Is Bitcoin Ready to Break New Highs as Gold Rally Fades?

Due to a variety of macro and crypto-specific problems, the value of bitcoin, the most valuable cryptocurrency by market value, has been ranging between $50,000 and $70,000 since April. The price of gold, on the other hand, has increased by over 20% throughout this time, reaching record highs. Bitcoin is expected to hit new highs as the optimistic frenzy around the gold fades, according to historical data.

Gold’s Lull Could Spark Bitcoin’s Next Bull Run – Will History Repeat?

Due to COVID lockdowns and central banks’ monetary stimulus, gold began to rise from $1,450 at the end of 2019 and reached a new high of more than $2,000 per ounce in August 2020. Aside from its abrupt COVID decline, bitcoin was stable throughout this time, lingering just below its then-record high of $20,000 during one of its longest periods of consolidation.

But when gold began to decline in late 2020, bitcoin began to rise, rising from $10,000 to more than $60,000 by March 2021. Therefore, if history is any indication, a lull in the gold surge will probably make room for increased demand for Bitcoin. However, it is still unclear if history will repeat itself, as gold is now showing no symptoms of slowing demand or upswing exhaustion.

Investors Turn to Gold and Bitcoin ETFs Ahead of U.S. Elections

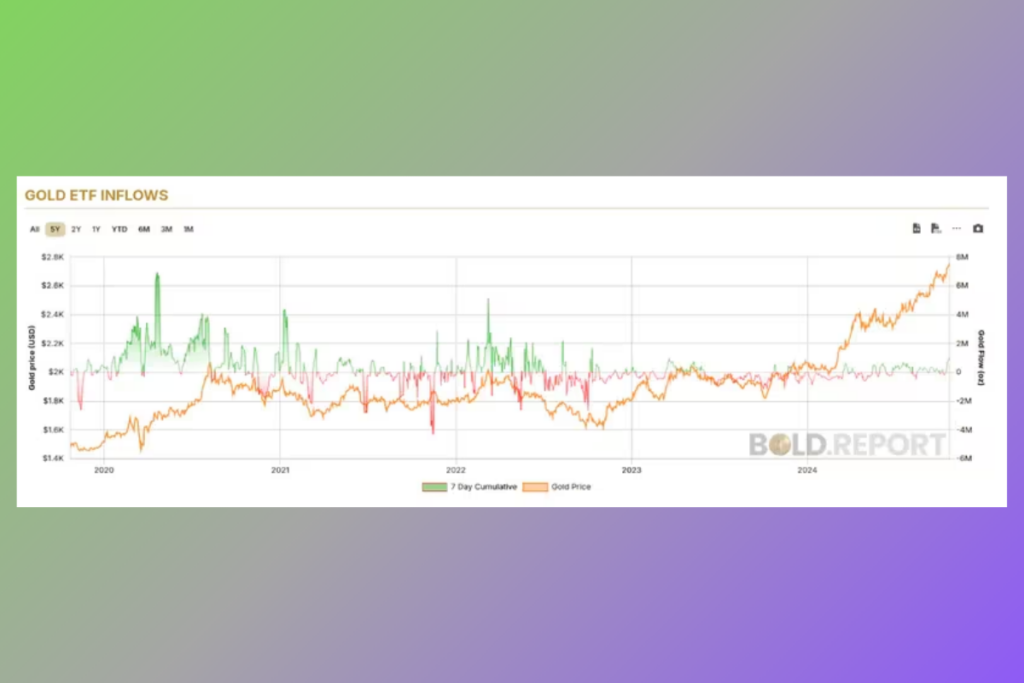

The Bold Report claims that inflows into gold ETF have contributed to the surge in gold prices, exceeding one million ounces on a seven-day basis. Since October 2022, these represent the largest inflows into the ETFs over a seven-day period. SPDR Gold Shares (GLD), a gold fund that is mostly used by individual investors in the United States, absorbed the majority of these inflows. Since July, the fund has enjoyed significant monthly accumulation.

There has also been an increase in inflows into U.S.-listed spot bitcoin ETFs. Net inflows for all U.S. bitcoin ETF products on October 23 amounted to $192.4 million, per Farside data. The iShares Bitcoin Trust (IBIT) witnessed a net inflow of $23.5 billion, including another huge inflow of $317.5 million. In summary, speculators believe that after the U.S. election is over, prices will soar to all-time highs.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment