MicroStrategy CEO Michael Saylor- Bitcoin Reserve Proposal by Michael Saylor Aims to Boost U.S. Treasury

MicroStrategy CEO Michael Saylor– MicroStrategy founder Michael Saylor has put forward a bold proposal to establish a “Digital Assets Framework” for the United States, which he believes could unlock up to $81 trillion in wealth for the U.S. Treasury. The plan calls for the creation of a strategic Bitcoin reserve, positioning the cryptocurrency as a key asset for strengthening the U.S. dollar and addressing the national debt.

Saylor’s Vision for Bitcoin-Backed Wealth Creation

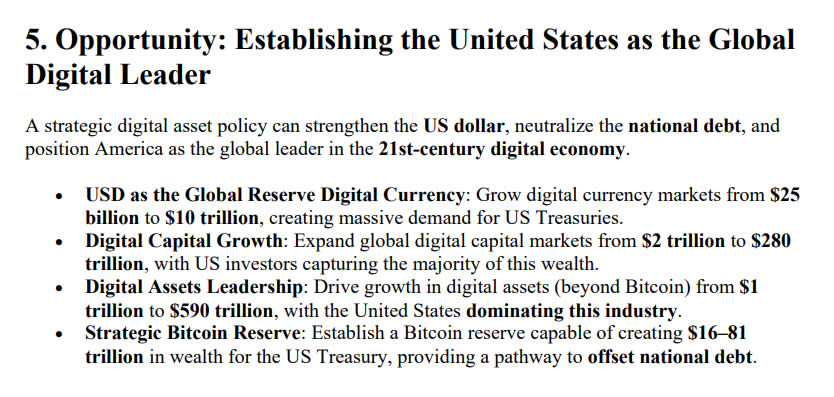

In a post on December 21, Saylor explained that a well-structured digital asset policy could not only enhance the U.S. dollar but also help neutralize the national debt, potentially securing America’s position as the global leader in the 21st-century digital economy. He described the proposed Bitcoin reserve as capable of generating between $16 trillion and $81 trillion for the U.S. Treasury, providing an avenue to offset the national debt.

Saylor’s company, MicroStrategy, has already accumulated over 439,000 BTC, currently valued at more than $41 billion, significantly boosting the company’s stock price. He also made headlines for pitching the idea to Microsoft, though the proposal was rejected by its shareholders.

A Comprehensive Digital Assets Framework

Saylor’s proposed framework breaks down digital assets into six distinct categories:

- Digital Commodities (like Bitcoin)

- Digital Securities

- Digital Currencies

- Digital Tokens

- Non-Fungible Tokens (NFTs)

- Asset-Backed Tokens

This classification system aims to create a clear structure for the roles of issuers, exchanges, and owners. Saylor emphasizes that all participants in the ecosystem should be held accountable, insisting that “no participant can lie, cheat, or steal.” The framework also seeks to provide a simplified compliance process, with cost limits for token issuance set at no more than 1% of assets under management, and an annual maintenance fee of 0.1%.

Economic Growth and Market Access Expansion

Saylor’s proposal outlines an ambitious vision to expand U.S. capital markets, from a current size of $2 trillion to $280 trillion. The framework focuses on lowering token issuance costs from millions to thousands of dollars and expanding market access from 4,000 public companies to 40 million businesses, enabling rapid asset issuance.

The overarching goal is to transform the U.S. dollar into the global reserve digital currency, significantly boosting global digital capital markets. Saylor’s plan forecasts that U.S. investors would capture the majority of the resulting wealth, unleashing trillions of dollars in value creation.

“By establishing a clear taxonomy, a legitimate rights-based framework, and practical compliance obligations, the United States can lead the global digital economy,” Saylor concluded in his proposal.

Opposition and Criticism

Despite the ambitious vision, not everyone shares Saylor’s optimism. Renowned Bitcoin critic Peter Schiff dismissed the proposal, calling it “complete bullshit.” Schiff argued that instead of strengthening the dollar, Saylor’s plan would “weaken the dollar, exacerbate the national debt, and make America a laughing stock.”

MicroStrategy’s Bitcoin Strategy

MicroStrategy, under Saylor’s leadership, has become the largest corporate holder of Bitcoin, with an aggregate portfolio profit of 54%, according to SaylorTracker. The company’s massive Bitcoin holdings have played a pivotal role in its stock performance, and Saylor’s proposal to leverage Bitcoin as a strategic asset for national economic growth is likely to stir further debate.

Saylor’s vision reflects a broader trend where Bitcoin and other cryptocurrencies are increasingly seen not just as speculative assets, but as tools with the potential to reshape global financial systems. Whether this bold proposal will gain traction in Washington remains to be seen, but it certainly highlights the growing influence of digital assets in shaping the future of finance.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Leave a comment