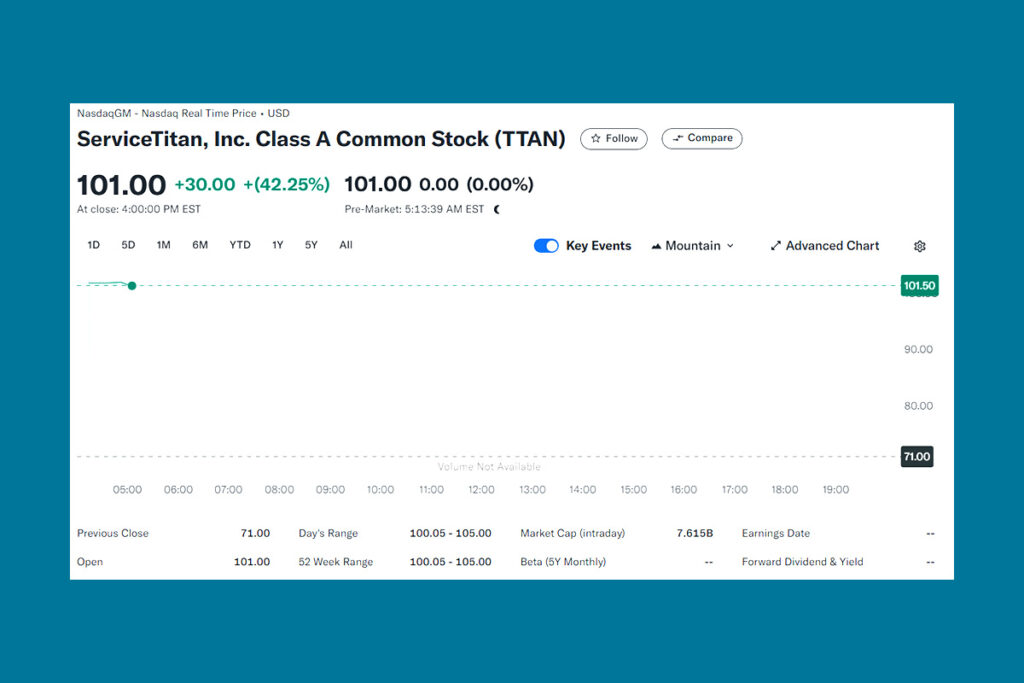

Home Repair Software Leader ServiceTitan Shares Soar 42% Gain After IPO

After raising $624.8 million, shares of ServiceTitan Inc., a software firm for home and commercial repair, surged 42% over their IPO price. The closing price of the Glendale, California-based company’s stock on Thursday was $101 a share, which was the same as when it debuted and significantly higher than the $71 offering price. According to data provided by Bloomberg, the first-day increase is the biggest for a US initial public offering (IPO) generating over $400 million since Reddit Inc.’s March debut, when its shares jumped 48% above the IPO price.

From $7.6B to $10B: How ServiceTitan’s Valuation Reflects Market Optimism?

The company’s fully diluted valuation is closer to $10 billion when stock options and restricted share units mentioned in its filings with the US Securities and Exchange Commission are taken into account. According to data source PitchBook, that contrasts with a valuation of roughly $7.6 billion following its 2022 investment round. The company was worth up to $9.5 billion during the boom of 2021.

According to Bloomberg Intelligence analyst Anurag Rana, the price range hike earlier this week demonstrated optimism in ServiceTitan’s growth potential given its vast addressable market and integrated software offering. On its business management platform, ServiceTitan offers software that streamlines operations, including scheduling, dispatching, and financing.

This was a forgotten industry until ServiceTitan came along. The product market fit is incredible.

Nina Achadjian, a board member at the company and a partner at Index Ventures

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment