Bitcoin News (December 18, 2024) – Bitcoin’s Upward Trajectory Likely to Persist, Crypto Analyst Says

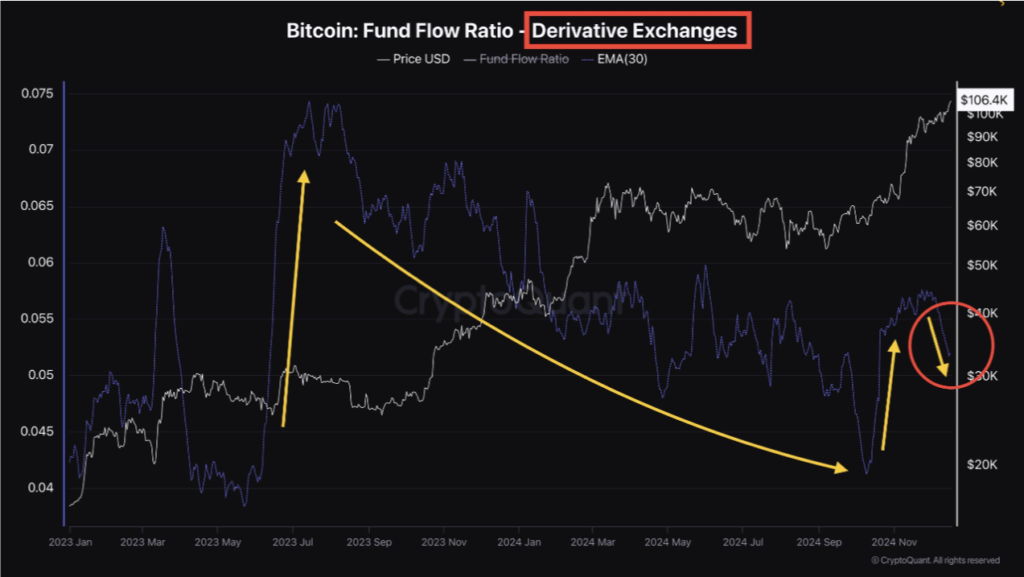

Bitcoin News (December 18, 2024) – Bitcoin (BTC) is showing signs of continued upward momentum, as its funding rate indicates that the market is not overheated and there are no clear signs of the cryptocurrency reaching its peak too early in the cycle. According to CryptoQuant contributor Avocado onchain, the 30-day exponential moving average (EMA) of the Bitcoin funding rate suggests that there is still significant room for further growth.

Bitcoin’s Upward Trajectory Likely to Continue

In a report published on December 17, Avocado pointed out that Bitcoin’s upward trend is likely to persist. “The funding rate analysis shows no visible signs of late-cycle overheating,” they said. The funding rate, which helps keep the futures and spot market prices in line by adjusting payments between buyers and sellers, currently sits at 0.0084% on Binance, the world’s largest cryptocurrency exchange by trading volume.

Bitcoin’s Parabolic Phase Just Beginning

In line with this, pseudonymous crypto trader Rekt Capital suggested in a December 17 post on X (formerly Twitter) that Bitcoin has just entered its parabolic phase of the current market cycle. Rekt emphasized that this phase typically lasts around 300 days, and according to his observations, Bitcoin is only 41 days into it, indicating that the cryptocurrency has much more room for growth before it peaks.

Funding Rate: A Key Indicator of Market Health

The funding rate is a key metric that reflects the balance between buyers and sellers in the market. In a buyer-dominated market, buyers need to pay a fee to sellers, leading to a positive funding rate. In contrast, in a seller-dominated market, sellers are the ones paying buyers, leading to a negative funding rate. Bitcoin’s current 0.0084% funding rate on Binance suggests that the market remains buyer-driven, signaling continued demand and a healthy market environment.

Bitcoin’s Recent Price Action and Market Sentiment

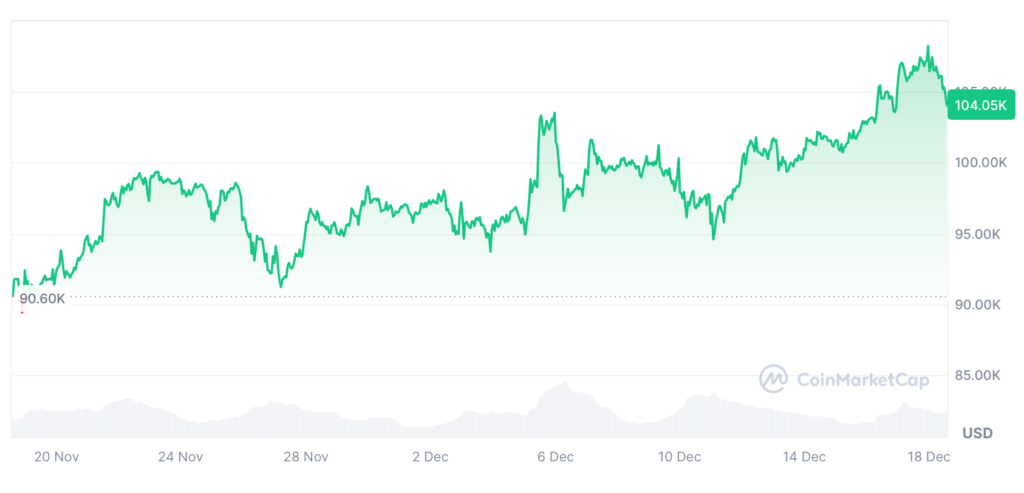

Bitcoin recently reached a new all-time high of $108,239 on December 17, according to data from CoinMarketCap. Despite this significant surge, the funding rate is still far from the 1% threshold that traders often view as a sign of an overheated market. Mister Crypto, another pseudonymous crypto trader, stated in a post on December 17 that Bitcoin’s funding rates are “still not overheated at all.” As long as the funding rate remains below 1%, Bitcoin could continue to see further upward momentum.

Bitcoin’s Price Momentum and Trading Volumes

Between March and October, Bitcoin’s price was consolidating within a range of $53,000 to $72,000, and trading volumes were relatively low during this period. However, since October, both the futures and spot markets have experienced a simultaneous rise in trading volumes, which has helped fuel Bitcoin’s upward price momentum, according to Avocado.

Institutional Demand and Future Projections

Looking ahead, Bitfinex analysts have expressed confidence in the continued strength of Bitcoin’s market, particularly due to strong institutional demand. In their latest analysis, Bitfinex stated that any price dips in 2025 are likely to be short-lived due to sustained institutional inflows. The analysts forecast that Bitcoin could reach $145,000 by mid-2025, and under favorable conditions, the price could even rise as high as $200,000.

Bitcoin’s Market Sentiment Remains Positive

The Bitcoin funding rate and other key indicators suggest that the cryptocurrency market remains optimistic about Bitcoin’s prospects. As long as the funding rate stays at reasonable levels and Bitcoin maintains its upward momentum, the cryptocurrency is expected to continue its growth. Traders and investors will be keeping an eye on the evolving market conditions, particularly the influence of institutional demand and market sentiment, which could dictate Bitcoin’s trajectory in the coming months.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Leave a comment