Tesla Share Price: Can TSLA Soar to $1,600 or $2,600?

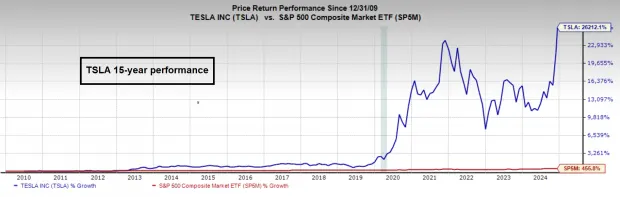

Tesla Share Price – Tesla (TSLA) and its CEO Elon Musk have faced skepticism since the company’s inception, with many questioning the viability of a profitless electric vehicle (EV) startup trying to compete in a market dominated by legacy players like General Motors (GM) and Ford (F). The company went public during the aftermath of the worst global financial crisis in decades, making its early success even more improbable. However, Tesla defied the odds, and over time, its stock has soared by an astonishing 32,564%, earning the Zacks Rank #1 (Strong Buy) and turning it into one of the most successful companies in the world.

While the stock’s meteoric rise has left many investors in awe, it’s also natural for some to feel hesitant when considering buying shares at these elevated levels. Despite the massive gains, TSLA has endured a prolonged correction since its peak in late 2021. However, the stock has recently clawed its way back, hitting fresh all-time highs this week. While short-term fluctuations are possible, many long-term investors are now considering potential price targets for Tesla should the breakout prove to be sustainable. Below are four ways to project the long-term price targets for TSLA.

Fibonacci extensions are a widely used technical analysis tool that helps predict the potential extension of a stock’s price after a significant move. By using a sequence of numbers (derived from the Fibonacci series), this tool helps traders identify key price levels that may act as support or resistance. The 161.8% and 261.8% extension levels are the most commonly used in this method.

When applying Fibonacci extensions to the current long-term breakout of Tesla stock from late 2021, the first two long-term price targets are around $600 and $900. These levels represent potential points where the stock might face resistance or consolidation as it continues its upward trajectory.

Tesla Stock Measured Move: A Straightforward Price Projection

The measured move technique is one of the simplest methods for setting price targets. It involves identifying the high and low of a previous price range (or base) and calculating the difference between these two points. This difference is then added to the high of the range to estimate the next target price.

Using the measured move method, TSLA’s price extension suggests a potential target of $727. While this approach is less complex than other methods, it provides a clear and straightforward price projection that can serve as a useful benchmark for investors.

Tesla Price Forecasts: Insights from Billionaire Investors Ron Baron and Cathie Wood

While many skeptics may be critical of these price predictions, it’s important to consider the views of prominent investors who have successfully predicted Tesla’s growth in the past.

Ron Baron, a billionaire investment legend, has been one of the most vocal proponents of Tesla. Baron, who invested hundreds of millions into Tesla between 2014 and 2016, has watched his stake appreciate to over $6 billion. Baron believes that Tesla could become a $5 trillion company within the next decade, with shares potentially soaring to $1,600. Although this target may seem ambitious to some, Baron’s track record and his successful investments in Tesla make him a credible source.

In a similar vein, Cathie Wood, the founder of Ark Invest and manager of the Ark Innovation ETF (ARKK), is another well-known Tesla bull. Wood, who also made early and bold bets on Tesla, predicts that the stock could climb to $2,600 per share within the next five years. Wood’s confidence in Tesla’s future is based on the company’s long-term growth potential, particularly in the EV market, autonomous driving, and energy solutions.

Tesla Stock: A Long-Term Growth Story

The extraordinary rise of Tesla’s stock is a testament to the company’s resilience and Elon Musk’s ability to defy expectations. Despite its early struggles and ongoing challenges, Tesla has proven itself as a dominant player in the electric vehicle market. With its ambitious goals and innovative technologies, many investors continue to see Tesla as a key player in the future of the automotive and energy industries.

While the stock may face short-term volatility, the long-term outlook for TSLA remains strong. If the predictions of Ron Baron and Cathie Wood hold true, Tesla could continue to disrupt the market and provide substantial returns for its investors. Whether the stock hits $900, $1,600, or even $2,600, it’s clear that Tesla is a company to watch in the years ahead.

As always, investors should conduct their own research and consider their risk tolerance before making any investment decisions.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Leave a comment