Bitcoin Price Today Drops 2.03%, Trades at $104,870: What’s Next for BTC?

Bitcoin price today trades at $104,870.0 as of 11 AM, following a daily high of $108,135.0 earlier in the session. This marks a -2.03% move on December 18. Will BTC sustain its upward momentum to set new highs, or will profit-taking spark a more significant correction?

Bitcoin Price Update: Why is BTC Down?

Bitcoin’s current price of $104,870.0 reflects a pullback, potentially due to investor caution ahead of the Federal Open Market Committee (FOMC) meeting. This crucial macroeconomic event is expected to influence the broader market sentiment. A dovish stance from the Fed may reignite Bitcoin’s rally, while hawkish comments could lead to a downturn for BTC and the broader cryptocurrency market.

Despite the recent drop, Bitcoin boasts a year-to-date (YTD) gain of approximately 148% as of December 18, up from a 56% increase noted on October 20. While some altcoins have achieved triple-digit YTD growth, Bitcoin is steadily catching up. Ethereum, in contrast, has seen a YTD growth of around 73%, significantly lagging behind BTC.

Why Bitcoin Continues to Dominate

Bitcoin’s dominance in the cryptocurrency market stems from its first-mover advantage and secure, decentralized network. Over the years, BTC has cemented its reputation as “digital gold” and an inflation hedge. These narratives, coupled with its uncorrelated nature to traditional assets, keep Bitcoin at the forefront of the crypto ecosystem.

Will Bitcoin End 2024 on a Bullish Note?

