Bitcoin ETFs Nearing Milestone as Traders Anticipate Market Movements

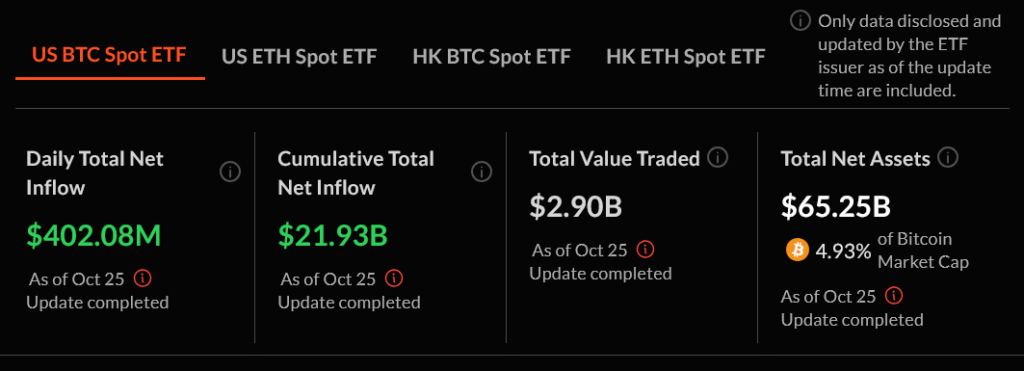

Bitcoin ETFs – As November approaches, the total holdings of United States spot Bitcoin exchange-traded funds (ETFs) may soon reach an impressive milestone of 1 million Bitcoin. With current holdings at 976,893 Bitcoin, worth over $66.2 billion, the ETFs constitute nearly 5% of Bitcoin’s total market cap of $1.34 trillion. This surge is attributed to various potential crypto tailwinds that could unfold this month, including the U.S. election, potential Federal Reserve interest rate cuts, and Russia’s lifting of its Bitcoin mining ban.

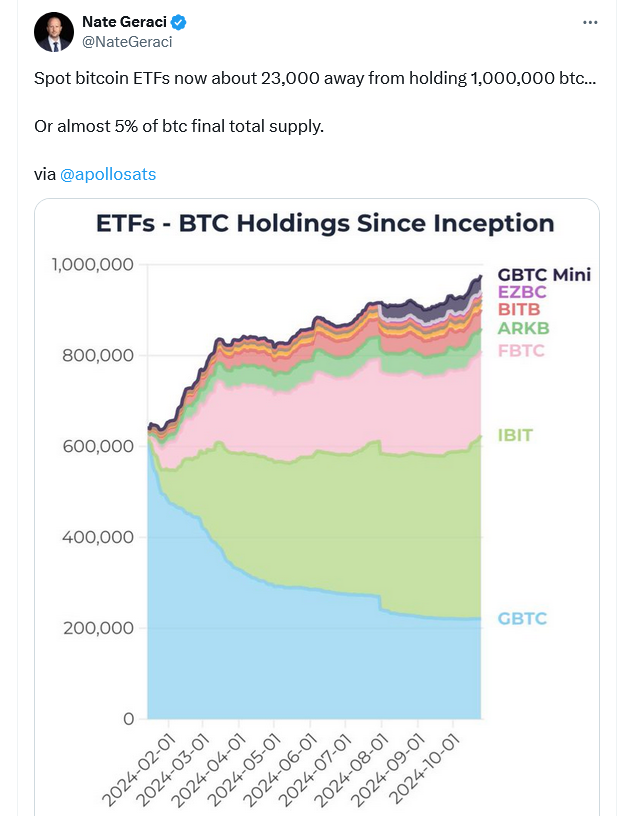

Path to 1 Million Bitcoin

To reach the coveted 1 million Bitcoin mark, spot Bitcoin ETFs would need to attract approximately $1.55 billion in net inflows at current prices to purchase an additional 23,107 Bitcoin. Analysts suggest that an average of $301 million in daily net inflows is necessary for this achievement to occur within the week. In the past two weeks alone, around $3 billion has already flowed into these ETFs, according to Bitcoin analyst Alessandro Ottaviani, who noted that maintaining this pace through November could lead to an all-time high (ATH) for Bitcoin.

Historical Context: Halving Events and Market Movements

Historically, Bitcoin has shown significant price increases several months following a halving event. The last halving occurred in April 2024, and with the U.S. presidential election scheduled for November 5, many investors are optimistic about a potential rally. For instance, Bitcoin experienced a remarkable 43% rally in November 2020 after the May 2020 halving and Joe Biden’s victory. Analysts like CK Zheng, chief investment officer of ZX Squared Capital, suggest that similar movements could occur again, regardless of the election outcome.

Impact of Political Factors on Bitcoin Price

The potential victory of Donald Trump in the upcoming election is viewed as a crucial factor influencing the crypto market. Henrik Andersson, chief investment officer of Apollo Capital, stated, “If he does win, we believe the resulting momentum in risk assets could drive BTC to reach $100,000 by the end of the year.” Such a development would not only set a new ATH but also capture global headlines.

Institutional Interest and Market Sentiment

Recent gains in Bitcoin prices are also linked to increased interest from academic institutions. For example, Emory University in Atlanta recently reported holdings exceeding $15.1 million in the Grayscale Bitcoin Mini Trust. This trend reflects a broader institutional adoption of Bitcoin and enhances market sentiment.

Upcoming Federal Reserve Meeting and Market Reactions

Looking ahead, the U.S. Federal Reserve’s Federal Open Market Committee is scheduled to meet on November 6 and 7, with predictions indicating a 94.7% likelihood of a 25 basis points interest rate cut. Such cuts often alleviate financial pressures on consumers and tend to positively impact markets in the short term, which could further bolster Bitcoin’s price.

Russia’s Mining Ban Lift: A Bullish Development

On November 1, Russia’s decision to lift its Bitcoin mining ban is expected to contribute to market positivity by improving network decentralization and security. This development aligns with the growing global acceptance of Bitcoin and its underlying technology.

Current Market Conditions

As of now, Bitcoin is trading at approximately $67,700, facing challenges in breaking through the $70,000 resistance level. However, there is significant support around the $65,000 mark, with a substantial number of long positions stacked just below this level. Crypto trader “Luca” remarked on social media that losing this support could expose the market to the next support range at $60,000.

Leave a comment