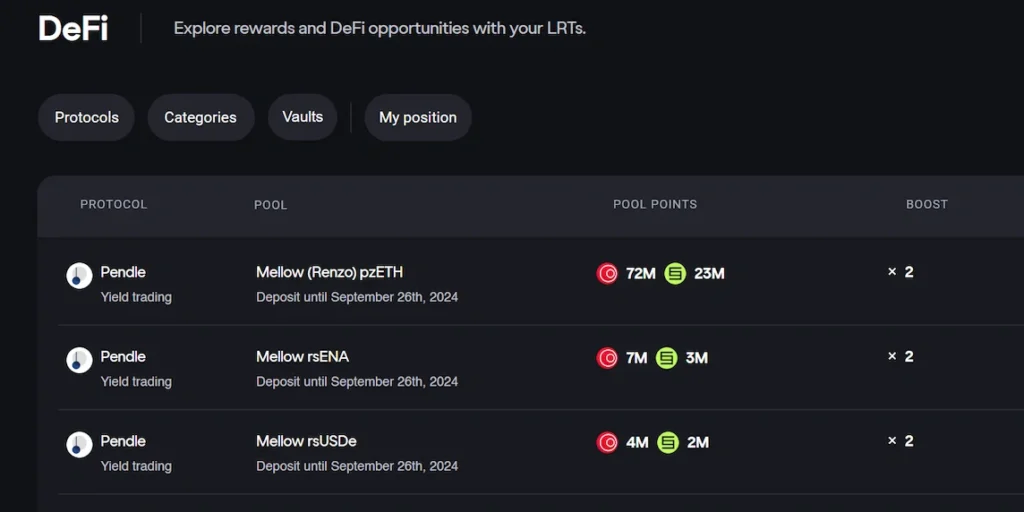

6. Mellow LRT

Mellow LRT offers customizable yield strategies through modular vaults with varying risk profiles. It supports Ethereum-based LSTs and plans to expand to WBTC and USDC.

- Key Features:

- Risk-adjustable staking strategies.

- Permissionless vault creation for tailored investments.

- Audited by ChainSecurity for robust security.

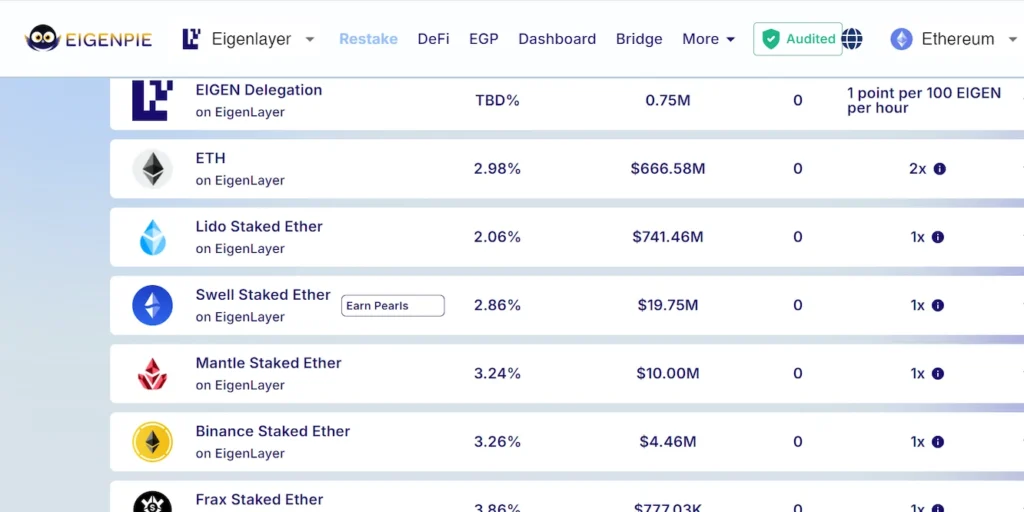

7. Eigenpie

Eigenpie leverages Eigenlayer to support diverse LSTs and isolated restaking for risk management. Institutions can use Eigenpie Enterprise for secure restaking solutions.

- Key Features:

- Isolated staking to minimize risk.

- Supports stETH, rETH, and mETH.

- Integrations with Pendle and Wombat for expanded yield opportunities.

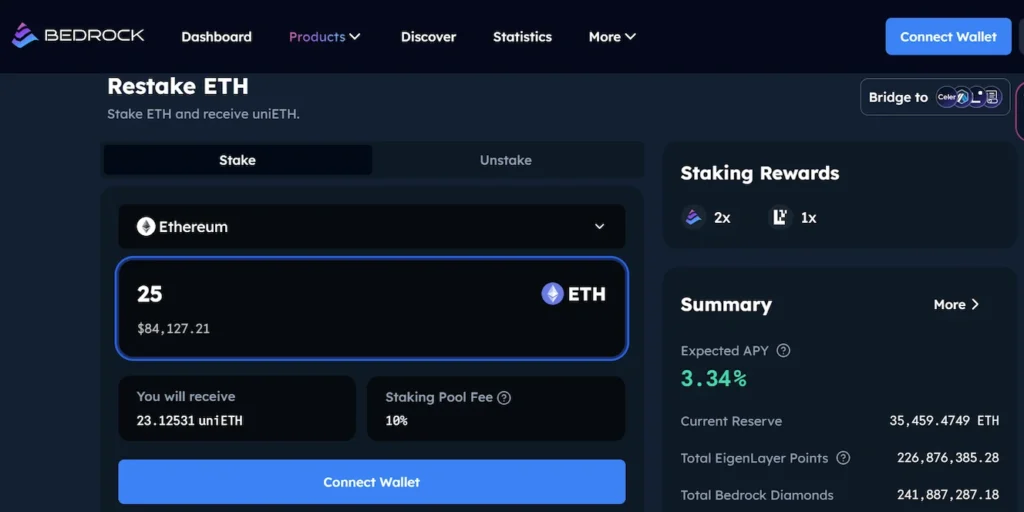

8. Bedrock

Bedrock supports multi-asset staking, including ETH, BTC, and IOTX. Its universal token standard makes it easy to restake and earn liquidity rewards across various DeFi platforms.

