Bitcoin Price Fluctuates Amid Fed Decisions and Political Shifts

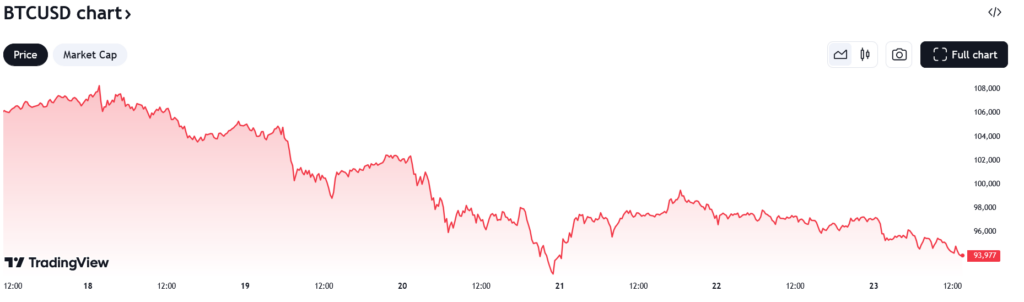

Bitcoin Price– Bitcoin (BTC) experienced its first significant weekly price drop in months, following a rally that began after Donald Trump’s November presidential election victory. This rally had driven the cryptocurrency to six-figure prices. However, in the week ending December 22, Bitcoin fell 10%, closing at $94,645, down from $105,185. This marks a drop of approximately $10,500 in just one week, according to TradingView data.

Bitcoin’s Decline Linked to Federal Reserve’s Rate Cut Decision

The recent drop in Bitcoin’s price came in the wake of the Federal Reserve’s Federal Open Market Committee announcement on December 20. After its third consecutive rate cut, the Fed reduced the number of anticipated interest rate cuts for 2024 from five to two. The federal funds rate, which is a key benchmark for interest rates, is now projected to stabilize near 3.9% in 2025 instead of the previously expected 3.4%. This shift towards a higher federal funds rate creates a less favorable environment for risk-on assets like Bitcoin, which are sensitive to changes in interest rates and economic conditions.

Prior to the pullback, Bitcoin had been on a winning streak, with six out of the last seven weekly closes showing gains. Despite the recent price decline, there is still optimism surrounding Bitcoin’s long-term prospects. According to Bitwise and VanEck, two prominent asset management firms, Bitcoin’s price could surge to the $180,000 to $200,000 range by 2025. These projections are based on expectations of increased institutional adoption, the potential creation of a U.S. Bitcoin reserve, and continued corporate interest.

Political and Regulatory Factors Driving Bitcoin’s Future Growth

The political climate surrounding Bitcoin and the broader cryptocurrency market is also playing a crucial role in shaping the future. Donald Trump has nominated the most pro-crypto U.S. administration to date, with Scott Bessent, a hedge fund manager, tapped as Secretary of the Treasury, and Howard Lutnik, the CEO of Cantor Fitzgerald, set to head the Commerce Department. This pro-crypto stance is likely to lead to a more favorable regulatory environment for digital assets.

Moreover, Paul Atkins, a known cryptocurrency advocate, is expected to replace Gary Gensler as the chair of the Securities and Exchange Commission (SEC) on January 20, coinciding with Trump’s inauguration. Atkins, who served as an SEC commissioner from 2002 to 2008, is anticipated to take a more crypto-friendly approach, which could provide much-needed clarity and support for the industry.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Leave a comment