Senator Cynthia Lummis Pushes for 1 Million Bitcoin to Be Acquired by U.S. Treasury

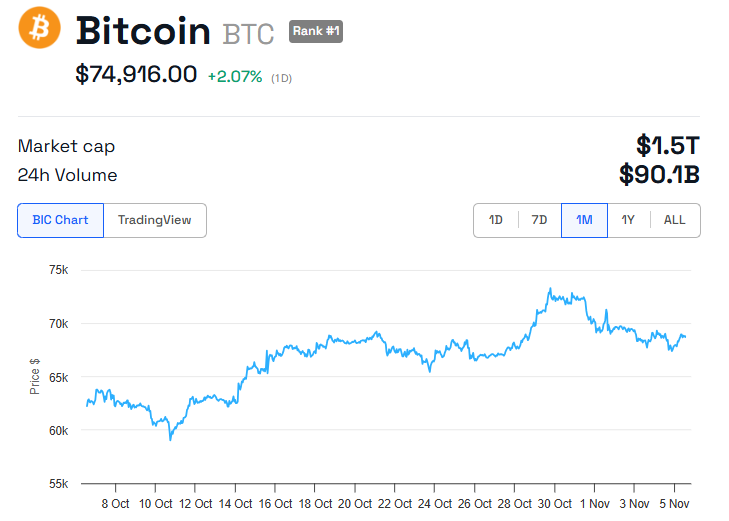

Senator Cynthia Lummis has unveiled a bold new proposal to establish a Bitcoin reserve in the United States, a move aimed at positioning the country as a global leader in financial innovation. The proposal comes at a time when Bitcoin has reached new all-time highs, and President-elect Donald Trump has made similar comments regarding the use of Bitcoin in the country’s financial future.

The BITCOIN Act of 2024: A Strategic Move for National Bitcoin Reserves

Lummis’s legislation, known as the BITCOIN Act of 2024, proposes that the US Treasury acquire 1 million Bitcoin (BTC) over a five-year period. At current prices, this would require an investment of approximately $76 billion. The plan calls for the purchase of 200,000 BTC each year, which would significantly strengthen the US’s Bitcoin reserve and provide a hedge against inflation.

“We are going to build a strategic Bitcoin reserve,” Senator Lummis shared in a recent post on her social media platform X (formerly Twitter).

The Political Landscape: A Push for Pro-Crypto Policies

With pro-crypto candidates gaining ground, Lummis’s bill has a better chance of passing through Congress. The most recent elections have seen 261 pro-crypto candidates elected to the House of Representatives, compared to only 116 anti-crypto candidates. Meanwhile, in the Senate, there are now 17 pro-crypto lawmakers, further strengthening the prospects of Lummis’s Bitcoin reserve plan.

This political alignment, combined with Bitcoin’s recent price surge, adds significant momentum to the proposal. Industry figures such as Michael Saylor from MicroStrategy and Samson Mow have also voiced their support, emphasizing Bitcoin’s importance as a national asset.

Mow, in particular, cautioned that Bitcoin’s value could increase significantly in the near future, suggesting that acquiring it now—when prices are below $100,000—could have massive geopolitical implications.

Bitcoin Reserve to Help Reduce US National Debt

The BITCOIN Act does more than just call for Bitcoin acquisition—it also lays out a framework for securely managing Bitcoin within the US Treasury. According to the bill, the Bitcoin reserve would be used as a means to reduce the national debt by 50% by the year 2045. This would not only protect against inflation but also provide a long-term solution to US debt management.

The idea of a national Bitcoin reserve has received significant attention, especially after President-elect Trump’s public endorsement at the Bitcoin 2024 conference in Nashville. Trump emphasized that his administration would aim to keep all of the Bitcoin the US government currently holds, further solidifying the idea of Bitcoin as a key asset for financial independence.

“It will be the policy of my administration… to keep 100% of all Bitcoin the US government holds,” Trump stated, signaling his support for a national Bitcoin stockpile.

State Governments Also Eyeing Bitcoin as Strategic Reserve

At the state level, several governments are beginning to recognize the potential of Bitcoin as a strategic reserve. For example, Florida’s Chief Financial Officer, Jimmy Patronis, recently endorsed the use of Bitcoin as a reserve asset for the state’s pension fund. This aligns with similar moves in Wisconsin and Michigan, where state governments are looking to Bitcoin’s long-term appreciation as a way to diversify investments and protect pension funds against economic uncertainty.

Bitcoin’s Finite Supply and Growing Adoption as a Hedge Against Inflation

While some economists raise concerns about the volatility of cryptocurrency and its role in national debt management, Bitcoin’s finite supply and growing international adoption present a strong case for it as a reliable hedge against inflation. Advocates argue that by positioning Bitcoin as a core asset, the US could bolster its financial resilience in an increasingly uncertain global economy.

Global Impact: Will Other Countries Follow the US’s Lead?

The potential creation of a national Bitcoin reserve in the US has sparked global interest. Many believe that if the US moves forward with such a policy, other countries may follow suit, further accelerating Bitcoin’s adoption as a global financial asset.

“Other countries will follow,” one prominent figure in the cryptocurrency industry commented on the proposal.

The Future of Bitcoin and National Reserves

With Trump’s support, a Republican-led Congress, and increasing state-level backing, the idea of a Bitcoin reserve in the US seems to be gaining momentum. If the BITCOIN Act of 2024 is passed, it could place the US at the forefront of a new era of financial innovation, marking the beginning of what could be a massive global shift in how countries manage their national assets.

This bold proposal has the potential to reshape how governments view and utilize Bitcoin, and if implemented, it could redefine the global financial landscape in ways that are only just beginning to be understood.

Leave a comment