Golden Cross in Bitcoin Puell Multiple Signals: Will History Repeat Itself?

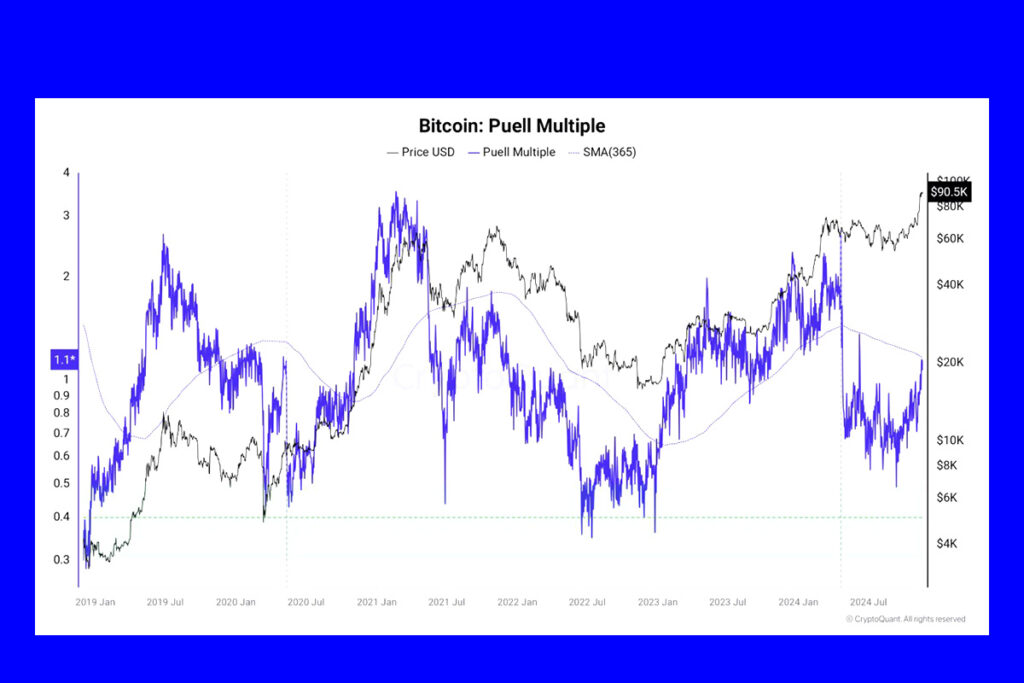

If one traditional BTC price indicator replicates a previous breakout, Bitcoin might see a significant bull run. CryptoQuant, an on-chain analytics tool, highlighted a rare golden cross for Bitcoin’s Puell Multiple in one of its Quicktake blog entries on November 18.

If the Puell Multiple stages a rare breakout, bitcoin bulls will profit from an average 90% increase in the price of the cryptocurrency. CryptoQuant’s five-year behavior analysis reveals that the indicator has only crossed its 365-day moving average three times. Each time, there were notable price spikes for BTC/USD.

Puell Multiple helps us understand market cycles from a mining perspective. It is a crucial indicator for evaluating mining profitability.

CryptoQuant contributor Burakkesmeci

Puell Golden Cross: Will Bitcoin’s Price Rally Like in 2020 and 2019?

To get a sense of miner stability, Puell compares the daily transaction value of Bitcoin to its 365-day moving average. Values that cross the moving average trend line typically correspond with sharp increases in the price of bitcoin. A Puell golden cross was followed by an 83% rally in March 2019. January 2024 was the most recent cross, offering 76% returns, while January 2020 triggered a 113% upside. The likelihood of an inevitable rally is increased by favorable macroeconomic conditions, according to CryptoQuant.

This data shows that after Puell Multiple settles above its SMA365, an average increase of around 90% in Bitcoin’s price has historically followed. All these data points and the macroeconomic framework suggest that a strong bull rally might be on the horizon,

the post

Bitcoin Enters Parabolic Phase: Analysts Predict 300-Day Rally

The Bitcoin bull market is only getting started, according to RSI. Even though BTC/USD has already gained more than 40% in Q4, according to Cointelegraph, a number of analysts now believe that Bitcoin’s most furious upside is yet ahead. The parabolic phase of the market has theoretically started and is expected to persist for about 300 days before a new macro top forms. Concerns that retail FOMO would force a major drop are tempering local predictions that Bitcoin will hit six digits for the first time in history.

Lots of people about to become intimately familiar with the phrase, Fear of Missing Out (FOMO), on this Bitcoin cycle,

commentator Preston Pysh, co-founder of The Investor’s Podcast

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment