Bitcoin Price Rejection at $100K: Retail FOMO and Institutional Inflows

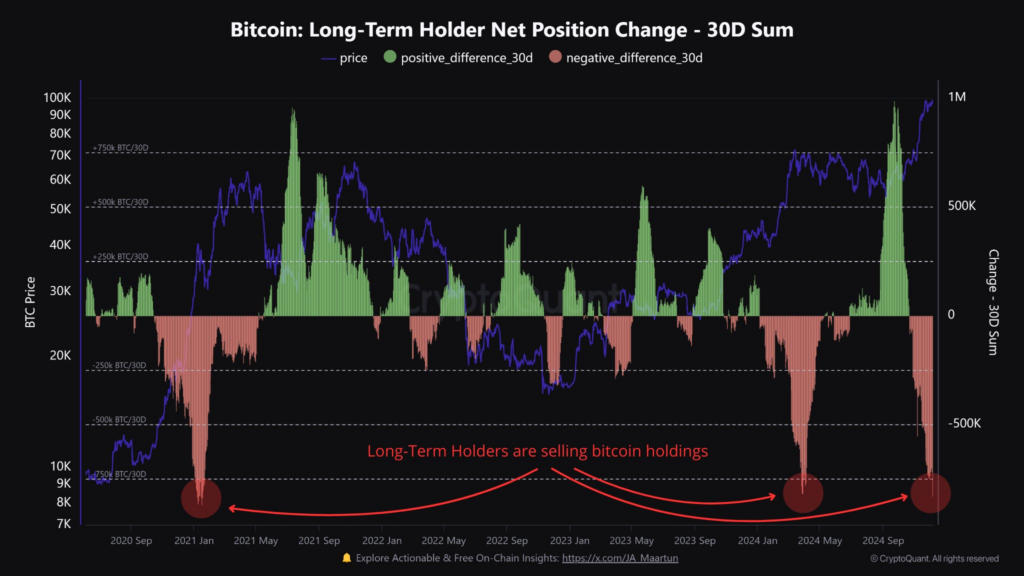

Bitcoin Price– Bitcoin has been struggling to break through the $100,000 price level, facing significant resistance despite an overall bullish market sentiment. Over the past month, long-term holders have been dumping large amounts of Bitcoin, contributing to the downward pressure on prices. A total of 827,000 BTC has been sold in just the last 30 days, a sign that long-term investors may be cashing out as the market shows signs of overheated conditions.

Why is Bitcoin Facing Rejection at $100K?

Bitcoin’s recent rally saw it surge to an all-time high of $104,000, yet the $100K mark has become a tough barrier to cross. A key factor behind this resistance is the ongoing sell-off by long-term holders, who have offloaded significant amounts of BTC in recent weeks. According to data from popular crypto analyst Maartunn, long-term holders sold a massive 827,783 BTC in the past 30 days, signaling potential bearish pressure on the market.

The massive sell-off from long-term holders is a noteworthy development, as this group typically represents a more stable and committed segment of the market. Their actions are often seen as a leading indicator of broader market sentiment, and their decision to sell could be interpreted as a sign that they believe Bitcoin’s price has peaked, at least in the short term.

Institutional Players Continue Buying, But Not Enough to Offset the Sell-Off

While long-term holders are reducing their exposure, institutional investors are stepping in to fill the gap. Major players like MicroStrategy and Bitcoin exchange-traded funds (ETFs) have been aggressively accumulating Bitcoin in recent weeks. Over the past 30 days, MicroStrategy alone has purchased 149,880 BTC, while Bitcoin ETFs have seen inflows of 84,193 BTC.

Despite these significant institutional buys, they have not been enough to offset the selling pressure from long-term holders. The combined institutional inflows are much smaller than the total BTC sold by long-term holders, which is contributing to the resistance at the $100K price level.

In addition to the direct purchases of Bitcoin, spot Bitcoin ETFs have also seen record inflows. For instance, last week, spot Bitcoin ETFs saw $2.73 billion in net inflows, the highest weekly inflow since the inception of these investment vehicles. The BlackRock Bitcoin ETF, which alone recorded inflows of $2.6 billion, crossed the $50 billion mark in assets under management (AUM).

Retail FOMO Drives the Price Surge

Despite the large-scale sell-off by long-term holders, retail investors have been driving much of the recent price surge. As seen in previous bull cycles, it is often retail demand that fuels the final leg of a rally. Retail participation has been particularly evident in the last month, with metrics indicating a spike in retail interest.

