Nvidia Stock- Nvidia’s Future in AI: What to Expect in 2024 and Beyond

Nvidia Stock– Nvidia (NVDA) has had a record-breaking year, with its stock surging to new heights, driven by the booming demand for artificial intelligence (AI) technology. Despite some recent declines that brought the stock into correction territory, analysts are still overwhelmingly bullish on Nvidia, with many predicting further gains. The growing demand for Nvidia’s AI chips continues to outpace supply, positioning the company for sustained growth.

AI Demand Drives Nvidia’s Sales to New Heights

Nvidia’s success this year has been primarily fueled by the skyrocketing demand for AI solutions. The company’s chips are at the forefront of AI development, powering data centers, AI models, and other cutting-edge technologies. This booming demand has not only resulted in record-breaking sales but also helped push Nvidia’s stock price to new all-time highs.

For 2024, Nvidia’s stock has more than doubled in value, making it one of the few companies to surpass a market capitalization of $3 trillion. In its most recent earnings report, Nvidia reported a fiscal third-quarter revenue of $35.1 billion, a new record. A significant portion of that growth came from its data-center business, which saw revenues more than double year-over-year, reaching $30.8 billion.

Nvidia’s AI Leadership and Future Growth Potential

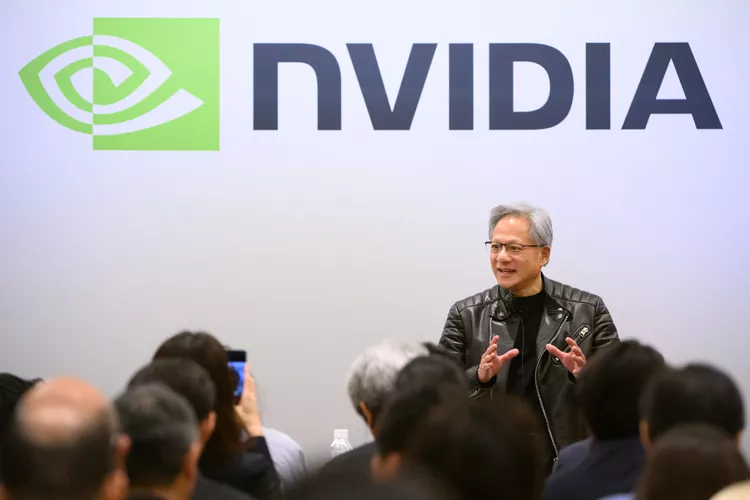

CEO Jensen Huang has been vocal about Nvidia’s pivotal role in the age of AI. In a statement to investors last month, Huang remarked, “The age of AI is upon us, and it’s large and diverse,” highlighting the vast opportunities in this rapidly growing sector. As computing power continues to grow exponentially, Nvidia stands to benefit from the increasing need for advanced AI chips.

Analysts remain overwhelmingly bullish on Nvidia’s future prospects. According to Visible Alpha, all but one of the 21 analysts covering the stock have a “buy” or equivalent rating. The average price target is around $177, which represents a potential upside of more than 31% from the current price of $134.70. This positive outlook reflects the company’s strong position in the AI and semiconductor markets.

Next-Generation Blackwell AI System: A Game Changer

A key factor driving Nvidia’s growth is its next-generation Blackwell AI system, which has been described as a “complete game changer for the industry” by CEO Huang. The demand for Blackwell has been described as “staggering” by company executives, further bolstering Nvidia’s position in the AI space. The company is confident that this new system will continue to set Nvidia apart as a leader in AI hardware.

Morgan Stanley analysts, in a note to clients, referred to Nvidia as a “top pick” and emphasized its continued AI leadership. They pointed to Nvidia’s substantial research and development (R&D) budget and its strong relationships with major cloud providers as factors that will help the company maintain its competitive edge in the AI space.

Catalysts for Nvidia Stock in Early 2024

Nvidia’s momentum is expected to continue into 2024, with several upcoming events likely to serve as key catalysts for the stock. One major event on the horizon is Nvidia’s CEO Jensen Huang’s keynote address at the Consumer Electronics Show (CES) on January 6, 2024. Citi analysts believe that Huang could use this platform to announce higher projections for Blackwell sales and highlight new growth opportunities tied to rising demand for robotics in the enterprise and industrial sectors. The company is also expected to unveil new graphics cards at the event, which could further drive investor excitement.

In addition to CES, Goldman Sachs analysts are looking ahead to Nvidia’s annual GPU Technology Conference (GTC) in March, where the company is expected to provide more details about its upcoming product lineup. At this year’s GTC, Nvidia revealed the Blackwell platform and expanded its partnerships with industry leaders. The company’s fiscal fourth-quarter earnings report, expected in February, will also be closely watched for further insights into its performance and outlook.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Leave a comment