Bitcoin Mining Difficulty Soars as BTC to Gold Ratio Breaks New Ground

Bitcoin Mining Difficulty – The Bitcoin to gold ratio, a key metric for assessing the relative purchasing power of Bitcoin against gold, has hit a new all-time high (ATH) as Bitcoin price reaches unprecedented levels.

On December 16, Peter Brandt, a seasoned futures forex trader, took to X (formerly Twitter) to announce that the Bitcoin to gold ratio had achieved a historic milestone. The ratio, which compares the price of Bitcoin to the cost of spot gold, indicates the number of ounces of gold required to buy one Bitcoin.

New Bitcoin to Gold Ratio ATH: 40 Ounces Per BTC

On December 16, the Bitcoin to gold ratio reached an ATH of 40 gold ounces per BTC, as the price of Bitcoin briefly surpassed $106,000 for the first time. At that time, the price of spot gold (XAU) was trading around $2,650. This new milestone highlights Bitcoin’s growing purchasing power relative to gold, further solidifying the argument for Bitcoin’s role as a store of value and a potential competitor to traditional assets like gold.

Brandt Predicts Continued Growth for the Ratio

Commenting on the new record, Peter Brandt expressed confidence that the Bitcoin to gold ratio would continue to rise. “Next stop will be 89 to 1 — it will require 89 ounces of gold to buy 1 BTC,” Brandt predicted. This optimistic forecast aligns with a widely circulated narrative in the cryptocurrency community, suggesting that Bitcoin could capitalize on the $15 trillion gold market, further increasing its dominance and value.

Bitcoin’s Market Capitalization and Potential for Growth

At the time of writing, Bitcoin was priced at approximately $104,690, giving it a market capitalization of around $2.1 trillion. This significant gap between Bitcoin and gold’s market capitalization presents a major opportunity for Bitcoin to continue growing, according to Cathie Wood, the founder of ARK Invest and a well-known Bitcoin bull. Her comments followed remarks made by Jerome Powell, the Chairman of the U.S. Federal Reserve, who referred to Bitcoin as a digital version of gold after BTC surpassed the $100,000 price mark on December 5.

Bitcoin Mining Difficulty Reaches New Historic High

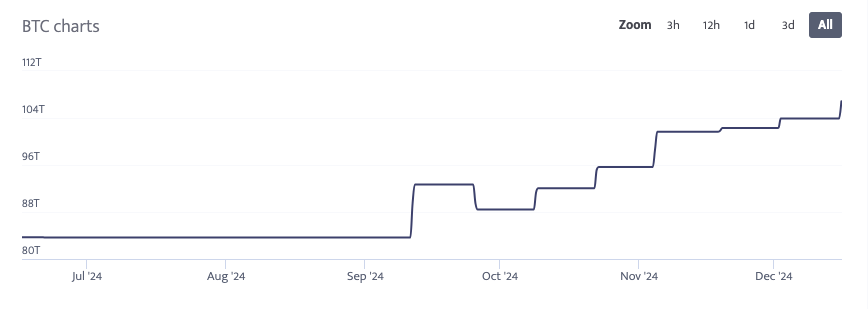

The record-breaking Bitcoin to gold ratio comes amid growing difficulty in Bitcoin mining. On December 15, the Bitcoin mining difficulty — a measure of how hard it is to find the correct hash for each block on the Bitcoin blockchain — hit a new all-time high, surpassing 105 trillion. This increase in mining difficulty reflects the increasing complexity of mining Bitcoin as the network continues to grow.

Bitcoin’s Mining Difficulty and Future Adjustments

The Bitcoin mining difficulty is adjusted approximately every 2,016 blocks, or about every 14 days. The next difficulty adjustment is scheduled for January 1, 2025, according to data from CoinWarz. As Bitcoin’s price continues to rise, the increasing mining difficulty could have significant implications for the overall supply and the cost of producing new coins, further reinforcing the narrative of Bitcoin as a deflationary asset.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Leave a comment