World Liberty Financial Crypto Buy Spree: $45 Million Investment by Trump’s Platform

World Liberty Financial– Donald Trump’s crypto initiative, World Liberty Financial, has been making waves in the cryptocurrency world with a major buying spree throughout December. As of mid-month, the project has spent nearly $45 million on a series of cryptocurrency purchases, including $250,000 worth of Ondo (ONDO).

World Liberty Financial’s Impressive Crypto Buy Spree

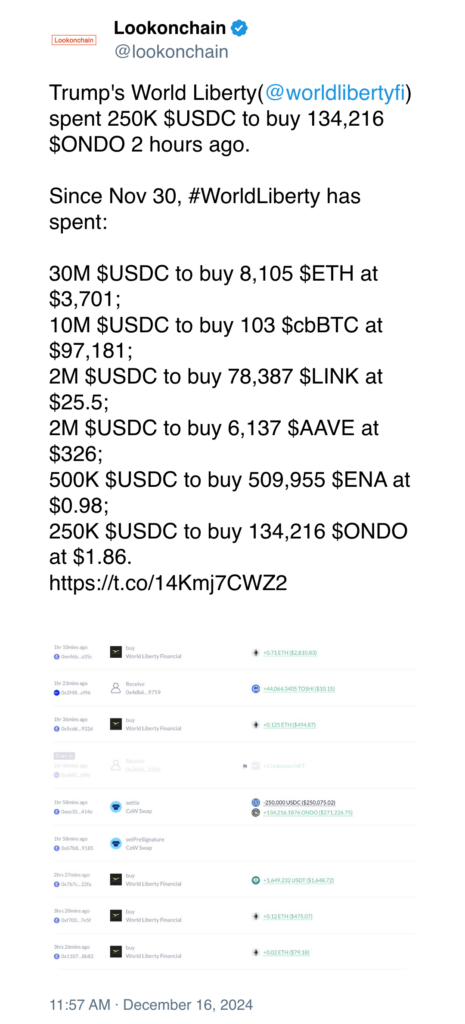

According to Lookonchain’s Dec. 16 post and data from Arkham Intelligence, World Liberty has been aggressively adding to its cryptocurrency holdings. Since November 30, the project has bought an astonishing $30 million worth of Ether (ETH) and $10 million worth of Coinbase Wrapped Bitcoin (cbBTC), alongside several other notable purchases.

Lookonchain’s data shows that, as of Dec. 15, World Liberty made its latest purchase of $250,000 in Ondo (ONDO) tokens around 11 pm UTC. This was just a day after it acquired $500,000 worth of Ethena (ENA). Previous purchases include $2 million each of Chainlink (LINK) and Aave (AAVE). This brings the total spending in December alone to $44.75 million in various crypto assets.

The World Liberty Financial Project: Trump’s DeFi Vision

Launched in September, World Liberty Financial bills itself as a decentralized finance (DeFi) platform aimed at facilitating cryptocurrency trading. The project proudly lists Donald Trump as its “chief crypto advocate,” with his sons Donald Jr., Eric, and Barron serving as “ambassadors.” A company affiliated with the Trump family is entitled to 75% of net revenues generated by the platform.

Despite the significant crypto buying activity, World Liberty Financial has faced challenges in meeting its sales targets for its native token, World Liberty Financial Token (WLFI). So far, the project has sold less than a quarter of the $300 million worth of WLFI tokens that it initially set out to sell.

Strategic Moves and Institutional Backing

A boost to the project’s credibility came last month when Justin Sun, the founder of the Tron blockchain, made a $30 million investment in World Liberty Financial. This investment made Sun the project’s largest shareholder and resulted in him being appointed as an adviser to the initiative. Sun, along with Tron, has faced scrutiny from the Securities and Exchange Commission (SEC), which has accused them of selling unregistered securities.

Interestingly, Trump has promised to overhaul the SEC to make it more crypto-friendly, a move that some believe could further enhance the regulatory environment for projects like World Liberty Financial.

World Liberty’s Proposal: AaveDAO Collaboration

In another recent development, AaveDAO, the decentralized autonomous organization behind the popular Aave DeFi protocol, approved World Liberty Financial’s proposal to deploy its own instance of the Aave protocol. This would allow users of World Liberty Financial to borrow and lend various assets, including Ether (ETH), Wrapped Bitcoin (WBTC), and stablecoins such as USD Coin (USDC) and Tether (USDT).

As part of the agreement, AaveDAO will receive 20% of the fees generated by World Liberty Financial’s platform, and 7% of WLFI’s supply, which is currently worth about $21 million at a price of 1.5 cents per token.

What’s Next for World Liberty Financial?

Despite the ambitious investments and partnerships, World Liberty Financial still has a long way to go in terms of reaching its goals. While it has successfully generated significant interest in its cryptocurrency purchases, it faces ongoing challenges in selling the WLFI token and establishing itself as a major player in the DeFi space.

Looking ahead, investors and crypto enthusiasts will be keen to see how Trump’s involvement and the growing institutional backing from figures like Justin Sun continue to shape the project. Given the regulatory uncertainties in the U.S. and the shifting dynamics within the crypto market, World Liberty Financial could either become a major force or struggle to fulfill its vision.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Leave a comment