Toncoin Gears Up for Major Bull Run Amid Positive Election Sentiment: 3 Key Charts Indicating a November Rally

With the US presidential election approaching, positive sentiment is brewing in the cryptocurrency market, potentially setting the stage for a powerful bull run. High-performing assets like Toncoin (TON) could see a boost, capitalizing on this renewed momentum. Here’s a breakdown of three bullish indicators suggesting a prolonged uptrend for Toncoin in November.

As of the latest update, TON trades at $4.70, marking a 3.3% intraday loss. According to CoinGecko, Toncoin’s market cap stands at $11.9 billion, with a 24-hour trading volume of $234.4 million.

3 Charts Signaling a Potential Toncoin Price Surge This Month

Despite recent market pullbacks, TON has displayed notable resilience and continued investor confidence. Below, we analyze three crucial charts that suggest Toncoin is on track for a robust rally in the coming weeks.

Whale Accumulation and Exchange Outflows Point to a Toncoin Price Surge

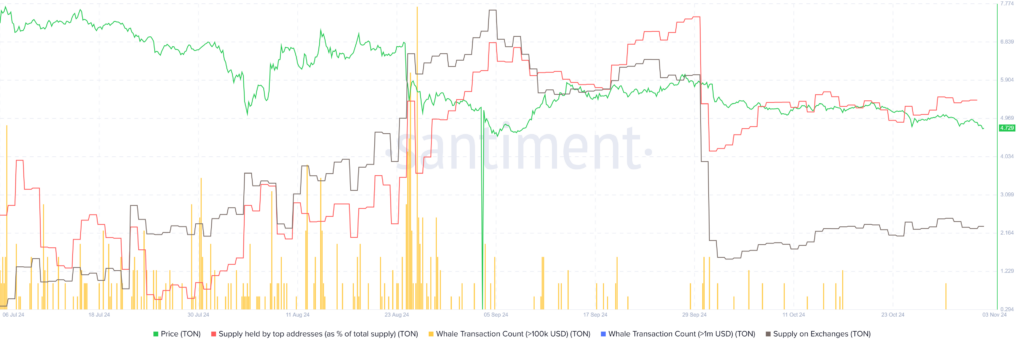

Data from Santiment reveals a sharp increase in the percentage of TON supply held by large investors, or “whales,” rising from 23.7% to 27.5% over the past three months. Such steady accumulation by major investors indicates growing confidence in Toncoin’s long-term potential. Historically, this pattern of whale accumulation aligns with price bottoms, often signaling the start of an uptrend.

Adding to the bullish narrative, the amount of TON available on exchanges has dropped significantly, from 2.54 million tokens to 1.68 million over the past two months. When exchange reserves decline, the reduced supply often triggers upward price pressure as demand increases, creating favorable conditions for a rally.

MVRV Ratio Decline Suggests Possible TON Market Recovery

Amid recent market corrections, Toncoin’s 30-day Market Value to Realized Value (MVRV) ratio has fallen to -6.6%. The MVRV ratio compares an asset’s current market cap with its realized value, helping assess if it’s undervalued or overvalued.

A negative MVRV value generally implies that recent buyers are operating at a loss, and if the correction continues, some speculative holders may choose to sell. However, this phase often attracts long-term buyers looking for value, which can drive a market rebound.

Price Analysis Signals Breakout Potential from Extended Correction

Toncoin price has been in a corrective phase for the last four months, declining from $8.17 to $4.70—a 42% drop. The daily chart shows this correction as a descending trendline that has been providing dynamic resistance to the asset.

As the broader crypto market braces for a potential bull run around the election, Toncoin has stabilized from its bearish trend, trading sideways in recent days. A sustained increase in buying could propel TON to test the overhead trendline, with an 8.5% surge likely as it challenges this resistance. If Toncoin breaks above the trendline, it may accelerate its bullish trajectory, potentially driving a 74% gain to reach the $8.20 level.

However, if sellers successfully defend the trendline, the correction could persist through November.

With strong whale accumulation, a favorable MVRV ratio, and signs of a potential breakout, Toncoin is positioned for a promising rally this November. Investors will be watching closely as these key metrics unfold, especially as election-driven optimism supports a broader market upswing.

Leave a comment