Recent data shows that retail demand for Bitcoin has surged to yearly highs, reflecting an increase in buying activity. Short-term holders, often retail investors, are absorbing much of the Bitcoin being sold by long-term holders, which is helping to maintain the upward momentum in the price. Additionally, the altcoin market has also seen significant interest, with open interest in altcoins rising to $53.3 billion and Bitcoin open interest reaching $30.6 billion.

This heavy presence of retail investors in both spot and derivatives markets suggests a high-stakes “musical chairs” dynamic, as pointed out by analyst Maartunn. Retail FOMO (fear of missing out) could be creating a precarious situation where a sudden shift in market sentiment could cause a sharp decline in prices.

Signs of Extreme Market Sentiment

The current market sentiment is showing signs of extreme greed, with the Crypto Fear & Greed Index reaching 84, which signals extreme greed. This level of market sentiment is often associated with heightened risks and can indicate that the market is approaching a potential top. Historical data suggests that such levels of greed are often followed by market corrections, making it a critical time for investors to monitor price movements carefully.

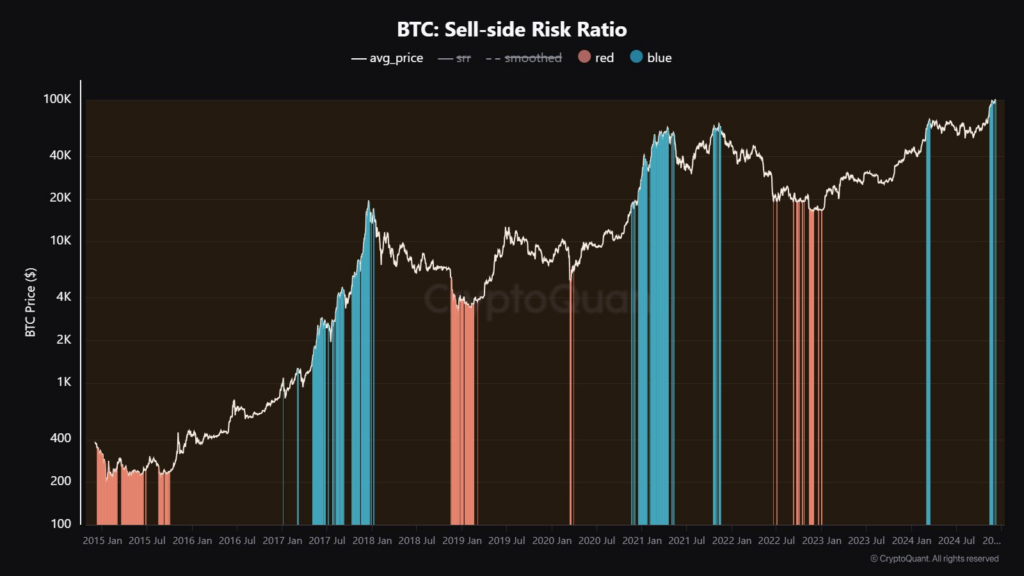

Other on-chain metrics also support the idea that the market could be nearing a top. The Sell-Side Risk Ratio and Net Taker Volume (ETH) are pointing to increased selling pressure, which aligns with the bearish signals seen in Bitcoin’s recent price movements.

The Impact of Macro Factors on Bitcoin Price

The future direction of Bitcoin’s price will largely depend on macroeconomic factors, particularly inflation data. The release of the U.S. Consumer Price Index (CPI) and the Producer Price Index (PPI) will be closely watched by investors and analysts. These figures will provide key insights into the U.S. economy’s inflationary pressures, which, in turn, could influence Federal Reserve decisions on interest rates.

With the market already displaying signs of extreme greed and heightened volatility, these upcoming inflation figures could play a pivotal role in determining whether Bitcoin will be able to break through the $100K resistance level or if it will face a significant correction.

Conclusion

Bitcoin’s journey to $100K and beyond faces multiple hurdles, including the massive sell-off by long-term holders, increased retail participation, and signs of extreme market sentiment. While institutional players like MicroStrategy and Bitcoin ETFs continue to accumulate, their purchases have not been enough to counteract the pressure from long-term holders. Additionally, retail FOMO could exacerbate the volatility in the short term.

As we approach critical macroeconomic data releases, Bitcoin investors should remain cautious and closely monitor market signals, as a potential market correction could be on the horizon.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Leave a comment