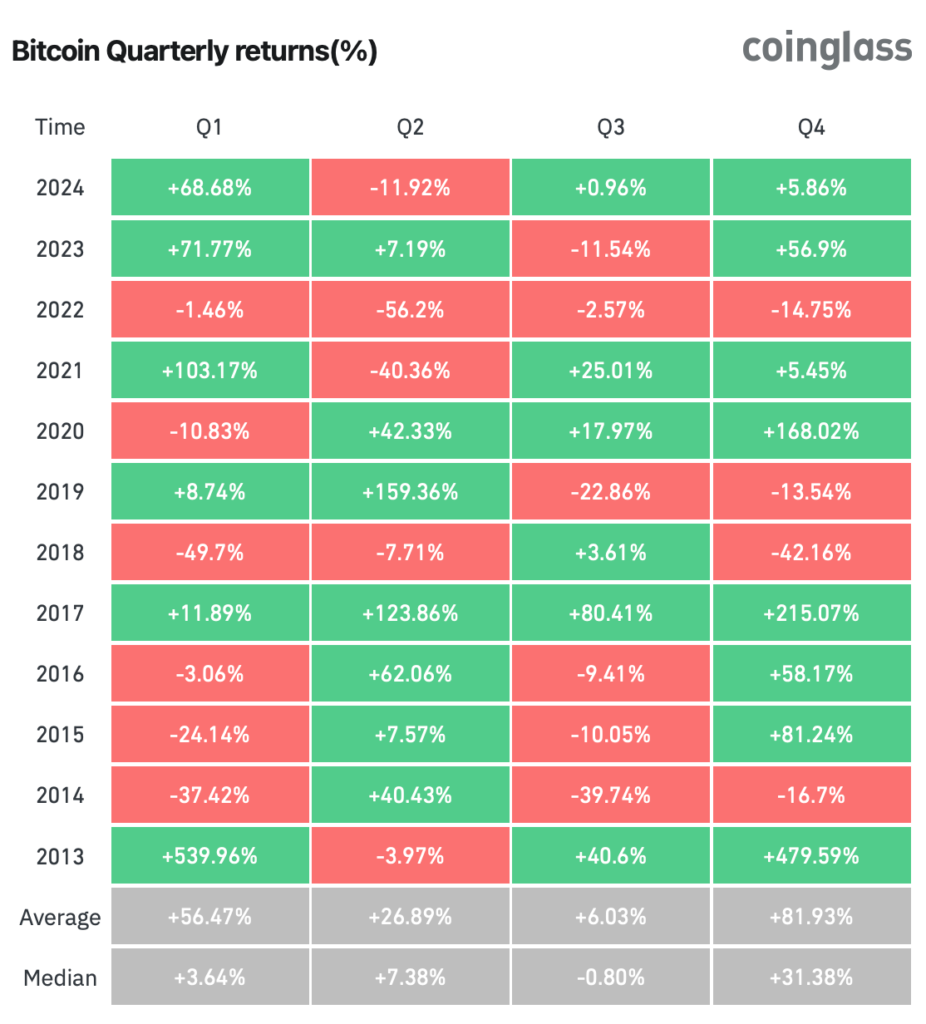

Market analysts remain optimistic about Bitcoin’s trajectory heading into 2025. Historically, BTC has delivered strong performances in the final quarter of the year and the first quarter of the next. Following a post-election bull run in the U.S., many experts predict Bitcoin will close out 2024 positively, with some projecting sustained six-digit price levels through 2025.

Bitcoin’s Market Capitalization

Bitcoin’s market cap currently stands at $2.076 trillion, contributing significantly to the combined dominance of BTC and Ethereum, which account for roughly 65% of the total cryptocurrency market cap. Analysts predict that Bitcoin’s market cap could surpass the $2 trillion mark in 2025.

BTC 24-Hour Trading Volume: Insights

As the leading cryptocurrency, Bitcoin enjoys substantial trading activity. Its 24-hour trading volume is $105.7 billion, with Binance leading the charge. Binance contributes approximately 41% through perpetuals trading and 11% through spot trading. Other major exchanges such as OKX and Bitget also play significant roles.

Key Bitcoin Blockchain Upgrades

To maintain its dominance, the Bitcoin network has undergone several upgrades since its inception in 2009. Notable updates include:

2020-2024

- Taproot Upgrade (2021): Enhanced privacy and smart contract capabilities.

- Muir Glacier (2020): Delayed a technical event to ensure smooth network operations.

2017-2019

- Segregated Witness (SegWit, 2017): Improved scalability and transaction efficiency.

- Schnorr/Tapscript (Proposed): Further improvements to scalability and efficiency.

2015-2016

- Bitcoin Core 0.12.0 (2016): Enhanced wallet management and security.

- BIP66 (2015): Improved transaction verification and network reliability.

2013-2014

- Bitcoin Core 0.9.0 (2014): Introduced a new wallet format and boosted performance.

2010-2012

- Pay-to-Script-Hash (P2SH, 2012): Allowed for more complex payment scenarios.

Bitcoin Price Outlook for the Next 30 Days

According to analysts, Bitcoin could see a double-digit rally leading to a peak of $108,918 by December 31. However, a brief correction may precede this move, with the overall trend remaining bullish.

Bitcoin Price Predictions for 2025-2050

Looking ahead:

- 2025: Bitcoin is expected to maintain six-digit price levels, with a projected peak of $104,280.26 by February.

- 2030: Analysts foresee an all-time high of $774,474.00, with average prices in the $465,000 to $774,000 range.

- 2050: Bitcoin’s value could soar to an average of $2.9 million to $3.3 million.

Technical Analysis: Make-or-Break Levels

Since November 11, Bitcoin has established higher highs and higher lows, signaling strong bullish momentum. Following a 4.89% correction from $108,366 to $103,065, BTC appears poised for another leg up.

Key levels to watch:

- Upside Targets: $113,888 (261.8% Fibonacci extension) and $122,681 (316.8% Fibonacci extension).

- Downside Risks: A rejection at $108,366 could lead to a drop below $100K. Failing to hold $99K could trigger a deeper correction to $90K.

Conclusion

Bitcoin’s short-term trajectory hinges on macroeconomic events, notably the FOMC meeting, and key technical levels. While the long-term outlook remains optimistic, traders should brace for potential volatility as BTC navigates pivotal price zones.

Leave a comment