- Key Features:

- Cross-chain restaking for Ethereum and Bitcoin.

- Partnerships with major DeFi protocols like Curve and Arbitrum.

- User-friendly interface for all skill levels.

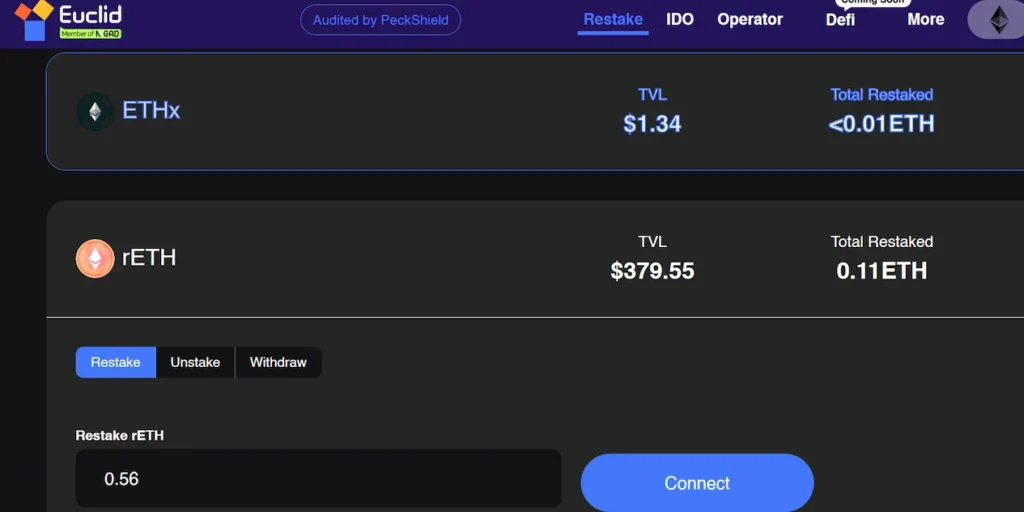

9. Euclid

Euclid aims to become the go-to platform for Ethereum-based restaking, supporting a wide range of LSTs and offering auto-compounding features for long-term growth.

- Key Features:

- Permissionless and trustless operator network.

- Deep liquidity for LSTs like stETH, rETH, and swETH.

- Protection against slashing for validator operators.

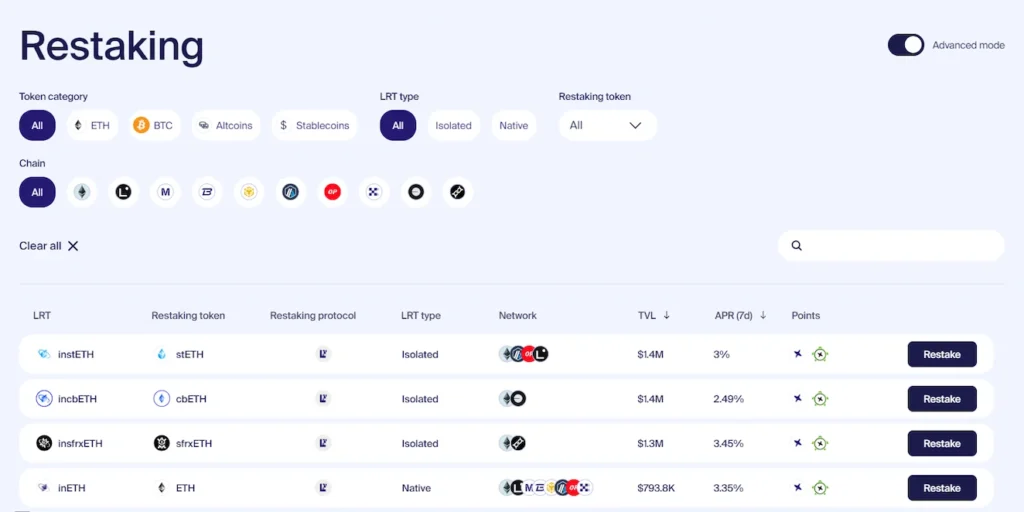

10. Inception LRT

Inception LRT focuses on isolated restaking, allowing users to manage risk and build scalable yield strategies. With 17+ supported LSTs and integrations with over 36 DeFi protocols, it’s a robust choice for diversification.

- Key Features:

- Tailored restaking strategies with asset isolation.

- Supports ETH, ETHx, tBTC, and more.

- Integrates with platforms like Uniswap and Curve for flexibility.

Benefits of Liquid Restaking

- Increased Yields: Multiply rewards through compounded staking strategies.

- Flexibility: Trade liquid restaking tokens to exit positions without delays.

- Diversification: Spread risk across various staking assets.

- Governance: Participate in protocol decision-making with governance tokens.

Risks of Liquid Restaking

- Smart Contract Vulnerabilities: Bugs in protocols can lead to losses.

- Counterparty Risk: Trust in platforms is crucial.

- Market Volatility: Token values can fluctuate significantly.

- Regulatory Uncertainty: Legal frameworks remain unclear.

Conclusion

Liquid restaking is revolutionizing the DeFi landscape, offering a powerful way to enhance passive earnings while maintaining flexibility. By selecting the right protocols and managing associated risks, investors can unlock new opportunities for growth and diversification in their crypto portfolios.

Leave a comment