ACHR Stock on Fire: Can It Reach $10 Amid Growing eVTOL Market?

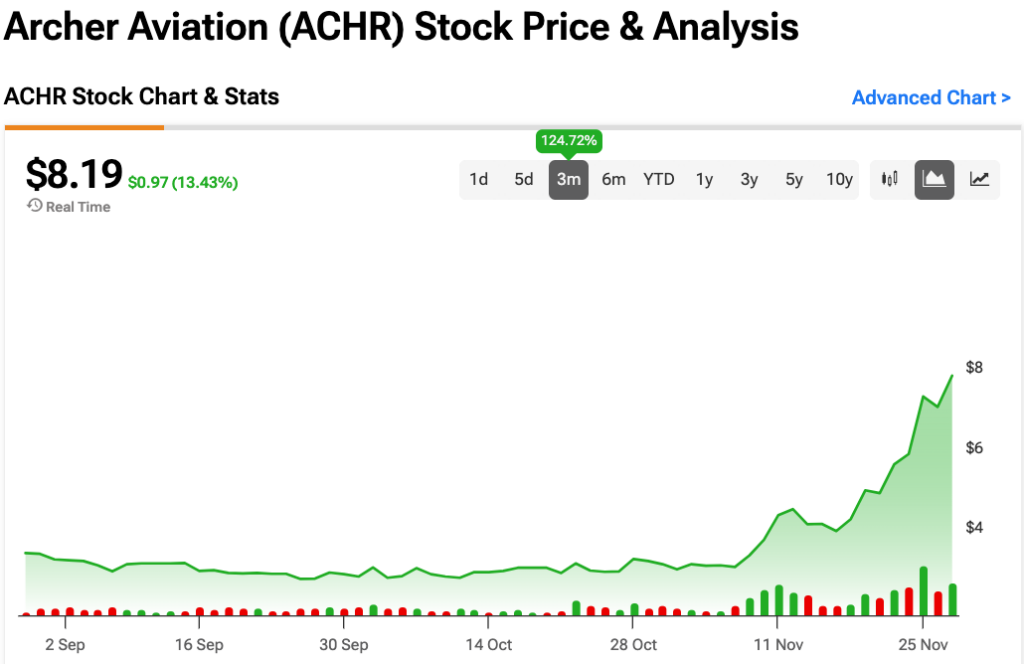

ACHR stock has been on an impressive upward trajectory, recently hitting a new 52-week high of $8.18 per share, reflecting a significant 13% gain on the day. This surge comes after the electric vertical take-off and landing (eVTOL) company reported stellar growth, which has been fueled by investor enthusiasm for the rapidly expanding eVTOL sector. The company’s stock surpassed its previous high of $6.70 set earlier this year, marking a notable milestone.

Archer Aviation’s Momentum Shows No Signs of Slowing Down

Archer’s recent stock performance is part of a larger trend of consistent growth. Over the past quarter, ACHR has gained an impressive 125%, a remarkable feat considering it was trading at penny stock levels just a few months ago, hovering around $3 per share when it began trading in September 2024. Now, as Archer continues to rise steadily, the company’s momentum is undeniable, even as market conditions remain uncertain. The question on many investors’ minds is whether Archer can maintain this trajectory, with many speculating that it could soon cross the $10 mark and become a leader in the eVTOL market.

Archer Aviation Faces Strong Competition from Joby Aviation

Archer is not alone in the eVTOL race. Joby Aviation (JOBY), a company with similar goals and technologies, has also posted strong results, although its stock has only increased 62% over the past quarter. While both companies are trading at just above $8 per share, Archer’s stronger growth and first-mover advantage in the eVTOL market make it a tempting play for investors looking to gain exposure to the rapidly growing sector.

Both companies are part of a new wave of electric aircraft manufacturers seeking to revolutionize urban mobility with electric-powered, vertical take-off and landing planes that promise to reshape the future of transportation.

What’s Driving Archer Aviation’s Stock Surge?

Casey Dylan of TipRanks recently analyzed the factors driving Archer’s stock surge. He pointed to the broader shift in transportation being led by eVTOL manufacturers like Archer, which are expected to be integral to the growth of the $9 trillion market for urban air mobility by 2050. With Archer’s first-mover status in the sector, it is poised to become a major player in this emerging industry. As more investors turn their attention to eVTOL stocks, Archer is well-positioned to benefit from the influx of capital into this space.

Wall Street Analysts Are Bullish on Archer Aviation Stock

Wall Street analysts are highly optimistic about ACHR stock, with a Strong Buy consensus rating. In the past three months, analysts have issued three Buy ratings and one Hold, reflecting strong confidence in the company’s future growth prospects. Following a 38% rally in its share price over the past year, analysts have set an average price target of $9.38 per share, which implies 15% upside potential from its current price of $8.18.

Is Archer Aviation the Next Big Player in eVTOL Stocks?

With its impressive growth over the past few months, Archer Aviation is quickly becoming a frontrunner in the eVTOL sector. As the market for urban air mobility grows, Archer’s early-mover advantage and strong market presence put it in an excellent position to continue its upward momentum. If the company can sustain its growth, it could soon become a leading name in the eVTOL industry, making it an attractive investment for those seeking exposure to the rapidly evolving aviation sector.

Conclusion: Archer Aviation on the Rise as eVTOL Market Grows

Archer Aviation’s ACHR stock is making waves in the eVTOL sector, and its rapid growth over the past quarter positions it as one of the most promising companies in the market. With strong investor interest, solid analyst ratings, and a potential $9 trillion market on the horizon, Archer could be a key player in the future of urban air mobility. Investors are watching closely, with many hoping the stock continues its upward trajectory toward $10 per share and beyond.

Disclaimer: This website’s content is for informational purposes only and does not constitute financial advice, with all cryptocurrency purchases carrying inherent risks.

Leave a comment