Bitcoin Faces Pressure: BTC Decline Prompts Warnings of Deeper Correction

After last week’s 8% decline, Bitwise’s head of research in Europe, who has been correctly optimistic about Bitcoin for months, has become cautious and warned of further losses in the weeks ahead. According to data sources TradingView and CoinDesk Indices, Bitcoin, the most valuable cryptocurrency by market value, dropped 8.8% to about $95,000 last week, the largest percentage decline since August. The losses occurred as the Federal Reserve emphasized that it is not allowed to hold Bitcoin and is not seeking a change in the law to do so while also hinting at fewer rate reductions for the upcoming year.

Dollar Index Hits 2022 High: What It Means for Bitcoin and Traditional Markets

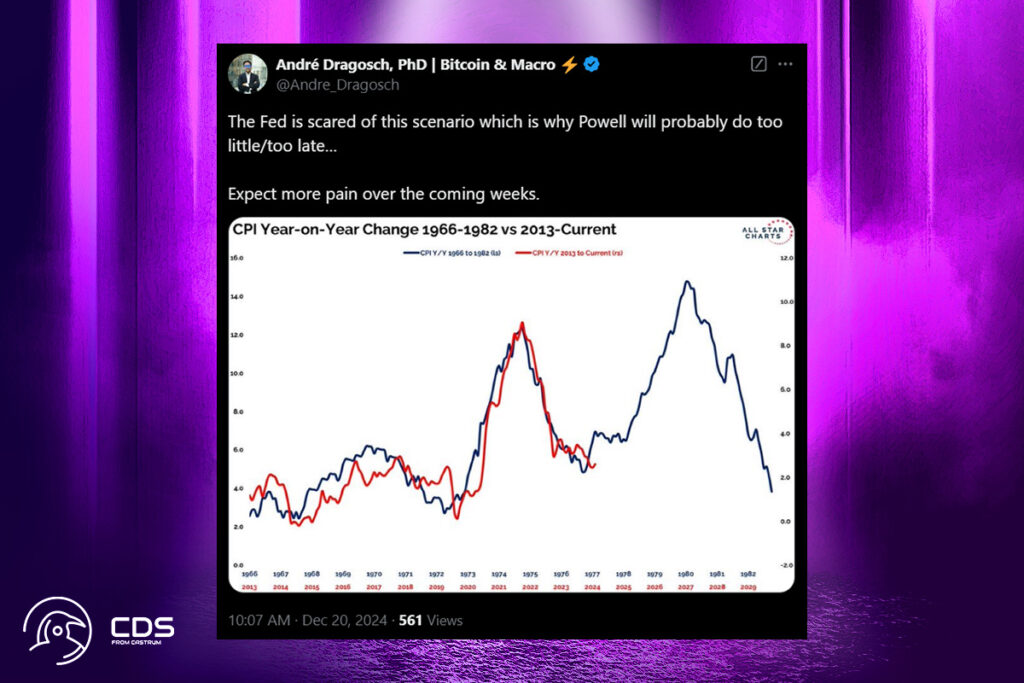

Traditional markets were also shaken by the so-called hawkish rate estimates, which caused the S&P 500 to fall 2% and the dollar index to rise 0.8%, reaching its highest level since October 2022. The yield on the 10-year Treasury note, sometimes known as the risk-free rate, broke out of a technical pattern bullishly, rising 14 basis points. Andre Dragosch, director and head of research Europe at Bitwise, said the risk-off sentiment might last for a while.

The big macro picture is that the Fed is stuck between a rock and a hard place as financial conditions have continued to tighten despite 3 consecutive rate cuts since September. Meanwhile, real-time measures of consumer price inflation have re-accelerated over the past months to new highs as well judging by truflation‘s indicator for U.S. inflation,

Dragosch

In late July, when sentiment was barely bullish, Dragosch was one of the few analysts who accurately forecasted a huge surge in the price of bitcoin. Around that time, Bitcoin hit lows of about $50,000 and just went above $100,000 for the first time ever.

So, it’s quite likely that we will see more pain in the coming weeks, but this could be an interesting buying opportunity given the ongoing tailwinds provided by the BTC supply deficit,

Dragosch

Dragosch stated that the Fed would be forced to act due to the financial tightness brought on by rising yields and the dollar index, highlighting the limited supply of Bitcoin as a key long-term bullish element.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment