Bitcoin ETFs See Historic Outflows, Wiping Out $1B from the Market

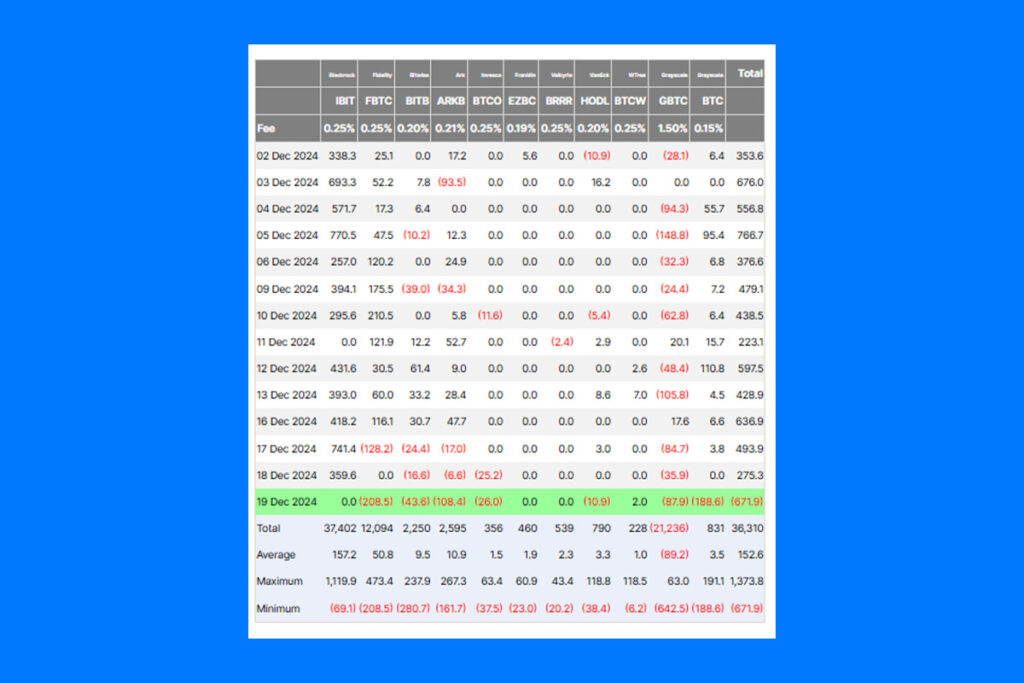

The biggest single-day outflow event of the year occurred on December 19, when Bitcoin ETFs saw a massive sell-off with net withdrawals of a record $671.9 million. The largest outflows, according to statistics from Farside Investors, were from Grayscale’s GBTC, which lost $208.6 million, and ARK Invest’s ARKB, which lost $108.4 million. This pushed the Bitcoin price as low as $94,079. The price is currently trading at $96,409. Moreover, over $1 billion was liquidated from the market in a single day.

- The majority of the December gains, which reached $121.7 billion on December 17, were erased when Sosovalue statistics revealed that the overall net assets of Bitcoin ETFs were $109.7 billion as of December 19.

- According to CoinMarketCap statistics, the outflows from Bitcoin ETFs occurred at the same time as the price of BTC fell, totaling a net outflow of $732.4 million.

Cryptocurrency Sentiment Shifts as Powell’s Rate Comments Stir Uncertainty

President-elect Donald Trump’s incoming administration in the US is anticipated to be pro-crypto if he keeps his word and encourages innovation in the sector. As optimism and greed have returned to space, the cryptocurrency market has been revitalized, and the price of Bitcoin has broken the $107,000 mark as a result of this expectation. On the other hand, Chair Jerome Powell conveyed a hawkish stance when he said that only two more rate reductions were planned for 2025, even though US markets were expecting the US Fed to decrease rates by 0.25%.

The S&P 500 fell as a result of the statement as well, which might have contributed to the current cryptocurrency trend where uncertainty is replacing greed. Additionally, in an X post on December 19, the cryptocurrency analysis firm Santiment stated that the ratio of comments about purchasing during the market downturn had reached its greatest level in more than eight months. The social dominance score, which refers to “buying the dip” on social media platforms, has reached 0.061 despite the market’s decline.

For more up-to-date crypto news, you can follow Crypto Data Space.

1 Comment