Crypto News – MicroStrategy’s Strategic Shift: Aiming to Raise $42 Billion for Bitcoin

Crypto News – Shares in MicroStrategy fell approximately 5.9% following the company’s third-quarter earnings report, which narrowly missed consensus estimates. An analyst cautioned that the stock may face additional challenges after the upcoming United States elections.

Q3 Revenue Decline and Bitcoin Performance

On October 30, MicroStrategy announced that its software business generated $116.1 million in revenue, reflecting a 10.3% decline compared to Q3 2023 and about 5.22% below analysts’ expectations. Despite this, the firm reported a 5.1% return on its Bitcoin holdings during the quarter, along with an overall gross profit of $81.7 million, which indicates a 70.4% gross margin. This performance comes as MicroStrategy has been rebranding itself as a “Bitcoin development company” this year.

Share Price Reaction and Comparisons with Tech Giants

MicroStrategy’s share price experienced a decline of about 4.23% during the trading day on October 30, closing at $247.31. After hours, the stock price further dropped 1.75%, bringing it to $242.99, according to Google Finance data. During an earnings call, CEO Michael Saylor compared MicroStrategy’s performance with other major tech companies, such as Nvidia (NVDA) and Tesla (TSLA), stating that since August 2020, MicroStrategy has achieved a remarkable 1,989% growth, surpassing Nvidia’s 1,165% growth.

Digital Capital and the Future of Investment

Saylor expressed confidence in MicroStrategy’s strategy, stating, “They are all great companies, but at the end of the day, these companies haven’t embraced digital capital.” He emphasized that MicroStrategy’s approach is straightforward and that the firm will continue to “publish the playbook” for digital transformation in capital investment. “Bitcoin is digital capital, and in time, dozens of companies will realize this, then hundreds, then thousands,” he added.

Potential Volatility Following U.S. Elections

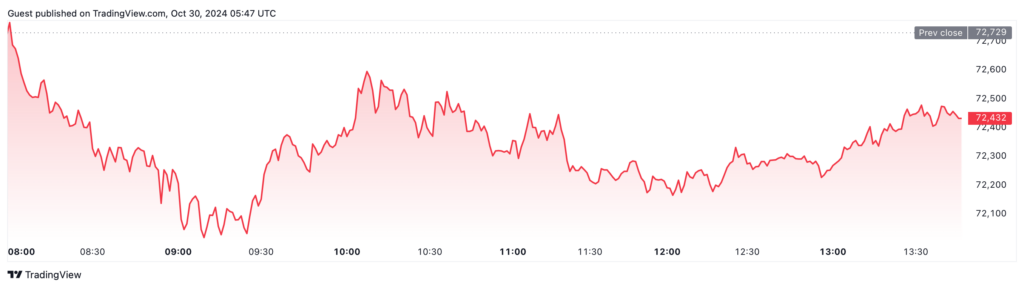

Despite the positive outlook, network economist Timothy Peterson warned of potential headwinds for MicroStrategy’s share price if Bitcoin falters after the U.S. presidential election on November 5. Given MicroStrategy’s high price sensitivity to Bitcoin, Peterson suggested that if BTC declines post-election, the company’s stock could experience a much steeper drop. “If Bitcoin crashes post-election, MicroStrategy’s (MSTR) price would likely fall two to three times more sharply, given its beta to Bitcoin,” Peterson explained. He also noted that should Bitcoin surpass its all-time high of $73,679—currently just 1.7% away at a trading price of $72,432—MSTR is “likely to surge,” as it acts as a proxy investment for Bitcoin exposure.

Future Plans: $42 Billion to Accumulate More Bitcoin

In a significant strategic move, MicroStrategy revealed plans to raise $42 billion over the next three years to increase its Bitcoin holdings. Dubbed the “21/21 plan,” this initiative will consist of $21 billion in equity and $21 billion in fixed-income securities. This ambitious plan underscores MicroStrategy’s commitment to Bitcoin and its vision for the future of digital assets.

Leave a comment